United Airlines 2009 Annual Report Download - page 135

Download and view the complete annual report

Please find page 135 of the 2009 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

the Company’s recorded obligation for the LAX municipal bonds to the amount considered probable of being allowed by the Bankruptcy Court. See Note 13,

“Commitments, Contingent Liabilities and Uncertainties,” for further information related to the LAX litigation.

Change in Estimate. In the third quarter of 2007, the Company recorded a change in estimate of $59 million for certain liabilities relating to bankruptcy

administrative claims. This adjustment resulted directly from the progression of the Company’s ongoing efforts to resolve certain bankruptcy pre-confirmation

contingencies. Therefore, the Company recorded a special operating revenue credit of $45 million and a special operating expense credit of $14 million for these

changes in estimate.

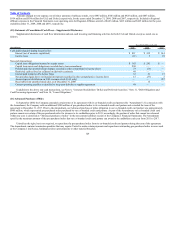

(19) Other Investments

In the fourth quarter of 2007, United, along with certain other major air carriers, sold its interests in Aeronautical Radio, Inc. (“ARINC”) to Radio

Acquisition Corp., an affiliate of The Carlyle Group. ARINC is a provider of transportation communications and systems engineering. The transaction generated

proceeds of $128 million and resulted in a pre-tax gain of $41 million.

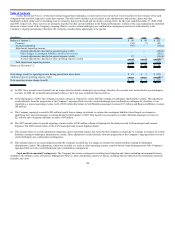

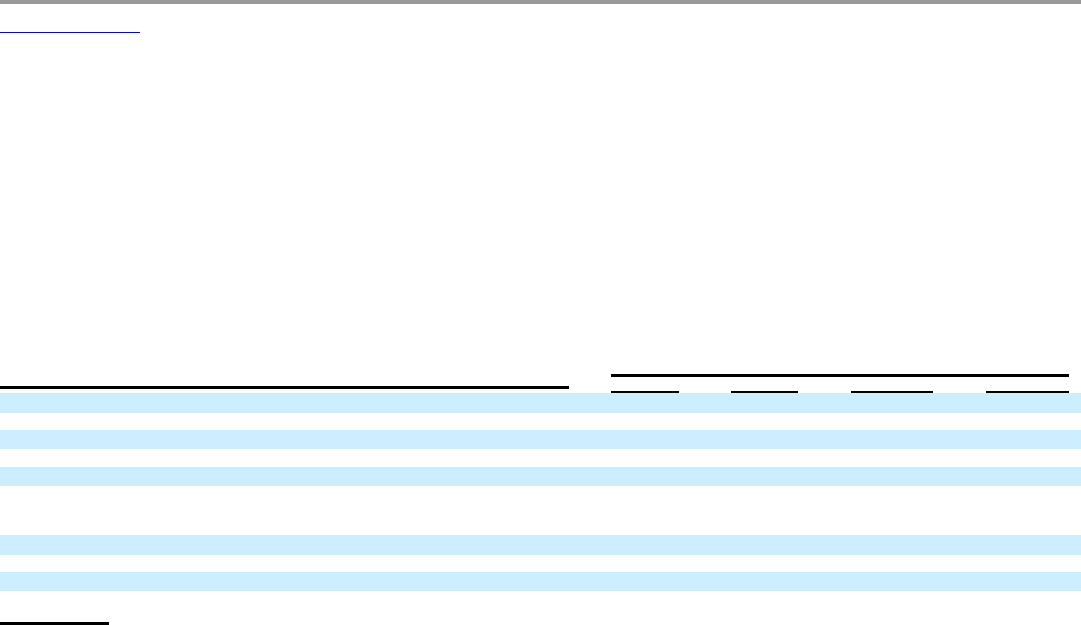

(20) UAL Selected Quarterly Financial Data (Unaudited)

(In millions, except per share amounts) Quarter Ended

March 31 June 30 September 30 December 31

2009:

Operating revenues $ 3,691 $ 4,018 $ 4,433 $ 4,193

Earnings (loss) from operations (282) 107 88 (74)

Net income (loss) (382) 28 (57) (240)

Basic and diluted earnings (loss) per share $ (2.64) $ 0.19 $ (0.39) $ (1.44)

2008:

Operating revenues $ 4,711 $ 5,371 $ 5,565 $ 4,547

Loss from operations (441) (2,694) (491) (812)

Net loss (a) (549) (2,740) (792) (1,315)

Basic and diluted loss per share (a) $ (4.55) $ (21.57) $ (6.22) $ (10.00)

(a) Amounts have been adjusted to include the impact of the Company’s retrospective adoption of ASC 470 Update related to accounting for certain types of

convertible debt instruments which were required to be adopted by the Company effective January 1, 2009 as discussed in Note 1 (p), “Summary of

Significant Accounting Policies — New Accounting Pronouncements.”

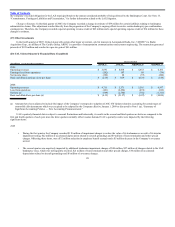

UAL’s quarterly financial data is subject to seasonal fluctuations and historically, its results in the second and third quarters are better as compared to the

first and fourth quarters of each year since the latter quarters normally reflect weaker demand. UAL’s quarterly results were impacted by the following

significant items:

2009

• During the first quarter, the Company recorded $110 million of impairment charges to reduce the value of its tradenames as a result of its interim

impairment testing, $22 million of accelerated depreciation related to aircraft groundings and $9 million of lease termination and other special

charges. Offsetting these items, was a $32 million reduction in employee benefit accruals and a $5 million decrease in the Company’s severance

accrual.

• The second quarter was negatively impacted by additional tradename impairment charges of $40 million, $27 million of charges related to the LAX

bankruptcy issue, which was subsequently resolved, $21 million of lease termination and other special charges, $10 million of accelerated

depreciation related to aircraft groundings and $6 million of severance charges.

131