United Airlines 2009 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2009 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

certain reference periods. If the value of the Company’s collateral underlying the Senior Notes declines, the Company may be required to provide the debtholders

with additional collateral in order to avoid a default and a subsequent acceleration of the applicable debt obligations.

The Company’s ability to comply with the covenants in the Amended Credit Facility or the indentures governing the Senior Notes may be affected by

events beyond its control, including the overall industry revenue environment and the level of fuel costs, and it may be required to seek waivers or amendments

of covenants or alternative sources of financing. The Company cannot provide assurance that such waivers, amendments or alternative financing could be

obtained or, if obtained, would be on terms acceptable to the Company.

A breach of certain of the covenants or restrictions contained in the Company’s Amended Credit Facility or indentures governing the Senior Notes could

result in a default. The Amended Credit Facility and the indentures governing the Senior Notes contain a cross-default provision with respect to final judgments

that exceed $50 million and $70 million, respectively. In addition, the indentures governing the Senior Notes contain a cross-default provision where a default

resulting in the acceleration of indebtedness under the Amended Credit Facility could result in a default under the indentures. A default under the agreements

could allow the Company’s debtholders to accelerate repayment of the obligations in these agreements and/or to declare all borrowings outstanding thereunder to

be due and payable. If the Company’s debt is accelerated, its assets may not be sufficient to repay the obligations in the Amended Credit Facility and the Senior

Notes.

The Company may be unable to continue to comply with certain covenants in agreements with financial institutions that process customer credit card

transactions, which, if not complied with, could materially and adversely affect the Company’s liquidity.

The Company has agreements with financial institutions that process customer credit card transactions for the sale of air travel and other services. Under

certain of the Company’s card processing agreements, the financial institutions either require, or have the right to require, that United maintain a reserve equal to

a portion of advance ticket sales that have been processed by that financial institution, but for which the Company has not yet provided the air transportation

(referred to as “relevant advance ticket sales”). As of December 31, 2009, the Company had total advance ticket sales of approximately $1.5 billion, of which

approximately 80% related to credit card sales.

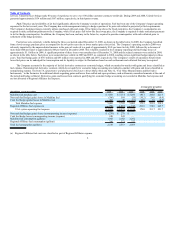

The Company’s credit card processing agreement with Paymentech and JPMorgan Chase Bank, N.A. contains a cash reserve requirement. In addition to

certain other risk protections provided to the processor, the amount of any such cash reserve will be determined based on the amount of unrestricted cash held by

the Company as defined under the Amended Credit Facility. If the Company’s unrestricted cash balance is at or more than $2.5 billion as of any calendar

month-end measurement date, its required reserve will remain at $25 million. However, if the Company’s unrestricted cash is less than $2.5 billion, its required

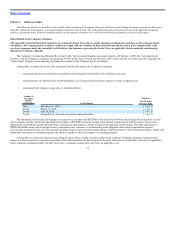

reserve will increase to a percentage of relevant advance ticket sales as summarized in the following table:

Total Unrestricted Cash Balance (a)

Required % of

Relevant Advance

Ticket Sales

Less than $2.5 billion 15%

Less than $2.0 billion 25%

Less than $1.0 billion 50%

(a) Includes unrestricted cash, cash equivalents and short-term investments at month-end, including certain cash amounts already held in reserve, as defined by

the agreement.

Based on the Company’s December 31, 2009 unrestricted cash balance, the Company was not required to provide cash collateral above the current $25

million reserve balance.

15