United Airlines 2009 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2009 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

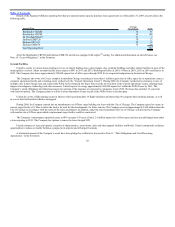

Table of Contents

prices have risen due to the highly competitive nature of the airline industry. United may not be able to increase its fares if fuel prices rise in the future and any

such increases may not be sustainable in the highly competitive environment. In addition, fare increases may not totally offset the fuel price increase and may

also reduce demand for air travel. From time to time, the Company enters into hedging arrangements to protect against rising fuel costs. The Company’s hedging

programs may use significant amounts of cash due to posting of cash collateral in some circumstances, may not be successful in controlling fuel costs and may be

limited due to market conditions and other factors. See Note 12, “Fair Value Measurements and Derivative Instruments,” in the Footnotes for additional

information on the Company’s hedging programs.

Additional terrorist attacks or the fear of such attacks, even if not made directly on the airline industry, could negatively affect the Company and the airline

industry.

The terrorist attacks of September 11, 2001 involving commercial aircraft severely and adversely impacted the Company’s financial condition and results

of operations, as well as prospects for the airline industry. Among the effects experienced from the September 11, 2001 terrorist attacks were substantial flight

disruption costs caused by the FAA-imposed temporary grounding of the U.S. airline industry’s fleet, significantly increased security costs and associated

passenger inconvenience, increased insurance costs, substantially higher ticket refunds and significantly decreased traffic and passenger revenue per revenue

passenger mile (“yield”).

Additional terrorist attacks, even if not made directly on the airline industry, or the fear of or the precautions taken in anticipation of such attacks

(including elevated national threat warnings or selective cancellation or redirection of flights) could materially and adversely affect the Company and the airline

industry. The wars in Iraq and Afghanistan and additional international hostilities, including heightened terrorist activity, could also have a material adverse

impact on the Company’s financial condition, liquidity and results of operations. The Company’s financial resources might not be sufficient to absorb the adverse

effects of any further terrorist attacks or other international hostilities involving the United States or U.S. interests.

The airline industry is highly competitive, susceptible to price discounting and may undergo further bankruptcy restructuring or industry consolidation.

The U.S. airline industry is characterized by substantial price competition. Some of our competitors have substantially greater financial resources or lower

cost structures than United does, or both. In recent years, the market share held by low-cost carriers has increased significantly. Large network carriers, like

United, have often had a lack of pricing power within domestic markets.

In addition, a number of carriers have filed for bankruptcy protection in recent years. Other domestic and international carriers could restructure in

bankruptcy or threaten to do so to reduce their costs. Carriers operating under bankruptcy protection can operate in a manner that could be adverse to the

Company and could emerge from bankruptcy as more vigorous competitors.

During 2008, the U.S. airline industry underwent consolidation with the merger of Delta Airlines and Northwest Airlines. In 2009, regional mainline

carriers Midwest Airlines and Frontier Airlines were acquired by Republic Airways, and Frontier Airlines remains a direct competitor of United at its Denver

hub. In early 2010, foreign carrier Japan Airlines filed for bankruptcy and began restructuring its business.

There is ongoing speculation that further airline industry consolidation could occur in the future. United routinely monitors changes in the competitive

landscape and engages in analysis and discussions regarding its strategic position, including alliances, asset acquisitions and divestitures and business

combinations. The Company’s strategic alliance with Continental Airlines will not realize all of the benefits of a merger. The Company may have future

discussions with other airlines regarding mergers and/or other strategic alternatives. If other airlines participate in merger activity, and United does not, those

airlines may significantly improve their cost structures or revenue generation capabilities, thereby potentially making them stronger competitors of United.

18