United Airlines 2009 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2009 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

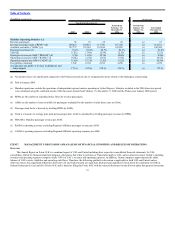

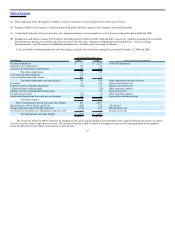

(a) These significant items affecting the Company’s results of operations are discussed in Results of Operations, below.

(b) Regional Affiliates’ fuel expense is classified as part of Regional Affiliates expense in the Company’s Financial Statements.

(c) As described in Results of Operations below, asset impairment charges were recorded as a result of interim testing performed in 2009 and 2008.

(d) Includes non-cash interest expense of $55 million, $48 million and $43 million in 2009, 2008 and 2007, respectively, related to accounting for convertible

debt instruments that may be settled in cash upon conversion. See Note 1(p), “Summary of Significant Accounting Policies—New Accounting

Pronouncements,” in the Footnotes for additional information. Also includes equity in earnings of affiliates.

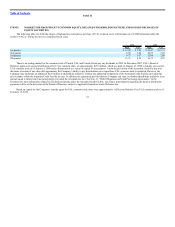

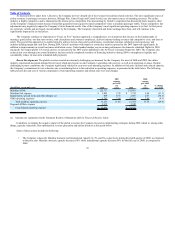

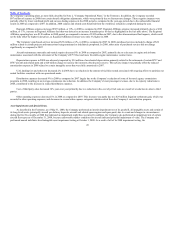

UAL recorded the following impairment and other charges, as further discussed below, during the year ended December 31, 2009 and 2008:

Year Ended December 31,

(In millions) 2009 2008 Income statement classification

Goodwill impairment $ — $ 2,277 Goodwill impairment

Intangible asset impairments 150 64

Aircraft and related deposit impairments 93 250

Total other impairments 243 314

LAX municipal bond litigation 27 —

Lease termination and other charges 104 25

Total other impairments and special items 374 339 Other impairments and special items

Severance 33 106 Salaries and related costs

Employee benefit obligation adjustment (35) 57 Salaries and related costs

Litigation-related settlement gain — (29) Other operating expenses

Charges related to terminated/deferred projects — 26 Purchased services

Net gain on asset sales (11) (3) Other operating expenses

Accelerated depreciation from early asset retirements 48 34 Depreciation and amortization

Total other charges 35 191

Total of impairments, special items and other charges 409 2,807

Operating non-cash fuel hedge (gain) loss (586) 568 Aircraft fuel

Nonoperating non-cash fuel hedge (gain) loss (279) 279 Miscellaneous, net

Tax benefit on intangible asset impairments and asset sales (21) (31) Income tax benefit

Total impairments and other charges $ (477) $ 3,623

The income tax benefit in 2009 is related to the impairment and sale of certain indefinite-lived intangible assets, partially offset by the income tax effects

of items recorded in other comprehensive income. The income tax benefit in 2008 is related to the impairment and sale of certain indefinite-lived intangible

assets, partially offset by the impact of an increase in state tax rates.

39