United Airlines 2009 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2009 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

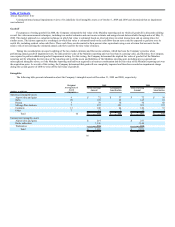

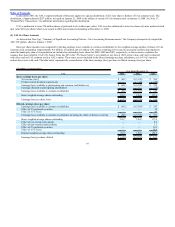

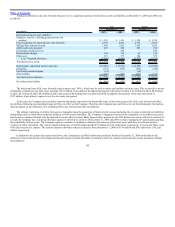

During the year ended December 31, 2009, the Company’s unamortized intangible assets decreased by $168 million consisting of $150 million impairment

of its tradenames and $18 million due to the sale of certain airport slot assets. Unamortized intangible assets, other than goodwill, decreased by $82 million

during 2008 as a result of a $64 million impairment of codeshare agreements and tradenames, and an $18 million decrease in airport slots and gates related to the

sale of assets.

Total amortization expense recognized was $69 million, $92 million and $155 million for the years ended December 31, 2009, 2008 and 2007,

respectively. The Company expects to record amortization expense of $42 million, $39 million, $38 million, $36 million and $31 million for 2010, 2011, 2012,

2013 and 2014, respectively.

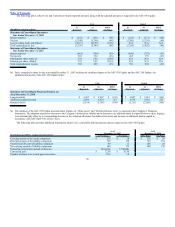

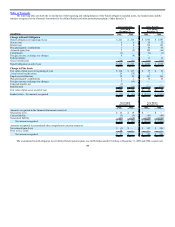

(4) Common Stockholders’ Deficit and Preferred Securities

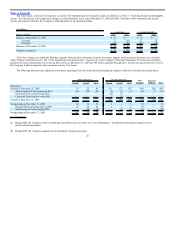

Changes in the number of shares of UAL common stock outstanding during the years ended December 31, 2009, 2008 and 2007 were as follows:

Year Ended December 31,

UAL 2009 2008 2007

Shares outstanding at beginning of year 140,037,928 116,921,049 112,280,629

Issuance of UAL stock under equity offering 26,111,183 11,208,438 —

Issuance of UAL stock upon conversion of preferred stock — 11,145,812 —

Issuance of UAL stock to creditors 1,648,989 765,780 3,849,389

Issuance of UAL stock to employees 82,450 418,664 1,155,582

Forfeiture of non-vested UAL stock (62,761) (110,926) (104,733)

Shares acquired for treasury (207,169) (310,889) (259,818)

Shares outstanding at end of year 167,610,620 140,037,928 116,921,049

Treasury shares at beginning of year 707,484 396,595 136,777

Shares acquired for treasury 207,169 310,889 259,818

Treasury shares at end of year 914,653 707,484 396,595

All treasury shares were acquired for tax withholding obligations related to UAL’s share-based compensation plan. See Note 6, “Share-Based

Compensation Plans,” for additional information related to the remaining grants available to be awarded under UAL’s share-based compensation plans and

outstanding option awards, neither of which are included in outstanding shares above.

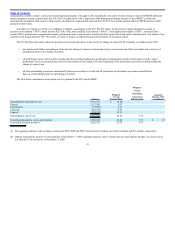

During 2009 and 2008, the Company sold 7.1 million and 11.2 million shares of common stock, respectively, as part of a $200 million equity offering

program generating net proceeds of $75 million and $122 million, respectively. Of the 2008 sales, $107 million was received in 2008 and $15 million was

received in January 2009 upon settlement of shares sold during the last three days of 2008. This equity offering program was completed in 2009.

In addition, UAL sold 19.0 million shares of UAL common stock in an underwritten, public offering for a price of $7.24 per share in October 2009. The

Company received approximately $132 million of net proceeds from this issuance. UAL contributed the proceeds from both its equity offering program and its

19.0 million common stock issuance to United, as further discussed in Note 17, “Related Party Transactions.”

In 2008, 11.1 million shares of UAL common stock were issued upon preferred stockholders’ elections to exercise their conversion option of all 5 million

shares of 2% mandatorily convertible preferred stock. This class of stock was retired in October 2008. The Company increased additional paid in capital by

$374 million and decreased the mandatorily convertible preferred stock by the same amount to record the impact of these conversions.

96