United Airlines 2009 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2009 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

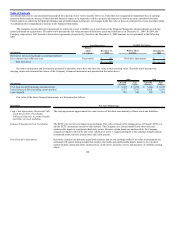

general, each consortium lease agreement requires the consortium to make lease payments in amounts sufficient to pay the maturing principal and interest

payments on the bonds. As of December 31, 2009, approximately $1.2 billion principal amount of such bonds were secured by significant fuel facility leases in

which United participates, as to which United and each of the signatory airlines has provided indirect guarantees of the debt. As of December 31, 2009, United’s

contingent exposure was approximately $214 million principal amount of such bonds based on its recent consortia participation. The Company’s contingent

exposure could increase if the participation of other carriers decreases. The guarantees will expire when the tax-exempt bonds are paid in full, which ranges from

2010 to 2040. The Company did not record a liability at the time these indirect guarantees were made.

Municipal Bond Guarantees. The Company has guaranteed interest and principal payments on $270 million of the Denver International Airport bonds,

which were originally issued in 1992, but were subsequently redeemed and reissued in 2007 and are due in 2032 unless the Company elects not to extend its

lease in which case the bonds are due in 2023. The bonds were issued in two tranches—approximately $170 million aggregate principal amount of 5.25%

discount bonds and $100 million aggregate principal amount of 5.75% premium bonds. The outstanding bonds and related guarantee are not recorded in the

Company’s Financial Statements at December 31, 2009 or 2008. The related lease agreement is recorded on a straight-line basis resulting in ratable accrual of the

final $270 million lease obligation over the expected lease term through 2032.

Labor Negotiations. Approximately 82% of United’s employees are represented by various U.S. labor organizations. During the second quarter of 2009,

the Company began negotiations with its labor groups as all of United’s domestic labor contracts became amendable during January 2010. Consistent with its

contractual commitments, United served “Section 6” notices to all six of its labor unions during April 2009 to commence the collective bargaining process. In

August 2009, United filed for mediation assistance in conjunction with three of its six unions–the Air Line Pilots Association, the Association of Flight

Attendants–Communication Workers of America and the International Association of Machinists and Aerospace Workers. In January 2010, the Company also

filed for mediation assistance in conjunction with another of its unions, the Professional Airline Flight Control Association. These filings were consistent with

commitments contained in current labor contracts which provided that the parties would jointly invoke the mediation services of the National Mediation Board in

the event agreements had not been reached by August 1, 2009. While the labor contract with the International Brotherhood of Teamsters also contemplates filing

for mediation, the parties have agreed to continue in direct negotiations. The current contract with the International Federation of Professional and Technical

Engineers does not contemplate filing for mediation. The outcome of these negotiations may materially impact the Company’s future financial results. However,

it is too early in the process to assess the timing or magnitude of the impact, if any.

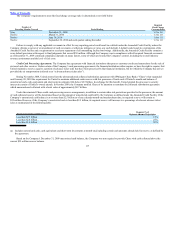

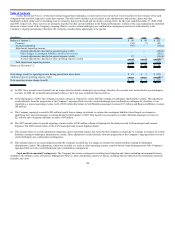

(14) Lease Obligations

The Company leases aircraft, airport passenger terminal space, aircraft hangars and related maintenance facilities, cargo terminals, other airport facilities,

other commercial real estate, office and computer equipment and vehicles.

In connection with fresh-start reporting requirements, aircraft operating leases were adjusted to fair value and a net deferred asset of $263 million was

recorded in the Financial Statements on the Effective Date, representing the net present value of the differences between stated lease rates in agreed term sheets

and the fair market lease rates for similar aircraft. As of December 31, 2009, the balance of the net deferred asset was $124 million. These deferred amounts are

amortized on a straight-line basis as an adjustment to aircraft rent expense over the individual applicable remaining lease terms, generally from one to 15 years.

126