United Airlines 2009 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2009 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

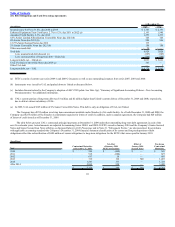

Table of Contents

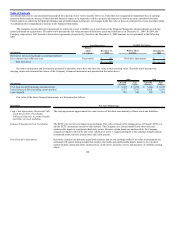

face amount of the equipment notes related to its outstanding Series 2001-1 EETCs, as well as for general corporate purposes. The transaction refinanced 29

aircraft covered under an existing EETC facility and financed two previously unencumbered aircraft.

In October 2009, UAL issued $345 million aggregate principal amount of 6% Senior Convertible Notes due 2029 (the “6% Senior Convertible Notes”),

generating approximately $336 million of net proceeds. The 6% Senior Convertible Notes are unsecured and may be converted by holders into shares of UAL’s

common stock at an initial conversion rate of 115.1013 shares of UAL common stock per $1,000 principal amount of notes, equivalent to an initial conversion

price of approximately $8.69 per share. Interest is payable semi-annually. UAL may redeem for cash all or part of the 6% Senior Convertible Notes on or after

October 15, 2014, and the 6% Senior Convertible Notes are subject to mandatory redemption in certain circumstances. In addition, holders of the 6% Senior

Convertible Notes have the right to require UAL to purchase all or a portion of their Notes on each of October 15, 2014, October 15, 2019 and October 15, 2024,

payable by UAL in cash, shares of UAL common stock or a combination thereof, at its option.

In October 2009, the Company completed total financings of $129 million with one of its regional flying partners. These financings consist of an $80

million secured note financing from its regional flying partner and an amendment to the Company’s capacity agreement with the regional flying partner that

allows a $49 million deferral of future obligations under that agreement. Interest obligations due under the secured note are at a fixed interest rate; principal and

interest payments are due monthly over the ten-year secured note term but may be repaid at any time partially or in full without penalty. The Company’s

obligations under the note are secured by certain of the Company’s ground equipment and slots. If a specified collateral ratio is not maintained, the Company

must either provide additional collateral or prepay the note to increase the collateral coverage ratio to the required minimum. Interest due on the deferral of future

obligations are at a fixed rate and the principal amount must be repaid within ten years. The Company also has the ability to repay the deferred obligations at any

time partially or in full without penalty. Also, the regional carrier can require the Company to repay the deferred obligations if the Company’s unrestricted liquid

assets drop below a specified dollar amount.

In August 2009, the Company completed a $30 million aircraft mortgage financing secured by one B777 aircraft. The financing agreement requires

monthly principal and interest payments and a balloon payment upon final maturity in March 2016. Interest is based on a variable interest rate plus a margin. The

Company has the right of prepayment with no penalty in certain circumstances.

In July 2009, United issued $175 million aggregate principal amount of 12.75% Senior Secured Notes due 2012 (the “12.75% Notes”). The 12.75% Notes

were issued at a discount of approximately $17 million from their principal amount at maturity. Interest on the principal of the 12.75% Notes is payable

quarterly. The 12.75% Notes are secured by a lien on certain aircraft spare parts owned by United and are guaranteed by UAL. United is required to maintain

certain collateral ratios, including a ratio of the outstanding principal to each of the following: total collateral, Section 1110 collateral and rotables/repairables

collateral. If any of these ratios fall below the required minimum, United would be required to provide additional collateral or redeem some or all of the 12.75%

Notes to comply with the minimum collateral ratio. In addition, the 12.75% Notes have a mandatory pro-rata redemption requirement if certain of United’s

in-service fleet falls below certain specified amounts. The Company has the right to redeem the 12.75% Notes at any time at par, plus accrued interest, plus a

potential make-whole amount. In addition, holders of the 12.75% Notes may require immediate repayment of the 12.75% Notes at par, plus accrued interest, in

the event of default.

In March 2009, the Company entered into a $134 million term loan agreement. This agreement requires quarterly interest and principal payments with the

remaining principal balance due at the end of the five year term. The applicable interest rate is variable. The loan is callable 42 months after its issuance and is

secured by certain of the Company’s spare engines. The agreement also cross-collateralizes the Company’s other obligations with this lender.

113