United Airlines 2009 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2009 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

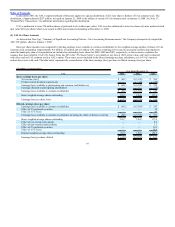

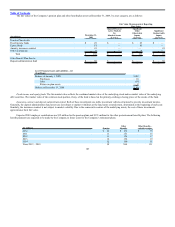

The assumptions below are based on country-specific bond yields and other economic data. The weighted-average assumptions used for the benefit plans

were as follows:

Pension Benefits Other Benefits

At December 31, At December 31,

Weighted-average assumptions used to determine benefit obligations 2009 2008 2009 2008

Discount rate 3.87% 3.59% 5.69% 5.97%

Rate of compensation increase 3.27% 2.94% — —

Weighted-average assumptions used to determine net expense

Year Ended

December 31,

Year Ended

December 31,

2009 2008 2009 2008

Discount rate 3.72% 4.16% 5.97% 6.27%

Expected return on plan assets 5.01% 6.31% 6.50% 6.50%

Rate of compensation increase 3.02% 3.22% — —

The expected return on plan assets is based on an evaluation of the historical behavior of the broad financial markets and the Company’s investment

portfolio.

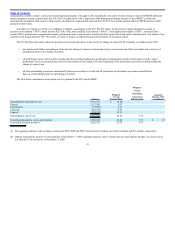

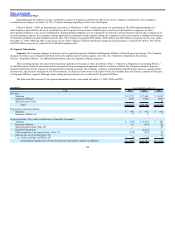

2009 2008

Health care cost trend rate assumed for next year 8.50% 8.00%

Rate to which the cost trend rate is assumed to decline (ultimate trend rate in 2015) 5.00% 5.00%

Assumed health care cost trend rates have a significant effect on the amounts reported for the Other Benefits plan. A 1% change in the assumed health care

trend rate for the Successor Company would have the following additional effects:

(In millions) 1% Increase 1% Decrease

Effect on total service and interest cost for the year ended

December 31, 2009 $ 22 $ (16)

Effect on postretirement benefit obligation at December 31, 2009 $ 241 $ (199)

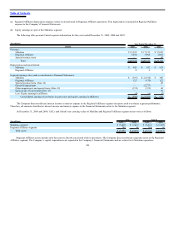

The Company believes that the long-term asset allocations on average will approximate the targeted allocations and regularly reviews the actual asset

allocations to periodically rebalance the investments to the targeted allocations when appropriate. Target asset allocations are established with the objective of

achieving the plans’ expected return on assets without undue investment risk. The target allocation for the defined benefit pension plan assets is 60% in equity

securities and 40% in fixed income securities, while 100% of other postretirement plan assets are invested in a deposit administration fund, described below.

106