United Airlines 2009 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2009 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

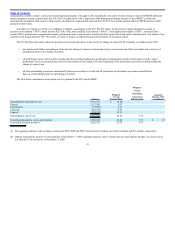

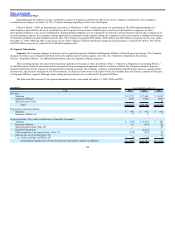

other comprehensive income. In 2008, UAL and United recorded tax benefits of $25 million and $22 million, respectively, primarily due to the impairment and

sale of select indefinite-lived intangibles and the impact of an increase in state tax rates. This tax benefit is small relative to the Company’s losses; consequently,

the Company’s effective tax rate is insignificant, when compared to the 35% U.S. federal statutory rate. In 2007, the Company’s regular taxable income was

completely absorbed by utilization of its net operating loss (“NOL”) carry forward; however, the Company did incur an alternative minimum tax (“AMT”)

liability of $6 million.

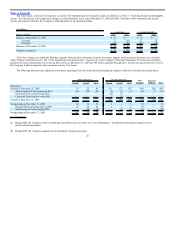

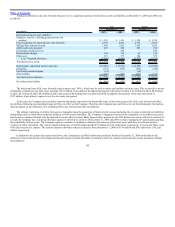

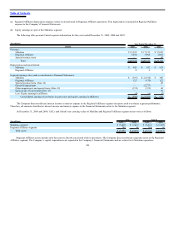

The significant components of the income tax expense (benefit) are as follows:

(In millions) Year Ended December 31,

UAL 2009 2008 2007

Current tax expense (benefit) $ (1) $ 1 $ 6

Deferred tax expense (benefit) (16) (26) 291

$ (17) $ (25) $ 297

United

Current tax expense $ — $ 4 $ 6

Deferred tax expense (benefit) (16) (26) 290

$ (16) $ (22) $ 296

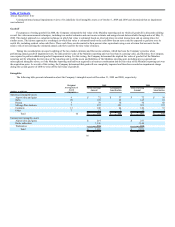

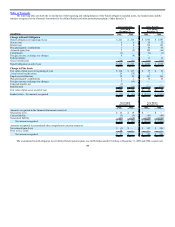

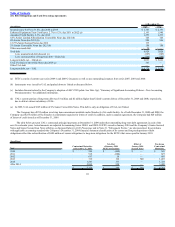

The income tax provision differed from amounts computed at the statutory federal income tax rate, as follows:

(In millions) Year Ended December 31,

UAL 2009 2008 2007

Income tax provision at statutory rate $ (234) $ (1,896) $ 229

State income taxes, net of federal income tax benefit 5 (68) 12

Goodwill — 798 —

Nondeductible employee meals 6 7 10

Nondeductible interest expense 12 10 21

Medicare Part D Subsidy (7) (12) (2)

Valuation allowance 190 1,117 15

Share-based compensation 7 — 2

Rate change beginning deferreds — 14 —

Other, net 4 5 10

$ (17) $ (25) $ 297

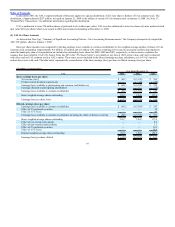

(In millions) Year Ended December 31,

United 2009 2008 2007

Income tax provision at statutory rate $ (225) $ (1,882) $ 229

State income taxes, net of federal income tax benefit 6 (67) 12

Goodwill — 798 —

Nondeductible employee meals 6 7 10

Nondeductible interest expense 12 10 21

Medicare Part D Subsidy (7) (12) (2)

Valuation allowance 182 1,101 15

Share-based compensation 7 — 2

Rate change beginning deferreds — 14 —

Other, net 3 9 9

$ (16) $ (22) $ 296

101