United Airlines 2009 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2009 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Credit Card Processing Agreements. The Company has agreements with financial institutions that process customer credit card transactions for the sale of

air travel and other services. Under certain of the Company’s card processing agreements, the financial institutions either require, or have the right to require, that

United maintain a reserve equal to a portion of advance ticket sales that have been processed by that financial institution, but for which the Company has not yet

provided the air transportation (referred to as “relevant advance ticket sales”). As of December 31, 2009, the Company had total advance ticket sales of

approximately $1.5 billion of which approximately 80% related to credit card sales.

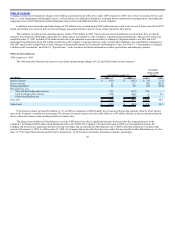

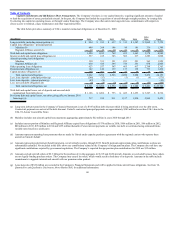

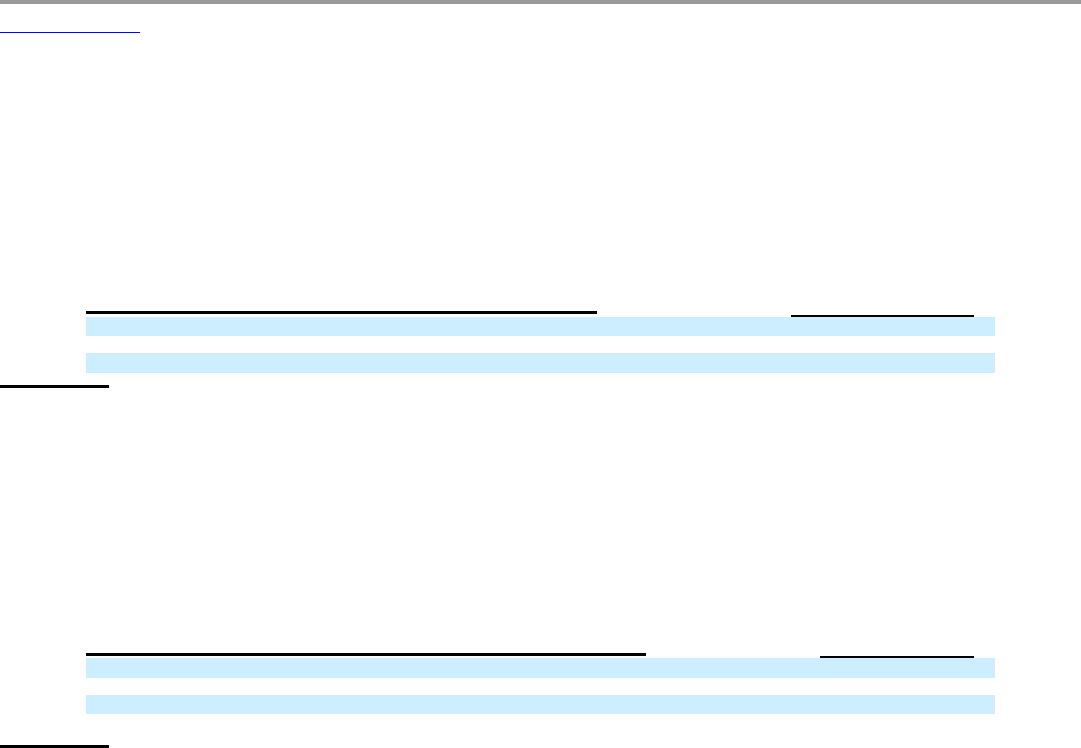

The Company’s credit card processing agreement with Paymentech and JPMorgan Chase Bank, N.A. contains a cash reserve requirement. In addition to

certain other risk protections provided to the processor, the amount of cash collateral reserve will be determined based on the amount of unrestricted cash held by

the Company as defined under the Amended Credit Facility. If the Company’s unrestricted cash balance is at or more than $2.5 billion as of any calendar

month-end measurement date, its required reserve will remain at $25 million. However, if the Company’s unrestricted cash is less than $2.5 billion, its required

reserve will increase to a percentage of relevant advance ticket sales as summarized in the following table:

Total Unrestricted Cash Balance (a)

Required % of

Relevant Advance Ticket Sales

Less than $2.5 billion 15%

Less than $2.0 billion 25%

Less than $1.0 billion 50%

(a) Includes unrestricted cash, cash equivalents and short-term investments at month-end, including certain cash amounts already held in reserve, as defined by

the agreement.

Based on the Company’s December 31, 2009 unrestricted cash balance, the Company was not required to provide cash collateral above the current $25

million reserve balance.

United entered into a new agreement with American Express on March 1, 2009 which has an initial five year term. Under the agreement, in addition to

certain other risk protections provided to American Express, the Company will be required to provide reserves based primarily on its unrestricted cash balance

and net current exposure as of any calendar month-end measurement date, as summarized in the following table:

Total Unrestricted Cash Balance(a)

Required % of

Net Current Exposure (b)

Less than $2.4 billion 15%

Less than $2.0 billion 25%

Less than $1.35 billion 50%

Less than $1.2 billion 100%

(a) Includes unrestricted cash, cash equivalents and short-term investments at month-end, including certain cash amounts already held in reserve, as defined by

the agreement.

(b) Net current exposure equals relevant advance ticket sales less certain exclusions, and as adjusted for specified amounts payable between United and the

processor, as further defined by the agreement.

The agreement with American Express permits the Company to provide certain replacement collateral in lieu of cash collateral, as long as the Company’s

unrestricted cash is above $1.35 billion. Such replacement collateral may be pledged for any amount of the required reserve up to the full amount thereof, with

the stated value of such collateral determined according to the agreement. Replacement collateral may be comprised of aircraft, slots and routes, real estate or

other collateral as agreed between the parties. Based on the Company’s unrestricted cash balance at December 31, 2009, the Company was not required to

provide any reserves under this agreement.

An increase in the future reserve requirements as provided by the terms of either, or both, of the Company’s material credit card processing agreements,

could materially reduce the Company’s liquidity.

59