United Airlines 2009 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2009 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

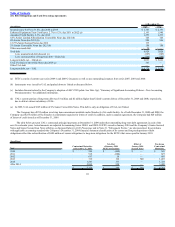

Borrowings under the Amended Credit Facility bear interest at a floating rate, which, at the Company’s option, can be either a base rate or a LIBOR rate,

plus an applicable margin of 1.0% in the case of base rate loans and 2.0% in the case of LIBOR loans. The Tranche B term loan requires regularly scheduled

semi-annual payments of principal equal to $9 million. Interest is payable at least every three months. The Company may prepay some or all of the Tranche B

loans from time to time, at a price equal to 100% of the principal amount prepaid plus accrued and unpaid interest, if any, to the date of prepayment, but without

penalty or premium.

Amended Credit Facility Collateral. United’s obligations under the Amended Credit Facility are unconditionally guaranteed by UAL Corporation and

certain of its direct and indirect domestic subsidiaries, other than certain immaterial subsidiaries (the “Guarantors”). As of December 31, 2009 and 2008, the

Amended Credit Facility was secured by certain of United’s international route authorities, international slots, related gate interests and associated rights. The

international routes include the Pacific (Narita, China and Hong Kong) and Atlantic (London Heathrow) routes (the “Primary Routes”) that United had as of

February 2, 2007.

In connection with the issuance of the Senior Secured Notes and the Senior Second Lien Notes in January 2010, certain assets currently encumbered under

the Amended Credit Facility are expected to be released and substituted by replacement collateral consisting of aircraft, spare engines, primary slots at LaGuardia

Airport and Reagan National Airport in Washington D.C. and flight simulators with an appraised value of approximately $830 million. The assets expected to be

released consist of route authorities to operate between the United States and Japan, and beyond Japan to points in other countries, certain airport takeoff and

landing slots and airport gate leaseholds utilized in connection with these routes, and were used as collateral for the January 2010 offering. See Note 21,

“Subsequent Events,” for further information related to this transaction.

Amended Credit Facility Covenants. The Amended Credit Facility contains covenants that in certain circumstances may limit the ability of United and the

Guarantors to, among other things, incur or guarantee additional indebtedness, create liens, pay dividends on or repurchase stock, make certain types of

investments, enter into transactions with affiliates, sell assets or merge with other companies, modify corporate documents or change lines of business. The

Company was in compliance with all of its Amended Credit Facility covenants as of December 31, 2009 and 2008. In May 2008, the Company amended the

terms of certain financial covenants of the Amended Credit Facility. The Company paid $109 million to amend the credit facility. These costs are being deferred

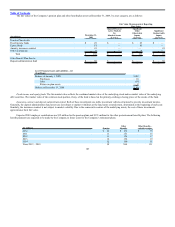

and amortized over the remaining life of the agreement. The following is a summary of the financial covenants after the May amendment.

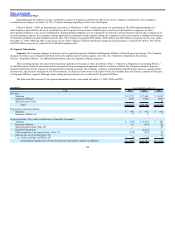

The Company must maintain a specified minimum ratio of EBITDAR to the sum of the following fixed charges for all applicable periods: (a) cash interest

expense and (b) cash aircraft operating rental expense. EBITDAR represents earnings before interest expense net of interest income, income taxes, depreciation,

amortization, aircraft rent and certain other cash and non-cash credits and charges as further defined by the Amended Credit Facility. The other adjustments to

EBITDAR include items such as foreign currency transaction losses, increases in our deferred revenue obligation, share-based compensation expense,

non-recurring or unusual losses, any non-cash non-recurring charge or non-cash restructuring charge, a limited amount of cash restructuring charges, certain cash

transaction costs incurred with financing activities and the cumulative effect of a change in accounting principle.

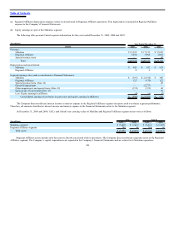

The Amended Credit Facility also requires compliance with the following financial covenants: (i) a minimum unrestricted cash balance (as defined by the

Amended Credit Facility) of $1.0 billion, and (ii) a minimum collateral ratio of 150% at any time, or 200% at any time following the release of the Pacific

(Narita, China and Hong Kong) and Atlantic (London Heathrow) routes (together, the “Primary Routes”) having an appraised value in excess of $1 billion on the

aggregate, unless the Primary Routes are the only collateral then pledged, in which case a minimum collateral ratio of 150% is required. The minimum collateral

ratio is calculated as the market value of collateral to the sum of (a) the aggregate outstanding amount of the loans, plus (b) the undrawn amount of outstanding

letters of credit, plus (c) the unreimbursed amount of drawings under such letters of credit and (d) the termination value of certain interest rate protection and

hedging agreements with the Amended Credit Facility lenders and their affiliates.

116