United Airlines 2009 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2009 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

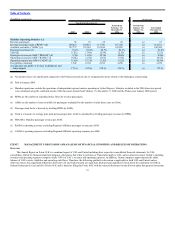

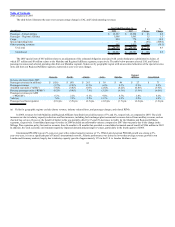

Consolidated capacity was approximately 3% and 7% lower in the fourth quarter and the full year of 2009, respectively, as compared to the prior

year;

• The Company permanently removed 100 aircraft from its fleet, including its entire fleet of 94 B737 aircraft and six B747 aircraft in order to

eliminate unprofitable capacity and divest the Company of assets that did not provide an acceptable return. The Company also streamlined its

operations and corporate functions in order to match the size of its workforce to the size of its reduced capacity, resulting in a workforce reduction

of approximately 9,000 positions during 2008 and 2009. The workforce reduction was completed through a combination of furloughs and

furlough-mitigation programs, such as voluntary early-out options, to reduce the required involuntary furloughs. Of the total represented workforce

reduction, approximately 45% was accomplished through voluntary furloughs;

• The Company reconfigured its entire Ted fleet of 56 all-economy Airbus aircraft to include United First, Economy Plus and economy seating and

continues to refit its widebody international aircraft with new first and business class premium seats, entertainment systems and other product

enhancements. During 2009, the Company completed its upgrade of all of its B767 and B747 aircraft, which are used for international flights, and

commenced the reconfiguration of its international B777 fleet in February 2010;

• The Company created new revenue streams through unbundling its flight services and various other new service offerings. The new revenue

initiatives include fees for checked bags on domestic and international flights, express airport check-in and boarding through Premier TravelSM and

Premier Travel PlusSM, and an annual subscription for two checked bags at no additional cost for United and Regional Affiliates-operated flights

through Premier Baggage;

• In October 2009, Continental joined United and its 24 partners in the Star Alliance linking the airlines’ networks and services worldwide and

creating new revenue opportunities, cost savings and other efficiencies;

• In December 2009, United filed an application jointly with All Nippon Airways and Continental to the DOT for antitrust immunity for a series of

alliance agreements between and among the carriers, including a transpacific joint venture agreement; and

• In December 2009, the Company announced its intention to place an aircraft order for 25 Boeing 787-8 Dreamliner aircraft and 25 Airbus A350

XWB aircraft, with future purchase rights for an additional 50 planes of each aircraft type. The 25 Boeing aircraft and 25 Airbus aircraft are to

replace the Company’s international Boeing 747s and 767s. The Company estimates that it will reduce its fuel costs and carbon emissions from the

25 Boeing aircraft and 25 Airbus aircraft combined by approximately 33% compared with the aircraft they will replace, lower average lifetime

maintenance costs for the 25 Boeing aircraft and 25 Airbus aircraft combined by approximately 40% per available seat mile compared with the

aircraft they will replace, and enable service to a broader range of international destinations while providing customers with state-of-the-art cabin

comfort. The Boeing aircraft order is pursuant to a purchase agreement entered into by the Company and The Boeing Company in February 2010

and the Airbus aircraft order is subject to the execution of a definitive written agreement that is expected to be finalized in the first quarter of 2010.

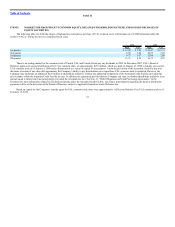

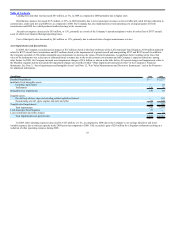

The Company also took certain actions to enhance its liquidity and minimize its financing costs during this challenging economic environment. In 2009,

the Company’s liquidity initiatives generated unrestricted cash of more than $1.5 billion primarily from the issuance of UAL common stock, proceeds from new

debt issuances and aircraft asset sale-leaseback transactions. See Liquidity and Capital Resources—Financing Activities, below, for additional information related

to these transactions.

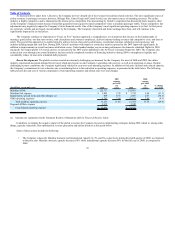

The Company also made the following significant changes to its international route network:

• The Company commenced new daily service from Washington Dulles to Moscow and Geneva in March and April 2009, respectively;

37