United Airlines 2009 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2009 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

United when the price of the underlying commodity is above (below) the price specified in the swap agreement. Generally, the Company’s hedge instruments are

based on crude oil, heating oil or jet fuel. As of December 31, 2009, the Company’s hedge positions were primarily based on either heating oil or jet fuel.

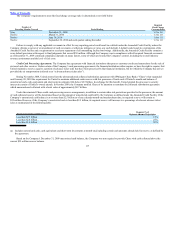

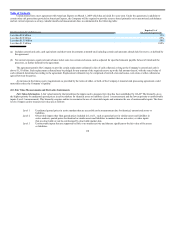

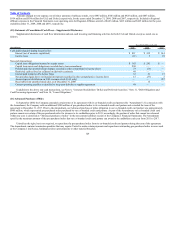

The following table presents the fuel hedge (gains) losses recognized during the periods presented and their classification in the Financial Statements. Fuel

hedge gains (losses) are not allocated to Regional Affiliates expense.

Mainline Fuel

Nonoperating Income

(Expense) Total

Year Ended December 31, Year Ended December 31, Year Ended December 31,

(In millions) 2009 2008 2007 2009 2008 2007 2009 2008 2007

Cash fuel hedge (gains) losses $ 482 $ 40 $ (63) $ 248 $ 249 $ — $ 730 $ 289 $ (63)

Non-cash fuel hedge (gains) losses (586) 568 (20) (279) 279 — (865) 847 (20)

Total fuel hedge (gains) losses $ (104) $ 608 $ (83) $ (31) $ 528 $ — $ (135) $ 1,136 $ (83)

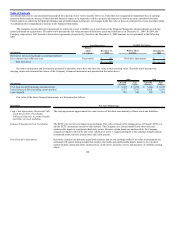

As of December 31, 2009, the Company had hedged approximately 36% of its 2010 consolidated fuel consumption primarily with a combination of swaps

and purchased call options. The Company’s hedge position at December 31, 2009 consisted of a notional amount of 9.7 million barrels with purchased call

options at a weighted-average crude oil equivalent strike price of $76 per barrel and 9.9 million barrels with swaps at a crude oil equivalent average price of $77

per barrel.

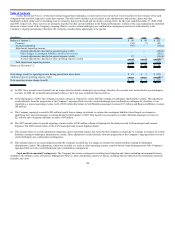

Foreign Currency Derivatives

The Company generates revenues and incurs expenses in numerous foreign currencies. Such expenses include fuel, aircraft leases, commissions, catering,

personnel expense, advertising and distribution costs, customer service expense and aircraft maintenance. Changes in foreign currency exchange rates impact the

Company’s results of operations and cash flows through changes in the dollar value of foreign currency-denominated operating revenues and expenses. When

management believes risk reduction can be effectively achieved, the Company may use foreign currency forward contracts to hedge a portion of its exposure to

changes in foreign currency exchange rates. The Company does not enter into foreign currency derivative contracts for purposes other than risk management. As

of December 31, 2009, the Company did not have any foreign currency derivatives. Hedge gains (losses) were not significant in any of the periods presented in

these Financial Statements. Foreign currency derivative gains and losses are classified in nonoperating expense in the Company’s Financial Statements.

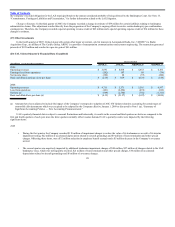

Fair Value of Nonfinancial Assets

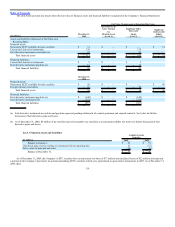

The table below presents disclosures about fair value measurements of nonfinancial assets that were performed during 2009. The fair values as of the

measurement dates are as follows:

(In millions)

Significant

Unobservable

Inputs

(Level 3)

Total

Gains/(Losses)

(Level 3)

Nonfinancial Assets Measured at Fair Value on a Nonrecurring Basis:

Nonoperating aircraft and spare engines $ 310 $ (93)

Tradenames 420 (150)

See Note 3, “Asset Impairments and Intangible Assets,” for a discussion of the factors warranting fair value assessment of the above assets. The Company

utilized a market approach to estimate the fair value of the aircraft.

122