United Airlines 2009 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2009 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

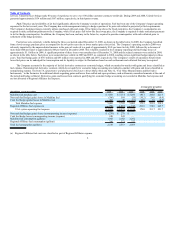

To ensure adequate supplies of fuel and to obtain a measure of control over fuel costs, the Company arranges to have fuel shipped on major pipelines and

stored close to its major hub locations. Although the Company currently does not anticipate a significant reduction in the availability of jet fuel, a number of

factors make predicting fuel prices and fuel availability uncertain, including changes in world energy demand, geopolitical uncertainties affecting energy supplies

from oil-producing nations, industrial accidents, threats of terrorism directed at oil supply infrastructure, extreme weather conditions causing temporary

shutdowns of production and refining capacity, as well as changes in relative demand for other petroleum products that may impact the quantity and price of jet

fuel produced from period to period.

Alliances. United has a number of bilateral and multilateral alliances with other airlines, which enhance travel options for customers seeking access to

markets that United does not serve directly. These marketing alliances typically include one or more of the following features: joint frequent flyer program

participation; codesharing of flight operations (whereby seats on one carrier’s selected flights can be marketed under the brand name of another carrier);

coordination of reservations, ticketing, passenger check-in, baggage handling and flight schedules; and other resource-sharing activities.

The most significant of the Company’s alliances is the Star Alliance, a global integrated airline network co-founded by United in 1997 and the most

comprehensive airline alliance in the world. As of January 1, 2010, Star Alliance carriers serve approximately 1,100 destinations in 175 countries with over

19,700 daily flights. Current Star Alliance partners, in addition to United, are Adria Airways, Air Canada, Air China, Air New Zealand, All Nippon Airways,

Asiana Airlines, the Austrian Airlines Group, Blue1, bmi, Brussels Airlines, Continental Airlines (“Continental”), Croatia Airlines, EgyptAir, LOT Polish

Airlines, Lufthansa, Scandinavian Airlines, Shanghai Airlines, Singapore Airlines, South African Airways, Spanair, Swiss International Air Lines, TAP Portugal,

THAI, Turkish Airlines and US Airways. Aegean Airlines, Air India and TAM Airlines have been announced as future Star Alliance members.

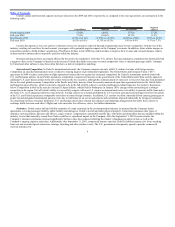

During 2009, Continental joined United and its 24 other partners in the Star Alliance. The alliance partnership between United and Continental allows the

two airlines to link their networks and services worldwide to the benefit of customers, employees and shareholders, creating new revenue opportunities, cost

savings and other efficiencies. Continental’s and United’s route networks are highly complementary, with little overlap, so they add value to each other and to

customers who are planning domestic and international travel. Under codesharing, customers benefit from a coordinated process for reservations/ticketing,

check-in, flight connections and baggage transfer. Frequent flyer reciprocity allows members of Continental’s OnePass program and United’s Mileage Plus

program to earn miles in their accounts when flying on either partner airline and redeem awards on both carriers. With Continental as a partner, United has added

more than 60 new destinations to its alliance network and dramatically enhanced its market presence in New York and Latin America. United and Continental are

exploring opportunities to capture important cost savings in the areas of information technology, frequent flyer programs, airport operations, lounges,

procurement and sales and marketing.

In addition, pursuant to antitrust immunity approval by the DOT, United, Air Canada, Continental and Lufthansa are implementing a joint venture

covering transatlantic routes that will deliver highly competitive flight schedules, fares and service. The European Commission is conducting a review of the

anticipated competitive impact of the joint venture operations. In December 2009, United and Continental applied jointly with All Nippon Airways to the DOT

for approval of, and immunity from U.S. antitrust laws for, a series of alliance agreements between and among the carriers, including a transpacific joint venture

agreement. A grant of antitrust immunity will enable the three carriers to integrate the services they operate between the United States and Japan, and other

destinations in Asia, to derive potentially significant benefits from coordinated scheduling, pricing, sales and inventory management. The integration of services

will also allow the three carriers to offer passengers highly competitive flight schedules, fares and services. The approval of the agreements and the DOT’s grant

of antitrust immunity, which is currently pending, is a condition precedent to Japan bringing into force the recently announced open skies agreement between

Japan and the United States. See Industry Regulation, below.

7