United Airlines 2009 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2009 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

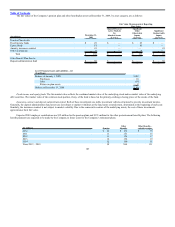

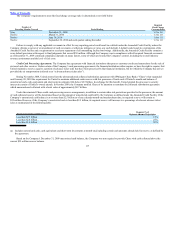

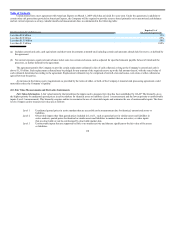

The Company’s requirement to meet the fixed charge coverage ratio is determined as set forth below:

Number of

Preceding Months Covered Period Ending

Required

Fixed Charge

Coverage Ratio

Nine December 31, 2009 1.2 to 1.0

Twelve March 31, 2010 1.3 to 1.0

Twelve June 30, 2010 1.4 to 1.0

Twelve September 30, 2010 and each quarter ending thereafter 1.5 to 1.0

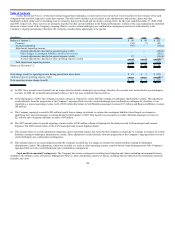

Failure to comply with any applicable covenants in effect for any reporting period could result in a default under the Amended Credit Facility unless the

Company obtains a waiver of or amendment of such covenants, or otherwise mitigates or cures, any such default. A default could result in a termination of the

Amended Credit Facility and a requirement to accelerate repayment of all outstanding facility borrowings. Additionally, the Amended Credit Facility contains a

cross default provision with respect to final judgments that exceed $50 million. Although the Company was in compliance with all required financial covenants

as of December 31, 2009 continued compliance depends on many factors, some of which are beyond the Company’s control, including the overall industry

revenue environment and the level of fuel costs.

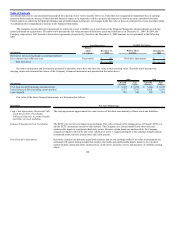

Credit Card Processing Agreements. The Company has agreements with financial institutions that process customer credit card transactions for the sale of

air travel and other services. Under certain of the Company’s card processing agreements, the financial institutions either require, or have the right to require, that

United maintain a reserve equal to a portion of advance ticket sales that have been processed by that financial institution, but for which the Company has not yet

provided the air transportation (referred to as “relevant advance ticket sales”).

During November 2008, United entered into the aforementioned collateral substitution agreement with JPMorgan Chase Bank (“Chase”) that suspended

until January 20, 2010 the requirement for United to maintain additional cash reserves with this processor of bank cards if United’s month-end balance of

unrestricted cash, cash equivalents and short-term investments falls below $2.5 billion. In exchange for this benefit, United granted the processor a security

interest in certain of United’s owned aircraft. In October 2009, the Company notified Chase of its intention to terminate the collateral substitution agreement

which unencumbered collateral with a book value of approximately $0.7 billion.

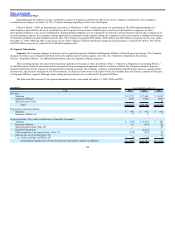

Under the reinstated Chase credit card processing reserve arrangements, in addition to certain other risk protections provided to the processor, the amount

of cash collateral reserve will be determined based on the amount of unrestricted cash held by the Company as defined under the Amended Credit Facility. If the

Company’s unrestricted cash balance is at or more than $2.5 billion as of any calendar month-end measurement date, its required reserve will remain at

$25 million. However, if the Company’s unrestricted cash is less than $2.5 billion, its required reserve will increase to a percentage of relevant advance ticket

sales as summarized in the following table:

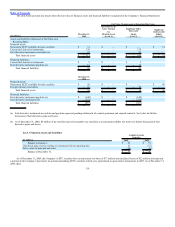

Total Unrestricted Cash Balance (a)

Required % of

Relevant Advance Ticket Sales

Less than $2.5 billion 15%

Less than $2.0 billion 25%

Less than $1.0 billion 50%

(a) Includes unrestricted cash, cash equivalents and short-term investments at month-end, including certain cash amounts already held in reserve, as defined by

the agreement.

Based on the Company’s December 31, 2009 unrestricted cash balance, the Company was not required to provide Chase with cash collateral above the

current $25 million reserve balance.

117