United Airlines 2009 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2009 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

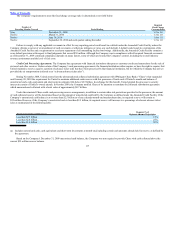

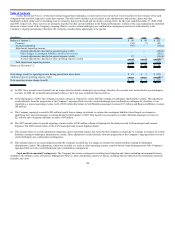

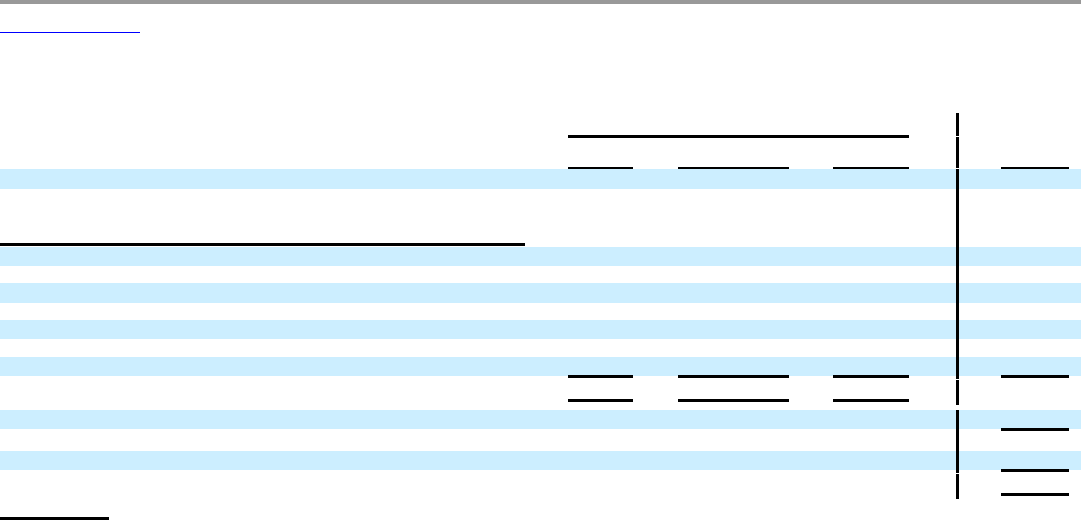

At December 31, 2009, the Company’s leased aircraft, scheduled future minimum lease payments under capital leases (substantially all of which are for

aircraft) and operating leases having initial or remaining noncancelable lease terms of more than one year were as follows:

Operating Leases

Mainline

Aircraft

Regional Affiliates

Aircraft Non-aircraft `

Capital

Leases (b)

Number of Leased Aircraft in Operating Fleet

United and UAL 113 252 — 116

(In millions)

Payable during (a)

2010 $ 330 $ 410 $ 623 $ 604

2011 331 416 557 423

2012 321 396 503 211

2013 293 374 465 200

2014 291 331 417 186

After 2014 363 878 2,798 671

UAL minimum lease payments $ 1,929 $ 2,805 $ 5,363 2,295

Imputed interest (at rates of 2.1% to 20.0%) (675)

Present value of minimum lease payments 1,620

Current portion (426)

Long-term obligations under capital leases $ 1,194

(a) The operating lease payments presented above include future payments for 28 nonoperating aircraft as of December 31, 2009.

(b) Aircraft capital lease obligations are for 76 Mainline and 40 Regional Affiliates aircraft. Includes non-aircraft capital lease payments aggregating

$22 million in years 2010 through 2013 and Regional Affiliates capital lease obligations of $44 million in both 2010 and 2011, $42 million in both 2012 and

2013, $34 million in 2014 and $259 million thereafter.

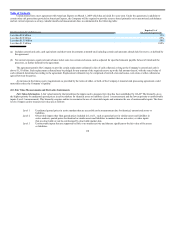

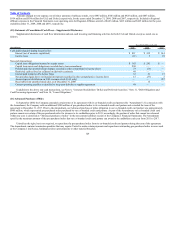

A portion of United’s aircraft lease obligations and related accrued interest ($295 million in equivalent U.S. dollars at December 31, 2009) is denominated

in foreign currencies that expose the Company to risks associated with changes in foreign exchange rates. To hedge against this risk, United has placed foreign

currency deposits ($295 million in equivalent U.S. dollars at December 31, 2009), primarily for euros, to meet foreign currency lease obligations denominated in

that respective currency. Since unrealized mark-to-market gains or losses on the foreign currency deposits are offset by the losses or gains on the foreign

currency obligations, United has hedged its overall exposure to foreign currency exchange rate volatility with respect to its foreign lease deposits and obligations.

In addition, the Company has $31 million of U.S. dollar denominated deposits to meet U.S. dollar denominated lease obligations. These deposits will be used to

repay an equivalent amount of recorded capital lease obligations.

Aircraft operating leases have initial terms of one to 26 years, with expiration dates ranging from 2010 through 2024. The Company has facility operating

leases that extend to 2032. Under the terms of most leases, the Company has the right to purchase the aircraft at the end of the lease term, in some cases at fair

market value and in others, at fair market value or a percentage of cost. See Note 1(i), “Summary of Significant Accounting Policies—Regional Affiliates,” for

additional information related to Regional Affiliates contracts and Note 2, “Company Operational Plans,” for information related to accrued rent related to the

Company’s fleet reductions.

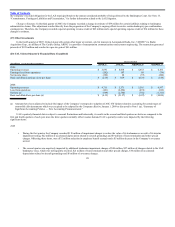

Certain of the Company’s aircraft lease transactions contain provisions such as put options giving the lessor the right to require us to purchase the aircraft

at lease termination for a certain amount resulting in residual value guarantees. Leases containing this or similar provisions are recorded as capital leases on the

balance sheet and, accordingly, all residual value guarantee amounts contained in the Company’s aircraft leases are fully reflected as capital lease obligations in

the Financial Statements.

127