United Airlines 2009 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2009 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Maintenance and repairs, including the cost of minor replacements, are charged to maintenance expense as incurred, except for costs incurred under our

power-by-the-hour engine maintenance agreements, which are expensed based upon the number of hours flown. Costs of additions to and renewals of units

of property are capitalized as property and equipment additions.

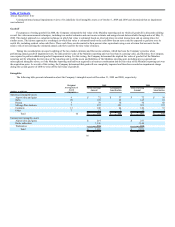

As of December 31, 2009, the “Other noncurrent assets” included the following significant items: nonoperating B737 and B747 aircraft, including related

spare parts and engines, and aircraft leased to third parties of $417 million and internal in-development and in-use software totaling $174 million.

(g) Mileage Plus Awards—The Company has an agreement with its co-branded credit card partner that requires its partner to purchase miles in advance of

when miles are awarded to the co-branded partner’s cardholders (referred to as “pre-purchased miles”). These sales are deferred when received by United

and disclosed in the Financial Statements as “Advanced purchase of miles.” Subsequently, when the Company’s credit card partner awards pre-purchased

miles to its cardholders, the Company transfers the related air transportation element for the awarded miles from “Advanced purchase of miles” to

“Mileage Plus deferred revenue” at estimated fair value and records the residual marketing element as “Other operating revenue.”

The Company has adopted a deferred revenue measurement method to record fair value of the frequent flyer obligation using a weighted-average ticket

value of each outstanding mile, based upon projected redemption patterns for available award choices when such miles are consumed. The Company

defers a portion of revenue from the sale of air services to record the fair value obligation of the miles earned. Miles sold to third parties have two revenue

elements: air transportation and marketing, as described below.

Air Transportation Element. The Company defers the portion of the sales proceeds that represents estimated fair value of the air transportation and

recognizes that amount as revenue when transportation is provided. The fair value of the air transportation component is determined based upon the

equivalent ticket value of similar fares on United and amounts paid to other airlines for miles. The initial revenue deferral is presented as “Mileage Plus

deferred revenue” in our Financial Statements. When recognized, the revenue related to the air transportation component is classified as “passenger

revenues” in our Financial Statements.

Marketing-related element. The amount of revenue from the marketing-related element is determined by subtracting the fair value of the air transportation

from the total sales proceeds. The residual portion of the sales proceeds related to marketing activities is recognized when miles are awarded. This portion

is recognized as “Other operating revenues” in our Financial Statements.

The value of miles is estimated assuming redemptions on both United and other participating carriers in the Mileage Plus program and by estimating the

relative proportions of awards to be redeemed by class of service within broad geographic regions of the Company’s operations, including Domestic,

Atlantic, Pacific and Latin America. The estimation of the fair value of each award mile requires the use of several significant assumptions, for which

significant management judgment is required. For example, management must estimate how many miles are projected to be redeemed on United, versus

on other airline partners. Since the equivalent ticket value of miles redeemed on United and on other carriers can vary greatly, this assumption can

materially affect the calculation of the weighted-average ticket value from period to period.

Management must also estimate the expected redemption patterns of Mileage Plus customers, who have a number of different award choices when

redeeming their miles, each of which can have materially different estimated fair values. Such choices include different classes of service (first, business

and several coach award levels), as well as different flight itineraries, such as domestic and international routings and different itineraries within domestic

and international regions of United’s and other participating carriers’ route networks. Customer redemption patterns may also be influenced by program

changes, which occur from time to time and introduce new award choices, or make material changes to the terms of existing award choices. Management

must often estimate the probable impact of such program changes on future customer behavior, which requires the use of significant judgment.

Management uses historical customer redemption patterns as the best single indicator of future redemption behavior in making its estimates, but changes in

customer mileage redemption behavior to patterns which are not consistent with historical behavior can result in material changes to deferred revenue

balances, and to recognized revenue.

86