United Airlines 2009 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2009 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

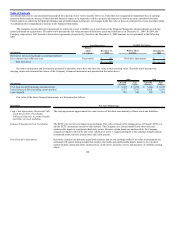

investments have been in an unrealized loss position for a period of over twelve months. However, United has not recognized an impairment loss in earnings

related to these securities because United does not intend or expect to be required to sell the securities and expects to recover its entire amortized cost basis.

United expects to collect the full principal balance and all related interest payments. All changes in the fair value of these investments have been classified within

Accumulated other comprehensive income in the Financial Statements.

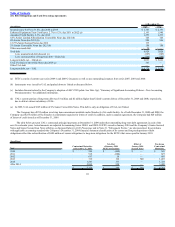

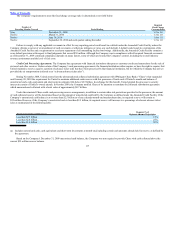

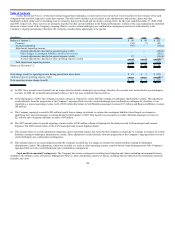

The Company records derivative instruments as a derivative asset or liability (on a gross basis) in its Financial Statements, and accordingly records any

related collateral on a gross basis. The table below presents the fair value amounts of derivative assets and liabilities as of December 31, 2009. In 2009, the

Company adopted new ASC derivative disclosure requirements prospectively; therefore, the December 31, 2008 amounts are not presented in the following

table.

Asset Derivatives Liability Derivatives

(In millions)

Balance

Sheet

Location

December 31,

2009

Balance Sheet

Location

December 31,

2009

Derivatives not receiving hedge accounting treatment:

Fuel contracts due within one year Receivables $ 138 Derivative instruments $ 5

Total derivatives $ 138 $ 5

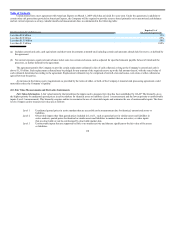

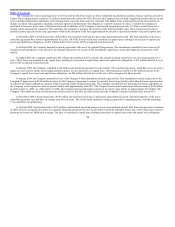

Derivative instruments and investments presented in the tables above have the same fair value as their carrying value. The table below presents the

carrying values and estimated fair values of the Company’s financial instruments not presented in the tables above:

2009 2008

(In millions)

Carrying

Amount

Fair

Value

Carrying

Amount

Fair

Value

UAL long-tem debt (including current portion) $ 6,923 $ 6,298 $ 6,644 $ 4,192

United long-tem debt (including current portion) 6,577 5,745 6,641 4,189

Lease deposits 326 340 326 351

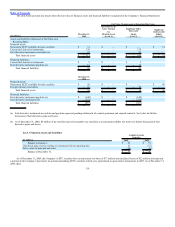

Fair value of the above financial instruments was determined as follows.

Description Fair Value Methodology

Cash, Cash Equivalents, Restricted Cash,

Trade Receivables, Fuel Hedge

Collateral Deposits, Accounts Payable

and Other Accrued Liabilities

The carrying amounts approximate fair value because of the short-term maturity of these assets and liabilities.

Enhanced Equipment Trust Certificates

The EETCs are not actively traded on an exchange. Fair value is based on the trading prices of United’s EETCs or

similar EETC instruments issued by other airlines. The Company uses internal models and observable and

unobservable inputs to corroborate third party quotes. Because certain inputs are unobservable, the Company

categorized inputs to the EETC fair value valuation as Level 3. Significant inputs to the valuation models include

contractual terms, risk-free interest rates and credit spreads.

Fuel Derivative Instruments

Derivative contracts are privately negotiated contracts and are not exchange traded. Fair value measurements are

estimated with option pricing models that employ observable and unobservable inputs. Inputs to the valuation

models include contractual terms, market prices, yield curves, fuel price curves and measures of volatility, among

others.

120