United Airlines 2009 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2009 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ITEM 1A. RISK FACTORS.

The following risk factors should be read carefully when evaluating the Company’s business and the forward-looking statements contained in this report

and other statements the Company or its representatives make from time to time. Any of the following risks could materially adversely affect the Company’s

business, operating results, financial condition and the actual outcome of matters as to which forward-looking statements are made in this report.

Risks Related to the Company’s Business

The Amended Credit Facility and the indentures governing the Senior Notes impose certain operating and financial restrictions on the Company and its

subsidiaries. The Company may be unable to continue to comply with the covenants in these and other agreements, which, if not complied with, could

accelerate repayment under the Amended Credit Facility or the indentures governing the Senior Notes, as applicable, thereby materially and adversely

affecting the Company’s liquidity.

The Company’s Amended and Restated Revolving Credit, Term Loan and Guaranty Agreement, dated as of February 2, 2007 (the “Amended Credit

Facility”), and the Company’s indentures governing the 9.875% Senior Secured Notes due 2013 and 12.0% Senior Second Lien Notes due 2013 (together, the

“Senior Notes”) impose certain operating and financial covenants on the Company and its subsidiaries.

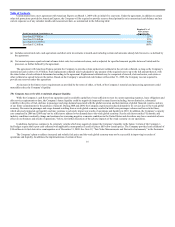

Among other covenants, the terms of the Amended Credit Facility require the Company to maintain:

• a minimum unrestricted cash balance (as defined in the Amended Credit Facility) of $1.0 billion at any time;

• a minimum ratio of collateral value to debt obligations, as of certain reference periods, subject to certain exceptions; and

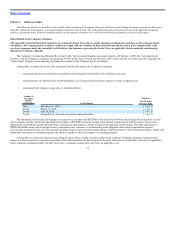

• a minimum fixed charge coverage ratio, as determined below.

Number of

Preceding

Months

Covered Period Ending

Required

Fixed Charge

Coverage Ratio

Nine December 31, 2009 1.2 to 1.0

Twelve March 31, 2010 1.3 to 1.0

Twelve June 30, 2010 1.4 to 1.0

Twelve September 30, 2010 and each quarter ending thereafter. 1.5 to 1.0

The Amended Credit Facility fixed charge coverage ratio is calculated as EBITDAR to the sum of the following fixed charges for such period: (a) cash

interest expense and (b) cash aircraft operating rental expense. EBITDAR represents earnings before interest expense net of interest income, income taxes,

depreciation, amortization, aircraft rent and certain cash and non-cash charges as further defined by the Amended Credit Facility. The other adjustments to

EBITDAR include items such as foreign currency transaction losses, increases in our deferred revenue obligation, share-based compensation expense,

non-recurring or unusual losses, any non-cash non-recurring charge or non-cash restructuring charge, a limited amount of cash restructuring charges, certain cash

transaction costs incurred with financing activities and the cumulative effect of a change in accounting principle.

Among other covenants, the indentures governing the Senior Notes contain covenants related to the collateral, including covenants requiring United,

subject to certain exceptions, to maintain ownership of the collateral and to calculate the priority lien debt value ratio or secured debt value ratio, as applicable,

and to maintain a minimum priority lien debt value ratio or minimum secured debt value ratio, as applicable, as of

14