United Airlines 2009 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2009 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

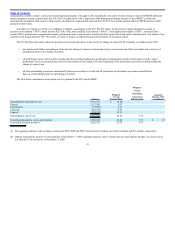

(3) Asset Impairments and Intangible Assets

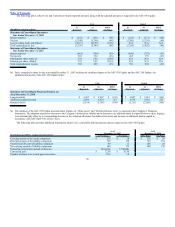

The Company recorded impairment charges during the years ended December 31, 2009 and 2008, as presented in the table below. All of these impairment

charges are within the Mainline segment. All of the impairments other than the goodwill impairment, which is separately identified, are classified within “Other

impairments and special items” in the Company’s Financial Statements.

Year Ended

December 31,

(In millions) 2009 2008

Goodwill impairment $ — $ 2,277

Indefinite-lived intangible assets:

Codeshare agreements — 44

Tradenames 150 20

Intangible asset impairments 150 64

Tangible assets:

Pre-delivery advance deposits including related capitalized interest — 105

Nonoperating aircraft, spare engines and parts and other 93 145

Tangible asset impairments 93 250

Total impairments $ 243 $ 2,591

Due to extreme fuel price volatility, tight credit markets, the uncertain economic environment, as well as other uncertainties, the Company can provide no

assurance that a material impairment charge will not occur in a future period. The Company will continue to monitor circumstances and events in future periods

to determine whether additional asset impairment testing is warranted.

The following is a discussion of impairment testing. See Note 12, “Fair Value Measurements and Derivative Instruments,” for additional information

related to the use of fair values in impairment testing.

Triggering Events Requiring Testing

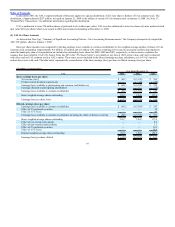

During 2009, the Company performed interim and annual impairment tests of its intangible assets and certain of its long-lived assets (principally aircraft

and related spare engines and spare parts) due to events and changes in circumstances that indicated an impairment might have occurred. The primary factors

deemed by management to have constituted a potential impairment triggering event were a significant decline in unit revenues experienced in early 2009 and

decreases in forecasted revenues and cash flows.

Similarly during 2008, the Company performed an interim impairment test of its goodwill, all intangible assets and certain of its long-lived assets

(principally aircraft and related spare engines and spare parts) as of May 31, 2008 due to events and changes in circumstances during the first and second quarters

of 2008 that indicated an impairment might have occurred. Factors deemed by management to have collectively constituted an impairment triggering event

included record high fuel prices, significant losses in the first and second quarters of 2008, a softening U.S. economy, analyst downgrade of UAL common stock,

rating agency changes in outlook for the Company’s debt instruments from stable to negative, the announcement of the planned removal from UAL’s fleet of 100

aircraft and a significant decrease in the fair value of the Company’s outstanding equity and debt securities, including a decline in UAL’s market capitalization to

significantly below book value.

Aircraft and definite-lived intangible assets

2009 Impairment Testing

The Company tested certain of its definite-lived intangible assets at February 28, 2009 and determined that the carrying value of its definite-lived

intangible assets was fully recoverable because their carrying amount

93