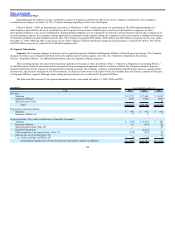

United Airlines 2009 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2009 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

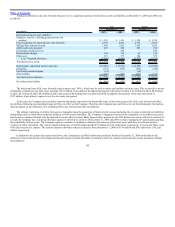

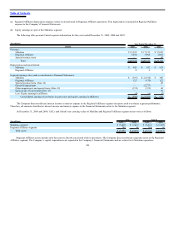

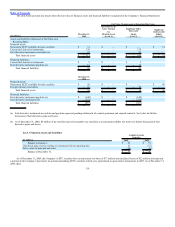

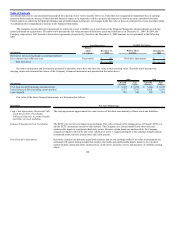

(11) Debt Obligations and Card Processing Agreements

At December 31,

(In millions) 2009 2008

Secured notes, 0.43% to 11.6%, due 2010 to 2019 $ 1,767 $ 2,391

Enhanced Equipment Trust Certificates, 2.7% to 12%, due 2011 to 2022 (a) 2,193 1,940

Amended Credit Facility, 2.3%, due 2014 1,255 1,273

4.5% Senior Limited Subordination Convertible Notes due 2021 (b) 726 726

6% Senior Notes due 2031 (b) 580 546

12.75% Senior Secured Notes due 2012 175 —

5% Senior Convertible Notes due 2021 (b) 150 150

Other unsecured debt 78 —

Total debt 6,924 7,026

Less: unamortized debt discount (c) (347) (385)

Less: current portion of long-term debt—United (d) (544) (780)

Long-term debt, net—United (e) 6,033 $ 5,861

UAL 6% Senior Convertible Notes due 2029 (e) 345 —

Other UAL debt — 1

Long-term debt, net—UAL $ 6,378 $ 5,862

(a) EETCs consist of current year series 2009-1 and 2009-2 issuances as well as any outstanding issuances from series 2007, 2001 and 2000.

(b) Instruments were issued by UAL and pushed down to United as discussed below.

(c) Includes discount related to the Company’s adoption of ASC 470 Update. See Note 1(p), “Summary of Significant Accounting Policies—New Accounting

Pronouncements,” for additional information.

(d) UAL’s current portion of long-term debt was $1 million and $2 million higher than United’s current debt as of December 31, 2009 and 2008, respectively,

due to debt at a direct subsidiary of UAL.

(e) In 2009, UAL issued $345 million of 6% Senior Convertible Notes. This debt is only an obligation of UAL, not United.

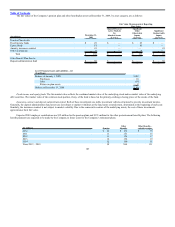

The Company has a $255 million revolving loan commitment available under Tranche A of its credit facility. As of both December 31, 2009 and 2008, the

Company used $254 million of the Tranche A commitment capacity for letters of credit. In addition, under a separate agreement, the Company had $20 million

of letters of credit issued as of December 31, 2009.

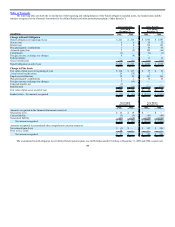

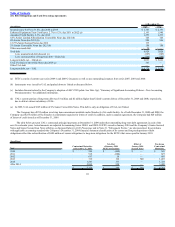

The table below presents UAL’s contractual principal payments at December 31, 2009 under then-outstanding long-term debt agreements in each of the

next five calendar years. Actual amounts are adjusted for remaining Series 2009-1 and 2009-2 EETCs issued in January 2010 and the Company’s Senior Secured

Notes and Senior Second Lien Notes offering, as discussed below in 2010 Financings and in Note 21, “Subsequent Events,” are also presented. In accordance

with applicable accounting standards the Company’s December 31, 2009 financial statement classification of its current and long-term portions of debt

obligations reflect the reclassification of $449 million of current obligations to long-term obligations for the EETCs that were repaid in January 2010.

(In millions)

Year

Contractual Maturities

at December 31, 2009

Net effect

of January 2010

EETC transactions

Effect of

January 2010

Secured Notes

Pro-forma

Contractual

Maturities

2010 $ 994 $ (449) $ — $ 545

2011 915 (288) — 627

2012 637 58 — 695

2013 315 192 700 1,207

2014 1,547 177 — 1,724

After 2014 2,862 558 — 3,420

$ 7,270 $ 248 $ 700 $ 8,218

111