United Airlines 2009 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2009 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

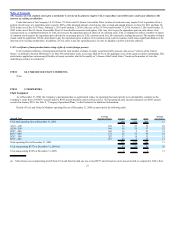

Table of Contents

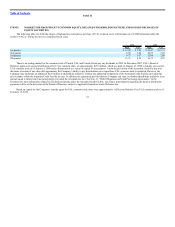

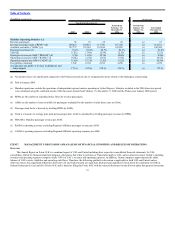

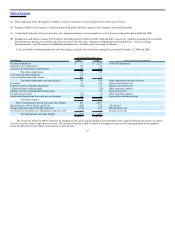

(In millions, except rates) Successor Predecessor

Year Ended December 31,

2009 2008 2007

Period from

February 1 to

December 31,

2006

Period from

January 1 to

January 31,

2006

Year Ended

December 31,

2005

Mainline Operating Statistics (c):

Revenue passengers 56 63 68 69 (c) 67

Revenue passenger miles (“RPMs”) (d) 100,475 110,061 117,399 117,470 (c) 114,272

Available seat miles (“ASMs”) (e) 122,737 135,861 141,890 143,095 (c) 140,300

Passenger load factor (f) 81.9% 81.0% 82.7% 82.1% (c) 81.4%

Yield (g) 11.81¢ 13.89¢ 12.99¢ 12.19¢ (c) 11.25¢

Passenger revenue per ASM (“PRASM”) (h) 9.70¢ 11.29¢ 10.78¢ 10.04¢ (c) 9.20¢

Operating revenue per ASM (“RASM”) (i) 10.81¢ 12.58¢ 12.03¢ 11.49¢ (c) 10.66¢

Operating expense per ASM (“CASM”) (j) 11.05¢ 15.74¢ 11.39¢ 11.23¢ (c) 10.59¢

Fuel gallons consumed 1,942 2,182 2,292 2,290 (c) 2,250

Average price per gallon of jet fuel, including tax and

hedge impact 175.3¢ 353.9¢ 218.3¢ 210.7¢ (c) 179.2¢

(a) Net income (loss) was significantly impacted in the Predecessor periods due to reorganization items related to the bankruptcy restructuring.

(b) Paid in January 2008.

(c) Mainline operations exclude the operations of independent regional carriers operating as United Express. Statistics included in the 2006 Successor period

were calculated using the combined results of the Successor period from February 1 to December 31, 2006 and the Predecessor January 2006 period.

(d) RPMs are the number of scheduled miles flown by revenue passengers.

(e) ASMs are the number of seats available for passengers multiplied by the number of miles those seats are flown.

(f) Passenger load factor is derived by dividing RPMs by ASMs.

(g) Yield is a measure of average price paid per passenger mile, which is calculated by dividing passenger revenues by RPMs.

(h) PRASM is Mainline passenger revenue per ASM.

(i) RASM is operating revenues excluding Regional Affiliates passenger revenue per ASM.

(j) CASM is operating expenses excluding Regional Affiliates operating expenses per ASM.

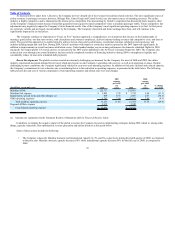

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

Overview

This Annual Report on Form 10-K is a combined report of UAL and United including their respective consolidated financial statements. As UAL

consolidates United for financial statement purposes, disclosures that relate to activities of United also apply to UAL, unless otherwise noted. United’s operating

revenues and operating expenses comprise nearly 100% of UAL’s revenues and operating expenses. In addition, United comprises approximately the entire

balance of UAL’s assets, liabilities and operating cash flows. Therefore, the following qualitative discussion is applicable to both UAL and United, unless

otherwise noted. Any significant differences between UAL and United results are separately disclosed and explained. United meets the conditions set forth in

General Instruction I(1)(a) and (b) of Form 10-K and is therefore filing this Form 10-K with the reduced disclosure format allowed under that general instruction.

35