United Airlines 2009 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2009 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

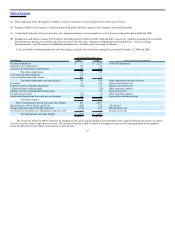

the Company’s operating plans, as more fully described in Note 2, “Company Operational Plans,” in the Footnotes. In addition, the Company recorded

$87 million of expense in 2008 from certain benefit obligation adjustments, which were primarily due to discount rate changes. These negative impacts were

partially offset by lower combined profit and success sharing expense in the 2008 period as compared to the year-ago period due to the unfavorable financial

results in 2008 as compared to 2007. In addition, 2008 salaries and related costs benefited from the workforce reductions completed during the year.

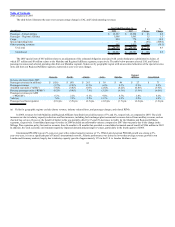

Regional Affiliates expense increased $307 million, or 10%, in 2008 as compared to 2007. Regional Affiliates expense increased primarily due to a $342

million, or 37%, increase in Regional Affiliates fuel that was driven by an increase in market price for fuel as highlighted in the fuel table above. The Regional

Affiliates operating loss was $150 million in 2008 period, as compared to income of $122 million in 2007, due to the aforementioned fuel impacts, which could

not be fully offset by higher ticket prices, as Regional Affiliates revenues were only 1% higher in 2008.

The Company’s purchased services increased $29 million, or 2%, in 2008 as compared to 2007. In 2008, purchased services included a charge of $26

million related to certain projects and transactions being terminated or indefinitely postponed. In 2008, other areas of purchased services did not change

significantly as compared to 2007.

Aircraft maintenance materials and outside repairs decreased 6% in 2008 as compared to 2007, primarily due to a decrease in engine and airframe

maintenance associated with the retirement of the Company’s B737 fleet and more favorable engine maintenance contract rates.

Depreciation expense in 2008 was adversely impacted by $34 million of accelerated depreciation primarily related to the retirement of certain B737 and

B747 aircraft and related parts and a $20 million charge to increase the inventory obsolescence reserve. This adverse impact was partially offset by reduced

amortization expense in 2008 related to certain intangible assets that were fully amortized in 2007.

UAL landing fees and other rent decreased 2% in 2008 due to a reduction in the amount of facilities rented associated with ongoing efforts to optimize our

rented facilities consistent with our operational needs.

Distribution expenses decreased 9% in 2008 as compared to 2007 largely due to the Company’s reduction of some of its travel agency commission

programs in 2008, resulting in an average commission rate reduction. In addition, the Company’s lower passenger revenues, due to its capacity reductions in

2008, contributed to the decrease in related distribution expenses.

Cost of third party sales decreased 14% year-over-year primarily due to a reduction in the cost of jet fuel sales as a result of a reduction in sales to third

parties.

Other operating expenses decreased 5% in 2008 as compared to 2007. This decrease was partly due to a $29 million litigation-settlement gain, which was

recorded in other operating expenses, and decreases in several other expense categories which resulted from the Company’s cost reduction program.

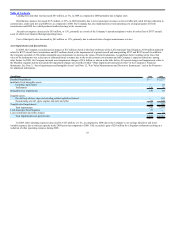

Asset Impairments and Special Items.

As described in the Footnotes, as of May 31, 2008, the Company performed an interim impairment test of its goodwill, all intangible assets and certain of

its long-lived assets (principally aircraft pre-delivery deposits, aircraft and related spare engines and spare parts) due to events and changes in circumstances

during the first five months of 2008 that indicated an impairment might have occurred. In addition, the Company also performed an impairment test of certain

aircraft fleet types as of December 31, 2008, because unfavorable market conditions for aircraft indicated potential impairment of value. The Company also

performed annual indefinite-lived intangible asset impairment testing at October 1, 2008. As a result of all of its 2008 impairment testing, the

49