United Airlines 2009 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2009 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

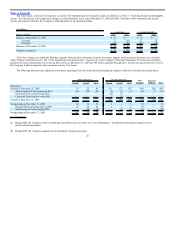

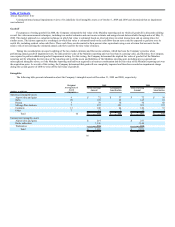

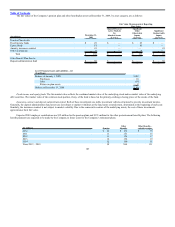

In December 2007, the UAL Corporation Board of Directors approved a special distribution of $2.15 per share to holders of UAL common stock. The

distribution, of approximately $257 million, was paid on January 23, 2008 to the holders of record of UAL common stock on January 9, 2008. See Note 17,

“Related Party Transactions,” for additional information regarding this distribution.

UAL is authorized to issue 250 million shares of preferred stock (without par value). UAL was also authorized to issue two shares of junior preferred stock

(par value $0.01 per share) which were issued in 2006 and remained outstanding at December 31, 2009.

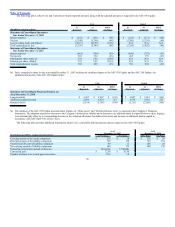

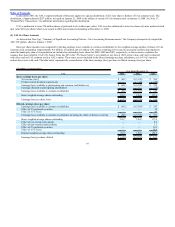

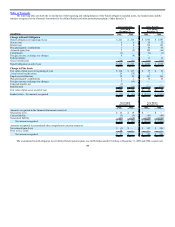

(5) UAL Per Share Amounts

As discussed in Note 1(p), “Summary of Significant Accounting Policies—New Accounting Pronouncements,” the Company retrospectively adopted the

ASC 260 Update, effective January 1, 2009.

Basic per share amounts were computed by dividing earnings (loss) available to common stockholders by the weighted-average number of shares of UAL

common stock outstanding. Approximately 0.4 million, 2.0 million and 2.8 million UAL shares remaining to be issued to unsecured creditors and employees

under the bankruptcy plan of reorganization are included in outstanding basic shares for 2009, 2008 and 2007, respectively, as the necessary conditions for

issuance have been satisfied. UAL’s 6% Senior Notes due 2031 (the “6% Senior Notes”), are callable at any time at 100% of par value, and can be redeemed

with either cash or UAL common stock at UAL’s option. These notes are not included in the diluted earnings per share calculation, as it is UAL’s intent to

redeem these notes with cash. The table below represents the reconciliation of the basic earnings (loss) per share to diluted earnings (loss) per share.

(In millions, except per share)

Year Ended December 31,

UAL 2009 2008 2007

Basic earnings (loss) per share:

Net income (loss) $ (651) $ (5,396) $ 360

Preferred stock dividend requirements — (3) (10)

Earnings (loss) available to participating and common stockholders (a) $ (651) $ (5,399) $ 350

Earnings allocated to participating shareholders — — (5)

Earnings (loss) available to common stockholders $ (651) $ (5,399) $ 345

Basic weighted-average shares outstanding 150.7 126.8 117.4

Earnings (loss) per share, basic $ (4.32) $ (42.59) $ 2.94

Diluted earnings (loss) per share:

Earnings (loss) available to common stockholders $ (651) $ (5,399) $ 345

Effect of 2% preferred securities — — 10

Effect of 4.5% Notes — — 44

Earnings (loss) available to common stockholders including the effect of dilutive securities $ (651) $ (5,399) $ 399

Basic weighted-average shares outstanding 150.7 126.8 117.4

Effect of non-vested stock options — — 0.2

Effect of non-vested restricted shares — — 1.1

Effect of 2% preferred securities — — 11.0

Effect of 4.5% Notes — — 20.8

Diluted weighted-average shares outstanding 150.7 126.8 150.5

Earnings (loss) per share, diluted $ (4.32) $ (42.59) $ 2.65

97