United Airlines 2009 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2009 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

In light of the current poor economic environment, these two factors—network composition and decline of premium and business demand—have had, and

may continue to have, a negative impact on our results of operations.

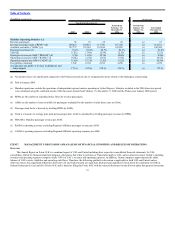

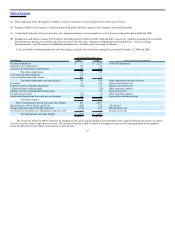

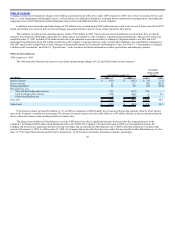

In 2009, revenues for both Mainline and Regional Affiliates were negatively impacted by yield decreases of 15% and 13%, respectively, as compared to

2008. The yield decreases were a result of the weak economic environment in 2009 and the economic factors discussed above. Mainline revenues were also

negatively impacted by lower RPMs, which were largely driven by the Company’s capacity reductions and by the severe global recession. Partially offsetting

Regional Affiliates’ decrease in yield was a 13% increase in RPMs, driven by an 11% increase in capacity. Regional Affiliates capacity increased as we adjusted

the size of our aircraft and capacity across United’s total network to conform to market demand and fulfill prior contractual commitments.

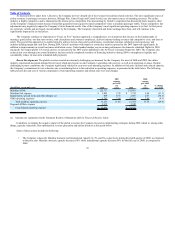

Although the impact of the global recession on the Company’s international network, as well as business and premium travel, during late 2008 and 2009

was severe, the Company saw indicators of economic recovery during the fourth quarter of 2009, which accelerated as the quarter progressed. While fourth

quarter 2009 consolidated passenger unit revenues were down 5.2% year-over-year, this performance was a vast improvement from the double digit declines in

prior quarters. Most importantly, there was a much needed sequential progress during the quarter, ending with modest growth in December. Signs of recovery

were evident internationally, as well as in premium cabin booking and corporate revenues.

In 2009, Mainline and Regional Affiliate revenues benefited from an increase in ancillary revenues, which includes bag fees and other unbundled services,

of approximately $141 million, compared to 2008. For the full year of 2009, ancillary revenues totaled approximately $1.1 billion.

Mainline and Regional Affiliate revenues were favorably impacted in 2009 by an adjustment of approximately $36 million related to certain tax accruals

that were previously recorded as a reduction of revenue. This adjustment was recorded as a result of new information received by the Company related to these

tax matters.

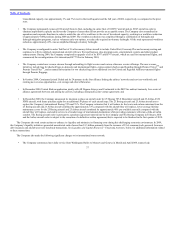

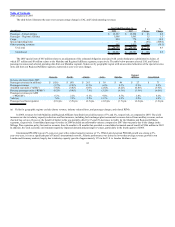

Cargo revenues declined by $318 million, or 37%, in 2009 as compared to 2008, due to four key factors. First, United took significant steps to rationalize

its capacity, with reduced international capacity affecting a number of key cargo markets. Second, as noted by industry statistical releases during 2009, virtually

all carriers in the industry, including United, were sharply impacted by reduced air freight and mail volumes driven by lower recessionary demand, with the

resulting oversupply of cargo capacity putting pressure on industry pricing in nearly all markets. Some of the largest industry demand reductions occurred in the

Pacific cargo market, where United has a greater cargo capacity as compared to the Atlantic, Latin and Domestic air cargo markets. Third, lower fuel costs in

2009 also reduced cargo revenues through lower fuel surcharges on cargo shipments as compared to 2008 when historically high fuel prices occurred. Finally

United, historically one of the largest carriers of U.S. international mail, was impacted by lower mail volumes and pricing beginning in third quarter of 2009

arising from U.S. international mail deregulation. The deregulation moved pricing from regulated rates set by the DOT to market-based pricing as a result of a

competitive bidding process. Towards the end of 2009, the Company began to experience significant market stabilization and improvement in cargo industry

demand and yields.

43