United Airlines 2009 Annual Report Download - page 136

Download and view the complete annual report

Please find page 136 of the 2009 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

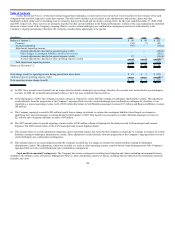

• The third quarter included $24 million of lease termination and other special charges, $22 million of severance charges, $19 million of aircraft

impairment charges to reduce the carrying value of five nonoperating B747 aircraft to their net realizable value and $6 million of accelerated

depreciation related to aircraft groundings. These items were offset by an $11 million gain on asset sales.

• During the fourth quarter, the Company recorded an additional $74 million of aircraft impairment charges, $50 million of lease termination and

other special charges, $10 million of severance charges and $10 million accelerated depreciation related to aircraft groundings.

2008

• The second quarter was negatively impacted by impairment charges of $2.5 billion related to the Company’s interim impairment testing of its

intangible assets. In addition, the Company incurred $110 million of severance and employee benefit charges, as well as $26 million of purchased

services charges. Offsetting these impacts was a $29 million gain from a litigation-related settlement gain.

• The third quarter included reversals of $16 million of intangible asset impairments recorded during the second quarter. The Company also recorded

an additional $6 million of severance charges, as well as $8 million of losses on the sale of assets and $7 million of lease termination and other

charges.

• During the fourth quarter, the Company recorded $107 million of impairment charges, $18 million of severance, $53 million of employee benefit

charges, $34 million of accelerated depreciation related to aircraft groundings and $18 million of lease termination and other special charges. In

addition, an $11 million net gain on asset sales partially offset these unfavorable expenses.

See Note 2, “Company Operational Plans” and Note 3, “Asset Impairments and Intangible Assets,” for further discussion of these items.

(21) Subsequent Events

The Company has evaluated its subsequent events for disclosure and has identified the following events.

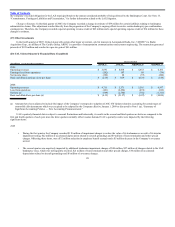

In January 2010, United issued the remaining $612 million of equipment notes relating to the Series 2009-1 EETCs of which $568 million was used to

complete the pre-payment of the remaining principal of the equipment notes issued in connection with the Series 2001-1 EETCs and the remaining $44 million,

before expenses and accrued interest due on the equipment notes related to the Series 2001-1 EETCs, provided the Company with incremental liquidity. The

Company also received $21 million of proceeds from the distribution of the Series 2001-1 EETC trust assets upon repayment of the note obligations.

In January 2010, United also issued the remaining $696 million of equipment notes relating to the Series 2009-2 EETCs of which $493 million was used to

pre-pay the remaining principal of the equipment notes issued in connection with the Series 2000-2 EETCs and the remaining proceeds of $203 million, before

expenses and accrued interest due on equipment notes related to the Series 2000-2 EETCs, provided the Company with incremental liquidity.

In January 2010, United issued $700 million aggregate principal amount of Senior Secured Notes and Senior Second Lien Notes. The Company expects to

receive proceeds from the issuance in April 2010, upon release of the collateral from the Amended Credit Facility.

The EETC repayments, discussed above, significantly reduced the future near term debt requirements. See Note 11, “Debt Obligations and Card

Processing Agreements,” for additional information related to these financings including the Company’s future debt maturities after giving effect to these

transactions.

132