United Airlines 2009 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2009 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

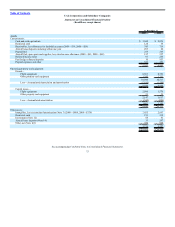

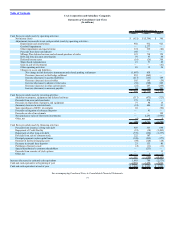

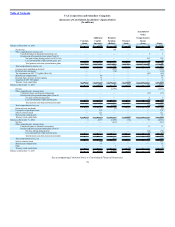

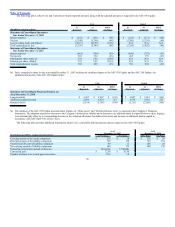

Table of Contents

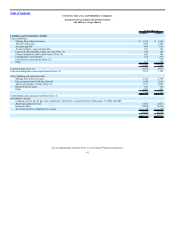

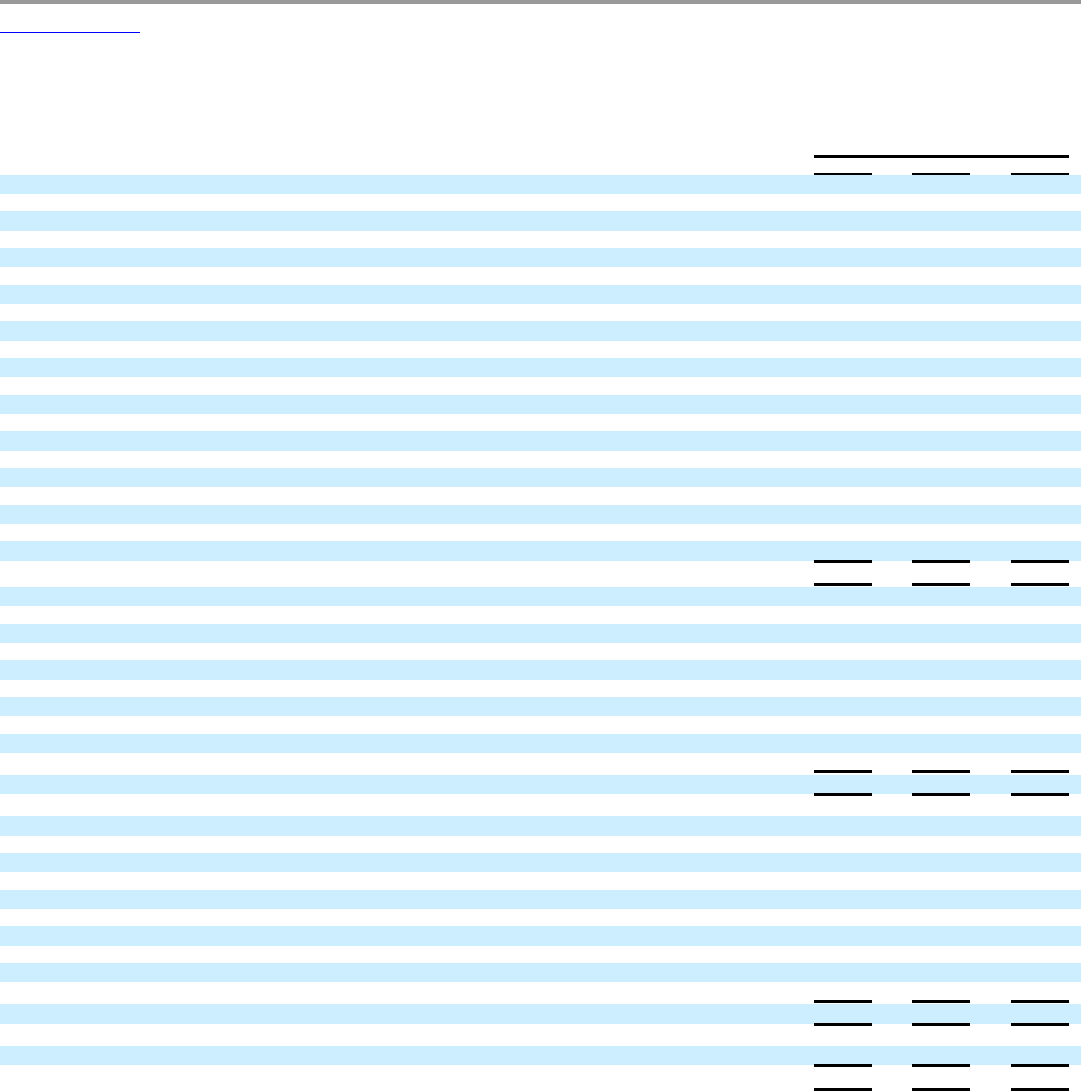

United Air Lines, Inc. and Subsidiary Companies

Statements of Consolidated Cash Flows

(In millions)

Year Ended December 31,

2009 2008 2007

Cash flows provided (used) by operating activities:

Net income (loss) $ (628) $ (5,354) $ 359

Adjustments to reconcile to net cash provided (used) by operating activities—

Depreciation and amortization 902 932 925

Goodwill impairment — 2,277 —

Other impairments and special items 374 339 (89)

Proceeds from lease amendment 160 — —

Mileage Plus deferred revenue and advanced purchase of miles 123 738 170

Debt and lease discount amortization 97 97 84

Deferred income taxes (16) (26) 318

Share-based compensation 21 31 49

Gain on sale of investment — — (41)

Other operating activities 63 (39) 48

Changes in assets and liabilities -

Net change in fuel derivative instruments and related pending settlements (1,007) 858 —

Decrease (increase) in fuel hedge collateral 955 (965) —

Increase (decrease) in accrued liabilities (213) (128) 172

Decrease (increase) in receivables 110 197 (58)

Increase (decrease) in accounts payable 94 (49) 210

Increase (decrease) in advance ticket sales (38) (388) 249

Decrease (increase) in other current assets (19) 257 (269)

978 (1,223) 2,127

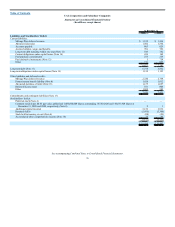

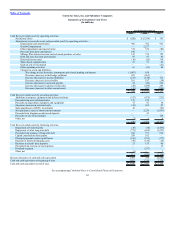

Cash flows provided (used) by investing activities:

Additions to property, equipment and deferred software (317) (475) (723)

Proceeds from asset sale-leasebacks 175 274 —

Proceeds on disposition of property and equipment 77 93 18

(Increase) decrease in restricted cash (24) 455 87

Sales (purchases) of EETC investments 10 — (96)

Net (purchases) sales of short-term investments — 2,259 (1,951)

Proceeds from litigation on advanced deposits — 41 —

Proceeds on sale of investments — — 128

Other, net (7) 9 4

(86) 2,656 (2,533)

Cash flows provided (used) by financing activities:

Repayment of Credit Facility (18) (18) (1,495)

Repayment of other long-term debt (775) (664) (1,255)

Proceeds from issuance of long-term debt 562 337 694

Capital contributions from parent 559 163 —

Principal payments under capital leases (190) (235) (177)

Payment of deferred financing costs (49) (120) (18)

Decrease in aircraft lease deposits 23 155 80

Proceeds from exercise of stock options — — 35

Dividend to parent — (257) —

Other, net (1) — 2

111 (639) (2,134)

Increase (decrease) in cash and cash equivalents 1,003 794 (2,540)

Cash and cash equivalents at beginning of year 2,033 1,239 3,779

Cash and cash equivalents at end of year $ 3,036 $ 2,033 $ 1,239

See accompanying Combined Notes to Consolidated Financial Statements.

82