United Airlines 2009 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2009 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

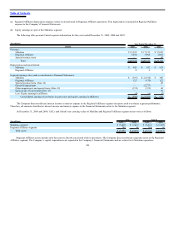

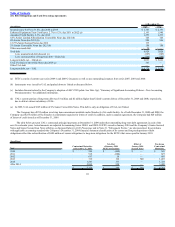

Table of Contents

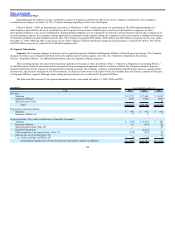

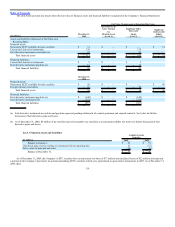

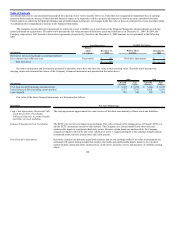

As of December 31, 2009, assets with a net carrying value of $8.0 billion, principally aircraft and related spare parts, route authorities and Mileage Plus

intangible assets were pledged under various loan and other agreements. After giving effect to the January 2010 debt transactions, assets with a carrying value of

$8.9 billion were pledged under various loan and other agreements.

2010 Financings

See Note 21, “Subsequent Events,” for additional information related to 2010 financing activities. In January 2010, the Company completed the planned

issuance of its remaining equipment notes relating to the Series 2009-1 and 2009-2 EETCs and used the proceeds to redeem all its existing equipment notes

issued in connection with the Series 2000-2 and 2001-1 EETCs, as discussed under 2009 Financings, below. As of December 31, 2009, most of the proceeds

from the issuance of the certificates were held in escrow pending completion of the refinancing activity that occurred in January 2010.

In January 2010, the Company issued $500 million aggregate principal amount of 9.875% Senior Secured Notes due 2013 (the “Senior Secured Notes”)

and $200 million aggregate principal amount of 12.0% Senior Second Lien Notes due 2013 (the “Senior Second Lien Notes”), guaranteed on a senior unsecured

basis by UAL and UAL’s subsidiaries that are guarantors or direct obligors under its Amended Credit Facility. The Senior Secured Notes and Senior Second Lien

Notes are secured by United’s route authority to operate between the United States and Japan and beyond Japan to points in other countries, certain airport

takeoff and landing slots and airport gate leaseholds utilized in connection with these routes. The notes contain a covenant, among others, that requires the

Company to maintain a minimum ratio of collateral value to debt obligations, which if not met may result in the acceleration of payments under the Senior

Secured Notes and Senior Second Lien Notes. The Company may meet this obligation by providing certain non-cash collateral and/or by redeeming, repaying,

prepaying, repurchasing or otherwise retiring its indebtedness, including by redeeming the Senior Secured Notes and Senior Second Lien Notes pursuant to any

available optional redemption provisions of the indentures governing the Senior Secured Notes and Senior Second Lien Notes. The interest on both the Senior

Secured Notes and Senior Second Lien Notes is payable semi-annually. The Company will contribute additional assets, primarily aircraft and engines, flight

simulators and certain domestic slots, to the Amended Credit Facility to allow the release of the collateral under the Senior Secured Notes and the Senior Second

Lien Notes from the Amended Credit Facility at a later date.

2009 Financings

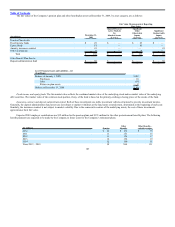

In November 2009, United created two pass-through trusts which issued approximately $810 million aggregate face amount of Series 2009-2A and

2009-2B EETCs. The EETCs represent fractional undivided interests in the respective pass-through trusts and are not obligations of United. The proceeds of the

issuance of the EETCs were used to purchase equipment notes issued by United, of which $114 million were issued during 2009 with the remainder issued in

January 2010. The payment obligations of United under the equipment notes are fully and unconditionally guaranteed by UAL. The equipment notes have a

stated interest rate of 9.75% for the Series A equipment notes and 12.0% for the Series B equipment notes, payable semi-annually. The net proceeds from the

issuance of these equipment notes were used to repay, at par, the entire $493 million aggregate face amount of the equipment notes related to its outstanding

Series 2000-2 EETCs, as well as for general corporate purposes. The equipment notes issued in connection with the Series 2009-2 EETCs are secured by a total

of 37 aircraft, four of which were previously unencumbered.

In October 2009, United created a pass-through trust which issued approximately $659 million aggregate face amount of Series 2009-1 EETCs. The

EETCs represent fractional undivided interests in the pass-through trust and are not obligations of United. The proceeds of the issuance of the EETCs were used

to purchase equipment notes issued by United, of which $47 million were issued during 2009 with the remainder issued in January 2010. The payment

obligations of United under the equipment notes are fully and unconditionally guaranteed by UAL. The equipment notes have a stated interest rate of 10.4%,

payable semi-annually. The net proceeds from the issuance of these equipment notes were used to repay, at par, the entire $568 million aggregate

112