United Airlines 2009 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2009 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

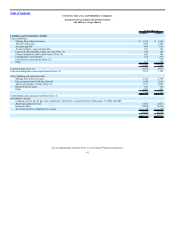

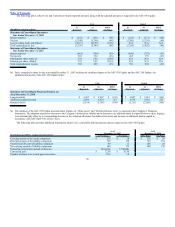

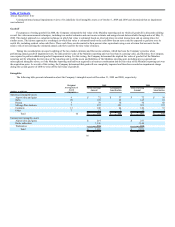

For the Year Ended December 31,

2009 2008

4.5% Notes 5% Notes 4.5% Notes 5% Notes

Effective interest rate on liability component 12.8% 12.1% 12.8% 12.1%

Non-cash interest cost recognized (a) 46 9 40 8

Cash interest cost recognized 33 7 33 7

(a) Amounts represent the adoption of the ASC 470 Update on interest expense for the years ended December 31, 2009 and 2008. The related negative impact

on loss per share for the year ended December 31, 2009 is $0.36.

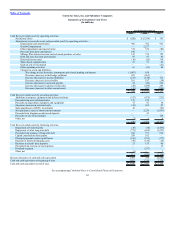

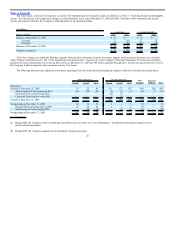

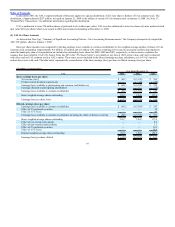

ASC 260 Update clarifies that instruments granted in share-based payment transactions that are considered to be participating securities prior to vesting

should be included in the earnings allocation under the two-class method of calculating earnings per share. The Company determined that its restricted

shares granted under UAL’s share-based compensation plans are participating securities because the restricted shares participate in dividends. The impact

of the ASC 260 Update on 2007 basic and diluted earnings per share, calculated after the ASC 470 Update adoption impact, was a $0.04 per share and

$0.03 per share, respectively, reduction in earnings per share. Nonvested restricted stock was not included in the common shareholder basic loss per share

computation for the year ended December 31, 2008 because of a loss in that period. There were 1.4 million nonvested restricted shares for the year ended

December 31, 2008 that would have been included in the common shareholder basic earnings per share computation had there been income in that period.

(q) Uncertain Income Tax Positions—The Company has recorded reserves for income taxes and associated interest that may become payable in future years.

Although management believes that its positions taken on income tax matters are reasonable, the Company nevertheless has established tax and interest

reserves in recognition that various taxing authorities may challenge certain of the positions taken by the Company, potentially resulting in additional

liabilities for taxes and interest. The Company’s uncertain tax position reserves are reviewed periodically and are adjusted as events occur that affect its

estimates, such as the availability of new information, the lapsing of applicable statutes of limitations, the conclusion of tax audits, the measurement of

additional estimated liability, the identification of new tax matters, the release of administrative tax guidance affecting its estimates of tax liabilities, or the

rendering of relevant court decisions. See Note 7, “Income Taxes,” for further information related to uncertain income tax positions.

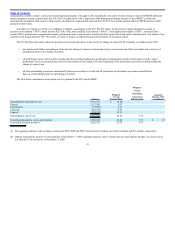

(2) Company Operational Plans

During 2009 and 2008, the Company implemented plans to address volatility in crude oil prices, industry over-capacity and the severe global recession.

The Company reduced capacity and permanently removed 99 aircraft from its Mainline fleet by December 31, 2009, including its entire B737 fleet and five B747

aircraft. The Company completed its fleet reduction plan in January 2010 with the removal of one additional B747 aircraft. In connection with the capacity

reductions, the Company streamlined its operations and corporate functions and cumulatively reduced the size of its workforce by approximately 9,000 positions.

The Company’s workforce reductions occurred through furloughs and furlough-mitigation programs, such as voluntary early-out options. Workforce reductions

included salaried and management positions and certain of the Company’s unionized workforce. The Company’s standard severance policies provide the affected

employees with salary continuation, as well as certain insurance benefits for a specified period of time.

91