United Airlines 2009 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2009 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

In December 2009, the FASB issued ASU No. 2009-16, Accounting for Transfers of Financial Assets. This guidance improves the information that a

reporting entity provides in its financial reports about a transfer of financial assets; the effects of a transfer on its financial position, financial performance

and cash flows; and a continuing interest in transferred financial assets. In addition, this guidance amends various accounting principles with respect to

accounting for transfers and servicing of financial assets and extinguishments of liabilities, including removing the concept of qualified special purpose

entities. This guidance must be applied to transfers occurring on or after the effective date. The Company will adopt this guidance in its first annual and

interim reporting periods beginning after November 15, 2009. The Company has not determined the impact that this guidance may have on its financial

statements.

In October 2009, the FASB issued ASU No. 2009-13, Multiple Deliverable Revenue Arrangements—A Consensus of the FASB Emerging Issues Task

Force. This update provides application guidance on whether multiple deliverables exist, how the deliverables should be separated and how the

consideration should be allocated to one or more units of accounting. This update establishes a selling price hierarchy for determining the selling price of a

deliverable. The selling price used for each deliverable will be based on vendor-specific objective evidence, if available, third-party evidence if

vendor-specific objective evidence is not available, or estimated selling price if neither vendor-specific or third-party evidence is available. The Company

will be required to apply this guidance prospectively for revenue arrangements entered into or materially modified after January 1, 2011; however, earlier

application is permitted. The Company has not determined the impact that this update may have on its financial statements.

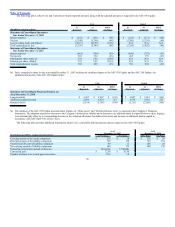

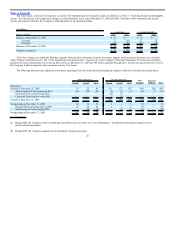

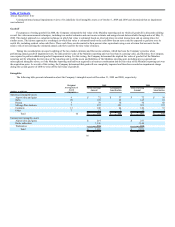

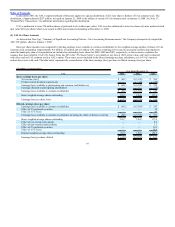

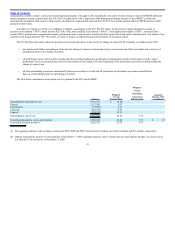

Retrospective Adoption of ASC 470 Update and ASC 260 Update

The Company adopted new accounting guidance related to accounting for convertible debt instruments that may be settled in cash (or other assets) on

conversion (“ASC 470 Update”) and new accounting guidance related to determining whether instruments granted in share-based payment transactions are

participating securities (“ASC 260 Update”) effective January 1, 2009, both of which required retrospective application. ASC 470 Update requires the

issuer of certain convertible debt instruments that may be settled in cash (or other assets) on conversion to separately account for the liability (debt) and

equity (conversion option) components of the instrument in a manner that reflects the issuer’s non-convertible debt borrowing rate. The Company’s 4.5%

Senior Limited-Subordination Convertible Notes due 2021 (“4.5% Notes”) and 5% Senior Convertible Notes due 2021 (“5% Notes”), see below, are

within the scope of the ASC 470 Update. Upon the original issuance of these two debt instruments in 2006, the Company recorded the net debt obligation

as long-term debt in accordance with applicable accounting standards at that time. To adopt this standard, effective January 1, 2009, the Company

estimated the fair value, as of the date of issuance, of its two applicable convertible debt instruments as if the instruments were issued without the

conversion options. The difference between the fair value and the principal amounts of the instruments was $254 million. This amount was retrospectively

applied to the Financial Statements from the issuance date of the debt instruments in 2006, and was retrospectively recorded as a debt discount and as a

component of equity. The discount is being amortized over the expected five-year life of the notes resulting in non-cash increase to interest expense in

historical and future periods.

89