United Airlines 2009 Annual Report Download - page 167

Download and view the complete annual report

Please find page 167 of the 2009 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

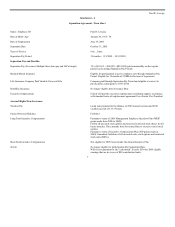

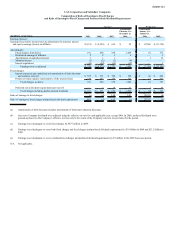

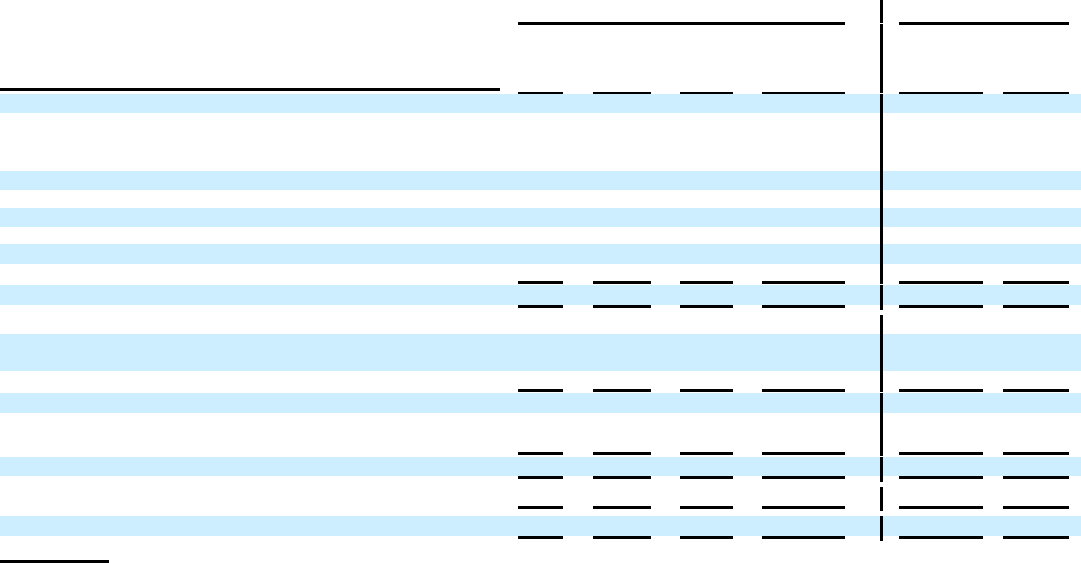

Exhibit 12.2

United Air Lines, Inc. and Subsidiary Companies

Computation of Ratio of Earnings to Fixed Charges

and Ratio of Earnings to Fixed Charges and Preferred Stock Dividend Requirements

Successor

Predecessor

Period from

February 1 to

December 31,

Period from

January 1 to

January 31,

(In millions, except ratios) 2009 2008 2007 2006

2006 2005

Earnings (losses):

Earnings (loss) before income taxes & adjustments for minority interest

and equity earnings (losses) in affiliates $ (647) $ (5,380) $ 653 $ 44 $ 22,620 $ (21,038)

Add (deduct):

Fixed charges, from below 911 869 938 1,071 64 786

Distributed earnings of affiliates 2 2 3 4 — 3

Amortization of capitalized interest 3 1 1 — 1 14

Minority interest (1) (2) (2) (4) — —

Interest capitalized (10) (20) (19) (15) — 3

Earnings (loss) as adjusted $ 258 $ (4,530) $ 1,574 $ 1,100 $ 22,685 $ (20,232)

Fixed charges:

Interest expensed and capitalized and amortization of debt discounts

and issuance costs (a) $ 577 $ 571 $ 703 $ 747 $ 42 $ 495

Portion of rental expense representative of the interest factor 334 298 235 324 22 291

Fixed charges, as above 911 869 938 1,071 64 786

Preferred stock dividend requirements (pre-tax) (b) — 3 18 29 — —

Fixed charges including preferred stock dividends $ 911 $ 872 $ 956 $ 1,100 $ 64 $ 786

Ratio of earnings to fixed charges (c) (d) 1.68 1.03 354.45 (d)

Ratio of earnings to fixed charges and preferred dividend requirements N/A (d) 1.65 1.00 N/A N/A

(a) Amortization of debt discounts includes amortization of fresh-start valuation discounts.

(b) Successor Company dividends were adjusted using the effective tax rate for each applicable year, except 2006. In 2006, preferred dividends were

grossed-up based on the Company’s effective tax rate only to the extent of the Company’s income tax provision for the period.

(c) Earnings were inadequate to cover fixed charges by $653 million and by $21.0 billion in 2005, respectively.

(d) Earnings were inadequate to cover both fixed charges and fixed charges and preferred dividend requirements by $5.4 billion in 2008.

N/A Not applicable.