United Airlines 2009 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2009 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

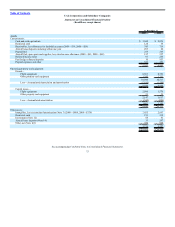

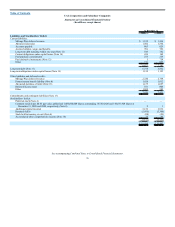

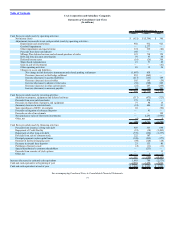

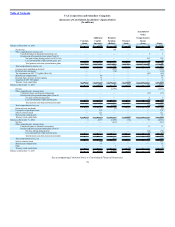

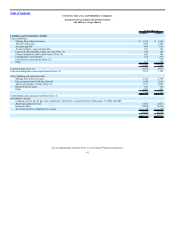

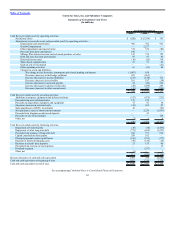

UAL Corporation and Subsidiary Companies

United Air Lines, Inc. and Subsidiary Companies

Combined Notes to Consolidated Financial Statements

The Company

UAL Corporation (together with its consolidated subsidiaries, “UAL”) is a holding company whose principal, wholly-owned subsidiary is United Air

Lines, Inc. (together with its consolidated subsidiaries, “United”). We sometimes use the words “we,” “our,” “us” and the “Company” in this Annual Report on

Form 10-K for disclosures that relate to both UAL and United.

This Annual Report on Form 10-K is a combined report of UAL and United. Therefore, these Combined Notes to Consolidated Financial Statements apply

to both UAL and United, unless otherwise noted. As UAL consolidates United for financial statement purposes, disclosures that relate to activities of United also

apply to UAL.

(1) Summary of Significant Accounting Policies

(a) Basis of Presentation—UAL is a holding company whose principal subsidiary is United. The Company’s consolidated financial statements (the

“Financial Statements”) include the accounts of its majority-owned affiliates. All significant intercompany transactions are eliminated. Certain prior year

amounts have been reclassified to conform to the current year’s presentation.

(b) Use of Estimates—The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America

(“GAAP”) requires management to make estimates and assumptions that affect the amounts reported in the Financial Statements and accompanying notes.

Actual results could differ from those estimates.

The Company estimates fair value of its financial instruments and indefinite-lived intangible assets for testing impairment of indefinite-lived

intangible assets. These estimates and assumptions are inherently subject to significant uncertainties and contingencies beyond the control of the

Company. Accordingly, the Company cannot provide assurance that the estimates, assumptions and values reflected in the valuations will be

realized, and actual results could vary materially.

(c) Airline Revenues—The value of unused passenger tickets and miscellaneous charge orders (“MCOs”) are included in current liabilities as advance ticket

sales. United records passenger ticket sales and tickets sold by other airlines for use on United as operating revenues when the transportation is provided or

when the ticket expires. Tickets sold by other airlines are recorded at the estimated values to be billed to the other airlines. Non-refundable tickets

generally expire on the date of the intended flight, unless the date is extended by notification from the customer on or before the intended flight date. Fees

charged in association with changes or extensions to non-refundable tickets are recorded as passenger revenue at the time the fee is incurred. Change fees

related to non-refundable tickets are considered a separate transaction from the air transportation because they represent a charge for the Company’s

additional service to modify a previous sale. Therefore, the pricing of the change fee and the initial customer order are separately determined and represent

distinct earnings processes. Refundable tickets expire after one year.

MCOs can be exchanged for a passenger ticket or refunded after issuance. United estimates the amount of MCOs that will not be exchanged or refunded

and recognizes revenue for these MCOs ratably over the redemption period, based on historical experience.

United records an estimate of tickets that have been used, but not recorded as revenue due to system processing errors, as revenue in the month of sale

based on historical results. Due to complex industry pricing structures, refund and exchange policies and interline agreements with other airlines, certain

amounts are recognized as revenue using estimates both as to the timing of recognition and the amount of revenue to be recognized. These estimates are

based on the evaluation of actual historical results. United recognizes cargo and mail revenue as service is provided.

84