United Airlines 2009 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2009 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Other Frequent Flyer Accounting Policies.

The Company has adopted a deferred revenue measurement method to record the fair value of its frequent flyer obligation. This method allocates an

equivalent weighted-average ticket value to each outstanding mile, based upon projected redemption patterns for available award choices when such miles are

consumed. For miles sold to third parties, the Company recognizes revenue related to the air transportation and marketing-related elements as follows:

Air Transportation Element. The Company defers the portion of the sales proceeds that represents estimated fair value of the air transportation and

recognizes that amount as revenue when transportation is provided. The fair value of the air transportation component is determined based upon the equivalent

ticket value of similar fares on United and amounts paid to other airlines for miles. The initial revenue deferral is presented as “Mileage Plus deferred revenue” in

the Financial Statements. When recognized, the revenue related to the air transportation component is classified as “Passenger revenues” in the Financial

Statements.

Marketing-related Element. The amount of revenue from the marketing-related element is determined by subtracting the fair value of the air transportation

from the total sales proceeds. The residual portion of the sales proceeds related to marketing activities is recognized when miles are awarded. This portion is

recognized as “Other operating revenues” in the Financial Statements.

The value of the deferred revenue is estimated assuming redemptions on both United and other participating carriers in the Mileage Plus program and by

estimating the relative proportions of awards to be redeemed by class of service within broad geographic regions of the Company’s operations, including

Domestic, Atlantic, Pacific and Latin America. The estimation of the fair value of each award mile requires the use of several significant assumptions, for which

significant management judgment is required. For example, management must estimate how many miles are projected to be redeemed on United, versus on other

airline partners. Since the equivalent ticket value of miles redeemed on United and on other carriers can vary greatly, this assumption can materially affect the

calculation of the weighted-average ticket value from period to period.

Management must also estimate the expected redemption patterns of Mileage Plus customers, who have a number of different award choices when

redeeming their miles, each of which can have materially different estimated fair values. Such choices include different classes of service (first, business and

several coach award levels), as well as different flight itineraries, such as domestic and international routings and varied itineraries within domestic and

international regions of United’s and other participating carriers’ route networks. Customer redemption patterns may also be influenced by program changes,

which occur from time to time and introduce new award choices, or make material changes to the terms of existing award choices. Management must often

estimate the probable impact of such program changes on future customer behavior. Management uses historical customer redemption patterns as the best single

indicator of future redemption behavior in making its estimates, but changes in customer mileage redemption behavior to patterns which are not consistent with

historical behavior can result in material changes to deferred revenue balances and to recognized revenue.

The Company measures its deferred revenue obligation using all awarded and outstanding miles, regardless of whether or not the customer has

accumulated enough miles to redeem an award. Eventually these customers accumulate enough miles to redeem awards, or their accounts deactivate after a

period of inactivity, in which case the Company recognizes the related revenue through its revenue recognition policy for expired miles.

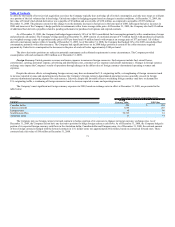

The Company recognizes revenue related to expected expired miles over the estimated redemption period. Based on analysis of mileage redemption and

expiration patterns, the Company estimates that 24% of earned miles will expire or go unredeemed. As of December 31, 2009 and 2008, the Company’s

outstanding number of miles was approximately 457.6 billion and 478.2 billion, respectively. The Company estimates that approximately 349.1 billion of the

outstanding miles at December 31, 2009 will ultimately be redeemed based on assumptions as of December 31, 2009. At December 31, 2009, a hypothetical 1%

change in the Company’s outstanding number of miles or the weighted-average ticket value has approximately a $41 million effect on the

63