United Airlines 2009 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2009 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

The issuance of UAL common stock upon a noteholder’s exercise of its option to require UAL to repurchase convertible notes could cause dilution to the

interests of existing stockholders.

Under the terms of the Company’s 4.5% Notes, 5% Notes and 6% Senior Convertible Notes, holders of such notes may require UAL to purchase all or a

portion of such notes at a repurchase price equal to 100% of the principal amount of such notes, plus accrued and unpaid interest, on June 30, 2011 and June 30,

2016 in the case of the 4.5% Notes, February 1, 2011 and February 1, 2016 in the case of the 5% Notes and October 15, 2014, October 15, 2019 and October 15,

2024 in the case of the 6% Senior Convertible Notes. If a noteholder exercises such option, UAL may elect to pay the repurchase price in cash, shares of its

common stock or a combination thereof. If UAL elects to pay the repurchase price in shares of its common stock, UAL is obligated to deliver a number of shares

of common stock equal to the repurchase price divided by an average price of UAL common stock for a 20-consecutive trading day period. The number of shares

issued could be significant. If UAL determines to pay the repurchase price in shares of its common stock, such an issuance could cause significant dilution to the

interests of its existing stockholders. In addition, if UAL elects to pay the repurchase price in cash, its liquidity could be adversely affected.

UAL’s certificate of incorporation limits voting rights of certain foreign persons.

UAL’s restated certificate of incorporation limits the total number of shares of equity securities held by persons who are not “citizens of the United

States,” as defined in Section 40102(a)(15) of Title 49 United States Code, to no more than 24.9% of the aggregate votes of all equity securities outstanding. This

restriction is applied pro rata among all holders of equity securities who fail to qualify as “citizens of the United States,” based on the number of votes the

underlying securities are entitled to.

ITEM 1B. UNRESOLVED STAFF COMMENTS.

None.

ITEM 2. PROPERTIES.

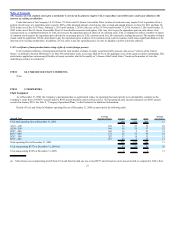

Flight Equipment

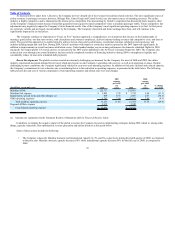

As of December 31, 2009, the Company’s operational plans to significantly reduce its operating fleet and capacity were substantially complete as the

Company’s entire fleet of 94 B737 aircraft and five B747 aircraft had been removed from service. The last planned early aircraft retirement of a B747 aircraft

occurred in January 2010. See Note 2, “Company Operational Plans,” in the Footnotes for additional information.

Details of UAL and United’s Mainline operating fleet as of December 31, 2009 are provided in the following table:

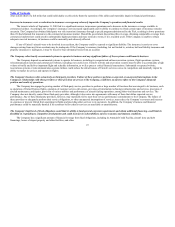

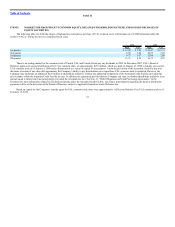

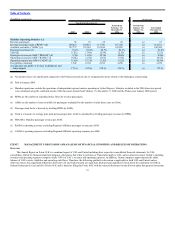

Aircraft Type

Average

Number of Seats Owned Leased Total

Average

Age (Years)

UAL total operating fleet at December 31, 2008 209 200 409 13

A319—100 120 32 23 55 10

A320—200 146 38 59 97 12

B747—400 368 16 9 25 15

B757—200 172 23 73 96 18

B767—300 207 17 18 35 15

B777—200 267 45 7 52 11

Total operating fleet at December 31, 2009 171 189 360 13

UAL nonoperating B737s at December 31, 2009 (a) 42 28 70 20

UAL nonoperating B747s at December 31, 2009 5 — 5 13

(a) United leases one nonoperating aircraft from UAL and therefore had one less owned B737 aircraft and one more leased aircraft as compared to UAL’s fleet.

27