United Airlines 2009 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2009 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

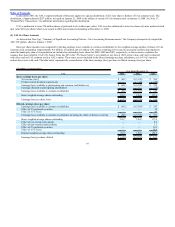

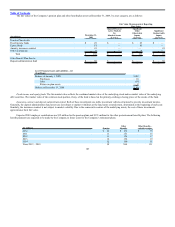

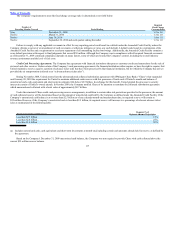

The fair values of the Company’s pension plan and other benefit plan assets at December 31, 2009, by asset category, are as follows:

(In millions)

December 31,

2009

Fair Value Measurements at Reporting

Date Using

Quoted Prices in

Active Markets

for

Identical Assets

(Level 1)

Significant

Other

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

Pension Plan Assets:

Fixed income funds $ 25 $ — $ 25 $ —

Equity funds 81 — 81 —

Annuity insurance contract 41 — — 41

Other investments 9 — 9 —

Total $ 156 $ — $ 115 $ 41

Other Benefit Plan Assets:

Deposit administration fund $ 58 $ — $ — $ 58

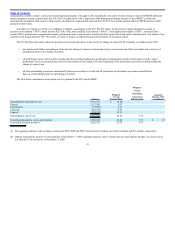

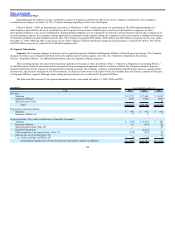

Level 3 Financial Assets and Liabilities—All

(In millions)

Balance at January 1, 2009 $103

Purchases 10

Sales (16)

Return on plan assets 2

Balance at December 31, 2009 $ 99

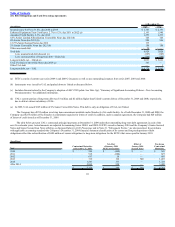

Fixed income and equity funds. The fair market value reflects the combined market value of the underlying stock and/or market value of the underlying

debt securities. The market value of the common stock portion, if any, of the fund is based on the primary-exchange closing prices of the stocks of the fund.

Insurance contract and deposit administration fund. Both of these investments are stable investment vehicles structured to provide investment income.

Generally, the deposit administration fund assets are not subject to market volatilities as the fund earns a stated return, determined at the beginning of each year.

Similarly, the insurance contract is not subject to market volatility. Due to the conservative nature of the underlying assets, the cost of these investments

approximates their fair value.

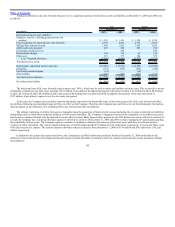

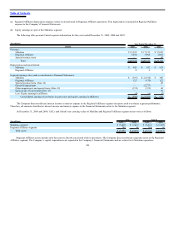

Expected 2010 employer contributions are $12 million for the pension plans and $153 million for the other postretirement benefit plans. The following

benefit payments are expected to be made by the Company in future years for the Company’s retirement plans:

(In millions) Pension

Other

Benefits

Other Benefits—

subsidy receipts

2010 $ 10 $ 155 $ 13

2011 11 157 15

2012 11 156 17

2013 12 156 19

2014 12 160 21

Years 2015 – 2019 58 864 131

107