United Airlines 2009 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2009 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

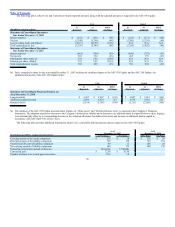

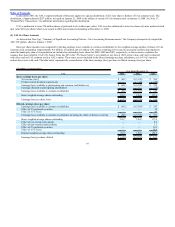

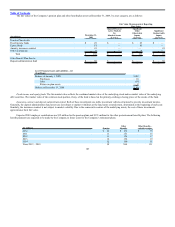

(In millions, except per share)

Year Ended December 31,

UAL 2009 2008 2007

Potentially dilutive shares excluded from diluted per share amounts:

Stock options 6.4 4.4 4.0

Restricted shares (b) 0.8 1.4 0.9

2% preferred securities — 3.1 —

4.5% Senior Limited-Subordination Convertible Notes due 2021 22.2 22.2 —

5% Senior Convertible Notes due 2021 3.4 3.4 3.2

6% Senior Convertible Notes due 2029 39.7 — —

72.5 34.5 8.1

(a) As discussed in Note 1(p), “Summary of Significant Accounting Policies—New Accounting Pronouncements,” nonvested restricted shares are considered

participating securities securities under the ASC 260 Update.

(b) These shares will also impact the computation of basic earnings per share in periods with income, because the shares are considered participating securities

under the ASC 260 Update.

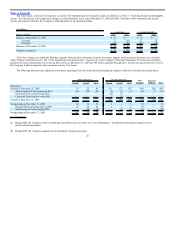

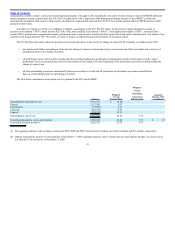

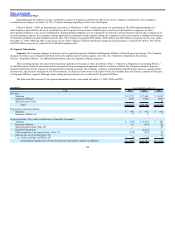

(6) Share-Based Compensation Plans

Compensation expense associated with the UAL share-based compensation plans has been pushed down to United.

The following table summarizes the number of awards authorized, issued and available for future grants under the Company’s share-based compensation

plans for management employees and directors as of December 31, 2009:

Employees Directors Total

Authorized 8,339,284 175,000 8,514,284

Granted (6,017,100) (131,327) (6,148,427)

Canceled awards available for reissuance 1,004,221 — 1,004,221

Available for future grants 3,326,405 43,673 3,370,078

The following table provides information related to our share-based compensation plans.

(In millions)

Year Ended

December 31,

2009 2008 2007

Compensation cost:

Restricted stock units $ 10 $ — $ —

Restricted stock 6 18 25

Stock options 5 13 24

Total compensation cost $ 21 $ 31 $ 49

The unrecognized compensation cost related to unvested awards at December 31, 2009 was $22 million. The unrecognized cost of the Company’s RSUs is

expected to be recognized over a weighted-average period of 2.2 years and the unrecognized cost of its stock options and restricted stock are expected to be

recognized over a weighted-average period of 1.6 and 1.0 years, respectively.

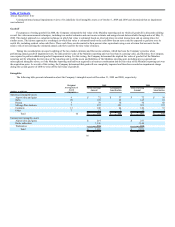

2008 Incentive Compensation Plan (“ICP”). In 2008, UAL’s Board of Directors and stockholders approved the ICP. The ICP is an incentive

compensation plan that allows the Company to use different forms of

98