United Airlines 2009 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2009 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

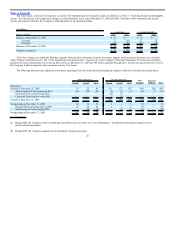

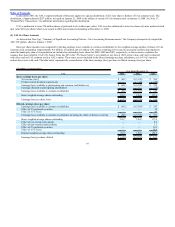

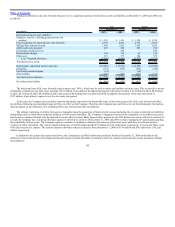

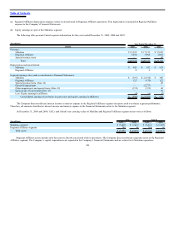

Temporary differences and carry forwards that give rise to a significant portion of deferred tax assets and liabilities at December 31, 2009 and 2008 were

as follows:

UAL United

December 31, December 31,

(In millions) 2009 2008 2009 2008

Deferred income tax asset (liability):

Employee benefits, including postretirement and

medical $ 1,328 $ 1,345 $ 1,358 $ 1,374

Federal and state net operating loss carry forwards 2,707 2,622 2,697 2,622

Mileage Plus deferred revenue 1,644 1,541 1,647 1,545

AMT credit carry forwards 287 298 287 298

Fuel hedge unrealized losses — 294 — 294

Restructuring charges 104 139 99 134

Other asset 291 337 284 329

Less: Valuation allowance (3,060) (2,886) (2,977) (2,812)

Total deferred tax assets $ 3,301 $ 3,690 $ 3,395 $ 3,784

Depreciation, capitalized interest and other $ (2,686) $ (2,961) $ (2,682) $ (2,958)

Intangibles (787) (864) (834) (910)

Fuel hedge unrealized gains (14) — (14) -

Other liability (303) (401) (277) (375)

Total deferred tax liabilities $ (3,790) $ (4,226) $ (3,807) $ (4,243)

Net deferred tax liability $ (489) $ (536) $ (412) $ (459)

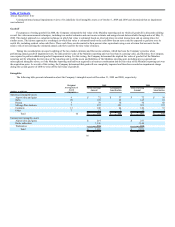

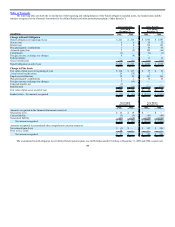

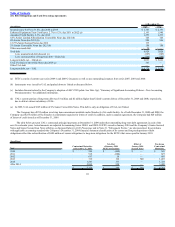

The federal and state NOL carry forwards relate to prior years’ NOLs, which may be used to reduce tax liabilities in future years. This tax benefit is mostly

attributable to federal pre-tax NOL carry forwards of $7.3 billion. If not utilized, the federal tax benefits will expire as follows: $1.0 billion in 2022, $0.4 billion

in 2023, $0.5 billion in 2024, $0.4 billion in 2025, and a total of $0.2 billion between 2026 and 2029. In addition, the majority of the state tax benefit of

$157 million, if not utilized, expires over a five to twenty year period.

At this time, the Company does not believe that the limitations imposed by the Internal Revenue Code on the usage of the NOL carry forward and other

tax attributes following an ownership change will have an effect on the Company. Therefore, the Company does not believe its exit from bankruptcy has had any

material impact on the utilization of its remaining NOL carry forward and other tax attributes.

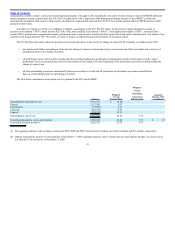

The ultimate realization of deferred tax assets is dependent upon the generation of future taxable income (including the reversals of deferred tax liabilities)

during the periods in which those temporary differences will become deductible. The Company’s management assesses the realizability of its deferred tax assets,

and records a valuation allowance for the deferred tax assets when it is more likely than not that a portion, or all of the deferred tax assets, will not be realized. As

a result, the Company has a valuation allowance against its deferred tax assets as of December 31, 2009 and 2008, to reflect management’s assessment regarding

the realizability of those assets. The Company expects to continue to maintain a valuation allowance on deferred tax assets until there is sufficient positive

evidence of future realization. The current valuation allowance of $3,060 million and $2,977 million for UAL and United, respectively, if reversed in future years

will reduce income tax expense. The current valuation allowance reflects an increase from December 31, 2008 of $174 million and $165 million for UAL and

United, respectively.

In addition to the deferred tax assets listed above, the Company has an $803 million unrecorded tax benefit at December 31, 2009 attributable to the

difference between the amount of the financial statement expense and the allowable tax deduction for UAL common stock issued to certain unsecured creditors

and employees

102