United Airlines 2009 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2009 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

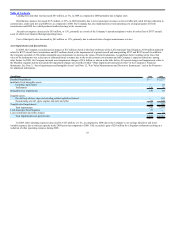

Company recorded asset impairment charges of $2.6 billion as presented in the table above under 2009 compared to 2008. See Critical Accounting Policies and

Note 3, “Asset Impairments and Intangible Assets,” in the Footnotes for additional information, including factors considered by management in concluding that

triggering events, which indicated potential impairment, had occurred and additional details of assets impaired.

In addition, lease termination and other charges of $25 million were recorded during 2008 which primarily relate to the accrual of future rents for the B737

leased aircraft that were removed from service and charges associated with the return of certain of these aircraft to their lessors.

The Company recorded special operating expense credits of $44 million in 2007. These items have been classified as special because they are directly

related to the resolution of bankruptcy administrative claims and are not indicative of the Company’s ongoing financial performance. Special items in the year

ended December 31, 2007 included a $30 million benefit due to the reduction in recorded accruals for bankruptcy litigation related to our SFO and LAX

municipal bond obligations and a $14 million benefit due to the Company’s ongoing efforts to resolve certain other bankruptcy pre-confirmation contingencies.

The 2007 special items resulted from revised estimates of the probable amount to be settled by the Bankruptcy Court. See Note 13, “Commitments, Contingent

Liabilities and Uncertainties” and Note 18, “Special Items,” in the Footnotes for further information on these special items and bankruptcy matters.

Other Income (Expense).

2009 compared to 2008

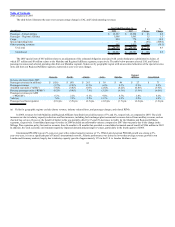

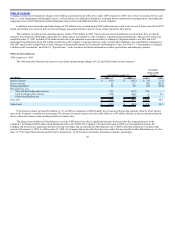

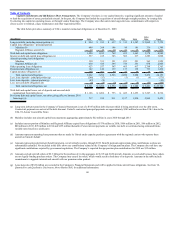

The following table illustrates the year-over-year dollar and percentage changes in UAL and United other income (expense).

Year Ended December 31,

Favorable/

(Unfavorable)

Change

(In millions) 2009 2008 $ %

Interest expense $ (577) $ (571) $ (6) (1.1)

Interest income 19 112 (93) (83.0)

Interest capitalized 10 20 (10) (50.0)

Miscellaneous, net:

Non-cash fuel hedge gains (losses) 279 (279) 558 —

Cash fuel hedge gains (losses) (248) (249) 1 0.4

Other miscellaneous, net 6 (22) 28 —

UAL total $ (511) $ (989) $ 478 48.3

United total $ (511) $ (989) $ 478 48.3

UAL interest expense increased $6 million, or 1%, in 2009 as compared to 2008 primarily due to increased borrowing, partially offset by lower interest

rates on the Company’s variable-rate borrowings. The decrease in interest expense was more than offset by a $93 million decrease in interest income primarily

due to reduced investment yields resulting from lower market rates.

The hedge losses included in Miscellaneous, net in the 2008 period were due to significant fuel price declines below the contractual prices in the

Company’s fuel hedge portfolio that existed during and at the end of 2008. The Company’s fuel derivative gain in 2009 was less significant because the

Company did not have any significant derivative activity for hedges that are classified in Miscellaneous, net, in 2009, other than settlement of contracts that

existed at December 31, 2008. As of December 31, 2009, the Company had no unsettled fuel derivative trades that are classified within Miscellaneous, net. See

Note 12, “Fair Value Measurements and Derivative Instruments,” in the Footnotes for further information related to fuel hedges.

50