United Airlines 2009 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2009 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

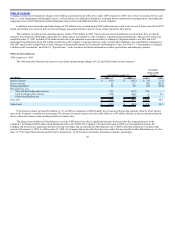

Table of Contents

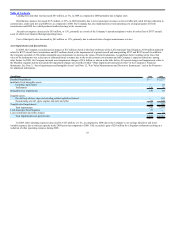

2008 compared to 2007

Net sales of short-term investments provided cash of $2.3 billion for UAL in 2008, as compared to cash used for net purchases of short-term investments

of $2.0 billion in 2007. In 2008, the Company invested most of its excess cash in money market funds, whereas in 2007, excess cash was largely invested in

short-term investments such as commercial paper. During 2008, the Company also received $357 million of cash that was previously restricted cash held by the

Company’s largest credit card processor and was released as a part of an amendment to the Company’s agreement with this processor. See Credit Card

Processing Agreements, below, for further discussion of the amended agreement and future cash reserve requirements.

In 2008, cash expenditures for property, equipment and software totaled approximately $475 million. Additions to property in 2008 included $20 million

of capitalized interest. In 2007, cash expenditures for property and equipment, software and capitalized interest were $639 million, $65 million and $19 million,

respectively. This year-over-year decrease is primarily due to the Company’s efforts to optimize its available cash and a reduction in cash used to acquire aircraft

as the 2007 capital expenditures included cash used to acquire six aircraft that were previously financed as operating leases.

During 2008, the Company generated $94 million from various asset sales including the sale of five B737 aircraft, spare parts, engines and slots. Investing

cash of $274 million was generated from aircraft sold under sale-leaseback financing agreements. In 2008, United entered into a $125 million sale-leaseback

involving nine previously unencumbered aircraft and a $149 million sale-leaseback involving 15 aircraft. See Note 14, “Lease Obligations” and Note 15,

“Statement of Consolidated Cash Flows—Supplemental Disclosures,” in the Footnotes for additional information related to these transactions. In addition, the

Company’s investing cash flows benefited from $41 million of cash proceeds from a litigation settlement that resulted in the recognition of a $29 million gain

during 2008. The litigation settlement related to pre-delivery advance aircraft deposits.

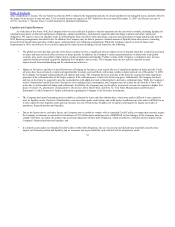

Cash Flows from Financing Activities.

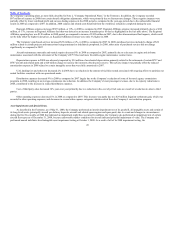

2009 Activity

In 2009, the Company generated gross proceeds of approximately $900 million from the following debt issuances:

• $158 million from the issuance of $175 million aggregate principal amount of 12.75% Senior Secured Notes due 2012 secured by certain aircraft

spare parts;

• $134 million from a mortgage financing secured by certain of the Company’s spare engines;

• $30 million from an aircraft mortgage financing secured by one B777 aircraft;

• $345 million from the issuance of 6% Senior Convertible Notes due 2029 (the “6% Senior Convertible Notes”);

• $129 million from a financing with one of the Company’s regional flying partners, consisting of an $80 million secured note and a $49 million

deferral of future obligations under an amendment to the Company’s capacity agreement;

• $47 million from the issuance of equipment notes relating to the issuance of $659 million aggregate face amount of enhanced equipment trust

certificates (“EETCs”), Series 2009-1; and

• $114 million from the issuance of equipment notes relating to the issuance of $810 million aggregate face amount of EETCs, Series 2009-2. See

EETC Financing, below, for further information related to the Series 2009-1 and 2009-2 financings.

In addition, in 2009, the Company generated net proceeds of $222 million from the following equity issuances:

• $90 million from the completion of the Company’s equity offering program that began in 2008, resulting in aggregate gross proceeds under the

program of approximately $200 million; and

55