United Airlines 2009 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2009 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

The issuance of UAL’s contingent senior unsecured notes could adversely impact results of operations, liquidity and financial position and could cause

dilution to the interests of its existing stockholders.

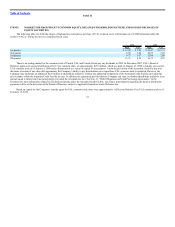

In connection with the Company’s Plan of Reorganization, UAL is obligated under an indenture to issue to the PBGC 8% Contingent Senior Notes (the

“8% Notes”) with an aggregate principal amount of up to $500 million in up to eight equal tranches of $62.5 million (with no more than two tranches issued as a

result of each issuance trigger event) upon the occurrence of certain financial triggering events. An issuance trigger event occurs when, among other things, the

Company’s EBITDAR (as defined in the PBGC indenture) exceeds $3.5 billion over the prior twelve months ending June 30 or December 31 of any applicable

fiscal year, beginning with the fiscal year ended December 31, 2009 and ending with the fiscal year ending December 31, 2017. However, if the issuance of a

tranche would cause a default under any other securities then existing, UAL may satisfy its obligations with respect to such tranche by issuing UAL common

stock having a market value equal to $62.5 million. The issuance of the 8% Notes could adversely impact the Company’s results of operations because of

increased interest expense related to the notes and adversely impact its financial position or liquidity due to increased cash required to meet interest and principal

payments. Any common stock issued in lieu of debt will cause additional dilution to existing UAL stockholders.

Risks Related to UAL Common Stock

The issuance of additional shares of UAL common stock, including upon conversion of its convertible notes, could cause dilution to the interests of its

existing stockholders.

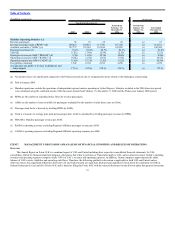

During 2009, UAL issued $345 million aggregate principal amount of 6% Senior Convertible Notes. Previously, UAL issued $726 million of 4.5% Notes

and $150 million of 5% Notes in connection with the Company’s Plan of Reorganization. Holders of these securities may convert them into shares of UAL’s

common stock according to their terms. See Note 11, “Debt Obligations and Card Processing Agreements,” in the Footnotes for further information regarding

these instruments.

The UAL restated certificate of incorporation authorizes up to one billion shares of common stock. In certain circumstances, UAL can issue shares of

common stock without stockholder approval. In 2008, the Board of Directors approved the issuance of $200 million of UAL common stock as part of an ongoing

equity offering by the Company. The Company completed this equity offering during 2009, which produced aggregate net proceeds of approximately $196

million after deducting related expenses. In October 2009, UAL sold an additional 19.0 million shares of UAL common stock in a separate underwritten, public

offering generating net proceeds of $132 million. In addition, the Board of Directors is authorized to issue up to 250 million shares of preferred stock without any

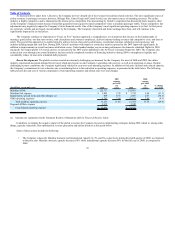

action on the part of UAL’s stockholders. The Board of Directors also has the power, without stockholder approval, to set the terms of any series of shares of

preferred stock that may be issued, including voting rights, conversion rights, dividend rights, preferences over UAL’s common stock with respect to dividends

or if UAL liquidates, dissolves or winds up its business and other terms. If UAL issues preferred stock in the future that has a preference over its common stock

with respect to the payment of dividends or upon its liquidation, dissolution or winding up, or if UAL issues preferred stock with voting rights that dilute the

voting power of its common stock, the rights of holders of its common stock or the market price of its common stock could be adversely affected. UAL is also

authorized to issue, without stockholder approval, other securities convertible into either preferred stock or, in certain circumstances, common stock. In the future

UAL may decide to raise additional capital through offerings of its common stock, securities convertible into its common stock, or rights to acquire these

securities or its common stock. The issuance of additional shares of common stock or securities convertible into common stock could result in dilution of existing

stockholders’ equity interests in UAL. Issuances of substantial amounts of its common stock, or the perception that such issuances could occur, may adversely

affect prevailing market prices for UAL’s common stock and UAL cannot predict the effect this dilution may have on the price of its common stock.

26