United Airlines 2009 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2009 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

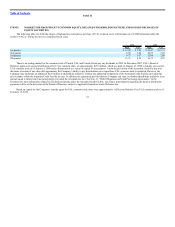

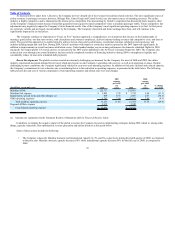

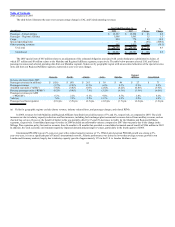

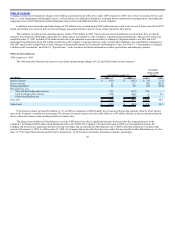

Liquidity. The following table provides a summary of the Company’s total cash and cash equivalents and restricted cash at December 31, 2009 and 2008.

As of December 31,

(In millions) 2009 2008

Cash and cash equivalents $ 3,042 $ 2,039

Restricted cash 341 272

Total cash and cash equivalents and restricted cash $ 3,383 $ 2,311

The increase in the Company’s cash and cash equivalents and restricted cash balances was primarily due to a $2.2 billion improvement in cash flows from

operations in 2009, as compared to 2008, and the significant liquidity initiatives described in Recent Developments, above. UAL’s variation in cash flows from

operations in the 2009 period, as compared to the prior year, was relatively consistent with its results of operations as further described below under Results of

Operations. Lower cash expenditures for fuel purchases were offset by lower cash receipts from the sale of passenger and cargo transportation in 2009, as

compared to 2008. In 2009, the Company received $160 million related to the future relocation of its O’Hare cargo operations. This cash receipt was classified as

an operating cash inflow. The Company also received $35 million from LAX as part of an agreement to vacate certain facilities. Decreases in the Company’s fuel

hedge collateral requirements also provided operating cash of approximately $955 million. This benefit was substantially offset by approximately $730 million of

net cash paid to counterparties for fuel derivative contract settlements and premiums during 2009.

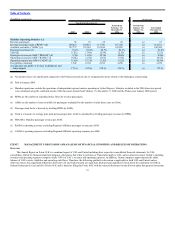

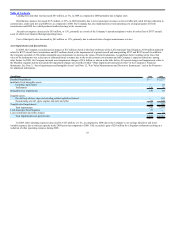

The Company expects its cash flows from operations and its available capital to be sufficient to meet its future operating expenses, lease obligations and

debt service requirements in the next twelve months; however, the Company’s future liquidity could be impacted by increases or decreases in fuel prices, fuel

hedge collateral requirements, inability to adequately increase revenues to offset high fuel prices, softening revenues resulting from reduced demand, failure to

meet future debt covenants and other factors. See Liquidity and Capital Resources and Item 7A, Quantitative and Qualitative Disclosures about Market Risk,

below, for a discussion of these factors and the Company’s significant operating, investing and financing cash flows.

Capital Commitments. The Company’s capital purchase commitments of $622 million are for the purchase of property and equipment, including

commitments related to its international premium cabin enhancement program. As of December 31, 2009, the Company had remaining capital commitments to

complete international enhancements on 46 aircraft. In addition, the Company has an option to purchase 42 A319 and A320 aircraft for $2.3 billion.

Contingencies. United has guaranteed $270 million of the City and County of Denver, Colorado Special Facilities Airport Revenue Bonds (United Air

Lines Project) Series 2007A (the “Denver Bonds”). This guarantee replaces our prior guarantee of $261 million of bonds issued by the City and County of

Denver, Colorado in 1992. These bonds are callable by United. The outstanding bonds and related guarantee are not recorded in the Company’s Financial

Statements. However, the related lease agreement is accounted for on a straight-line basis resulting in a ratable accrual of the final $270 million payment over the

lease term.

Bankruptcy Matters. On December 9, 2002, UAL, United and 26 direct and indirect wholly-owned subsidiaries filed voluntary petitions to reorganize its

business under Chapter 11 of the Bankruptcy Code. The Company emerged from bankruptcy on February 1, 2006, under the Plan of Reorganization that was

approved by the Bankruptcy Court. During the course of its Chapter 11 proceedings, the Company successfully reached settlements with most of its creditors and

resolved all claims pending in the bankruptcy case. On December 8, 2009, the Bankruptcy Court issued a final decree closing all bankruptcy cases against the

Company, effective as of that date. See Note 13, “Commitments, Contingent Liabilities and Uncertainties,” in the Footnotes for further information regarding

bankruptcy matters.

Legal and Environmental. The Company has certain contingencies resulting from litigation and claims incident to the ordinary course of business.

Management believes, after considering a number of factors,

40