United Airlines 2009 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2009 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

(j) Advertising—Advertising costs, which are included in other operating expenses, are expensed as incurred.

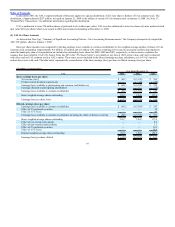

(k) Intangibles—Indefinite-lived intangible assets are not amortized but are reviewed for impairment annually or more frequently if events or circumstances

indicate that the asset may be impaired. The Mileage Plus customer database is amortized on an accelerated basis utilizing cash flows correlating to the

expected attrition rate of the Mileage Plus database. The other customer relationships, which are included in “Contracts,” are amortized in a manner

consistent with the timing and amount of revenues that the Company expects to generate from these customer relationships. All other definite-lived

intangible assets are amortized on a straight-line basis over the estimated lives of the related assets.

The Company applies a fair value-based impairment test to the net book value of goodwill, which was determined to be completely impaired in 2008, and

indefinite-lived intangible assets on an annual basis as of October 1, or on an interim basis whenever a triggering event occurs.

See Note 3, “Asset Impairments and Intangible Assets,” for additional information related to intangibles, including impairments recognized in 2009 and

2008.

(l) Measurement of Impairments—The Company evaluates the carrying value of long-lived assets and intangible assets subject to amortization whenever

events or changes in circumstances indicate that an impairment may exist. For purposes of this testing, the Company has identified the aircraft fleet type as

the lowest level of identifiable cash flows for purposes of testing aircraft for impairment. An impairment charge is recognized when the asset’s carrying

value exceeds its net undiscounted future cash flows and its fair market value. The amount of the charge is the difference between the asset’s carrying

value and fair market value. See Note 3, “Asset Impairments and Intangible Assets,” for information related to asset impairments recognized in 2009 and

2008.

(m) Share-Based Compensation—The Company measures the cost of employee services received in exchange for an award of equity instruments based on

the grant-date fair value of the award. The resulting cost is recognized over the period during which an employee is required to provide service in exchange

for the award, usually the vesting period. Obligations for restricted stock units (“RSUs”) are remeasured throughout the requisite service period based on

the market share price as of the last day of the reporting period. A cumulative adjustment is recorded to adjust compensation expense based on the current

value of the awards. See Note 6, “Share-Based Compensation Plans,” for additional information.

(n) Ticket Taxes—Certain governmental taxes are imposed on United’s ticket sales through a fee included in ticket prices. United collects these fees and

remits them to the appropriate government agency. These fees are recorded on a net basis (excluded from operating revenues).

(o) Early Retirement of Leased Aircraft—The Company accrues for the present value of future minimum lease payments, net of estimated sublease rentals

(if any) in the period aircraft are removed from service. When reasonably estimable and probable, the Company estimates maintenance lease return

condition obligations for items such as minimum aircraft and engine conditions specified in leases and accrues these amounts over the lease term while the

aircraft are operating, and any remaining unrecognized estimated obligations are accrued in the period an aircraft is removed from service.

(p) New Accounting Pronouncements—In December 2009, the FASB issued Accounting Standards Update (“ASU”) No. 2009-17, Improvements to

Financial Reporting by Enterprises Involved with Variable Interest Entities, which amends certain concepts related to consolidation of variable interest

entities. Among other accounting and disclosure requirements, this guidance replaces the quantitative-based risks and rewards calculation for determining

which enterprise has a controlling financial interest in a variable interest entity with an approach focused on identifying which enterprise has the power to

direct the activities of a variable interest entity and the obligation to absorb losses of the entity or the right to receive benefits from the entity. The

Company will adopt this guidance in its first annual and interim reporting periods beginning after November 15, 2009. The Company has not determined

the impact that this guidance may have on its financial statements.

88