United Airlines 2009 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2009 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

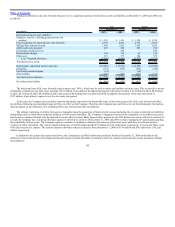

pursuant to the Company’s bankruptcy reorganization. The Company is accounting for this unrecorded tax benefit by analogy to ASC Topic 718 which requires

recognition of the tax benefit to be deferred until it is realized as a reduction of taxes payable. If not utilized, unrecognized tax benefits of $159 million will

expire in 2025, $484 million in 2026 and $160 million over a period from 2027 through 2050.

Our liability for uncertain tax positions was $16 million, $20 million and $35 million at December 31, 2009, 2008 and 2007, respectively. Included in the

ending balance are unrecognized tax benefits of $16 million that would affect our effective tax rate if recognized. During 2009, there were no uncertain tax

positions that were effectively settled. Excluding these items and amounts related to tax positions for which the ultimate deductibility is highly certain, there were

no other significant changes in the components of the liability during the year ended December 31, 2009. Any change in the amount of unrecognized tax benefits

within the next twelve months is not expected to significantly impact the Company’s results of operations or financial position.

There are no amounts included in the balance at December 31, 2009 for tax positions for which the ultimate deductibility is highly certain but for which

there is uncertainty about the timing of such deductibility.

The Company records penalties and interest relating to uncertain tax positions in “Other operating expenses” and “Interest expense,” respectively, within

its Financial Statements. There are no significant accrued interest or penalties or interest or penalty expense recorded in the Financial Statements.

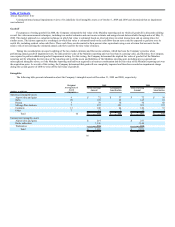

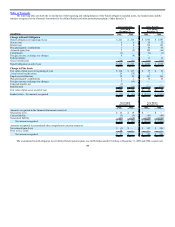

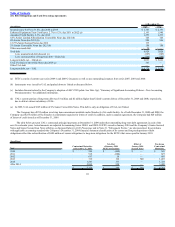

The following is a reconciliation of the beginning and ending amount of unrecognized tax benefits related to uncertain tax positions:

(In millions) 2009 2008 2007

Balance at January 1, $ 20 $ 35 $ 48

Increase in unrecognized tax benefits as a result of tax positions taken during the current period 1 1 1

Decrease in unrecognized tax benefits as a result of tax positions taken during a prior period (5) (11) (14)

Decrease in unrecognized tax benefits relating to settlements with taxing authorities — (5) —

Balance at December 31, $ 16 $ 20 $ 35

Our income tax returns for tax years after 2002 remain subject to examination by the Internal Revenue Service and state taxing jurisdictions.

United and its domestic consolidated subsidiaries file a consolidated federal income tax return with UAL. Under an intercompany tax allocation policy,

United and its subsidiaries compute, record and pay UAL for their own tax liability as if they were separate companies filing separate returns. In determining

their own tax liabilities, United and each of its subsidiaries take into account all tax credits or benefits generated and utilized as separate companies and they are

compensated for the aforementioned tax benefits only if they would be able to use those benefits on a separate company basis.

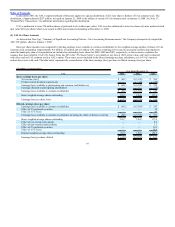

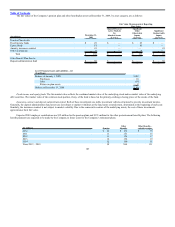

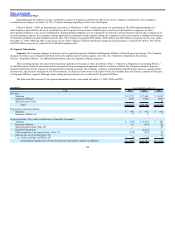

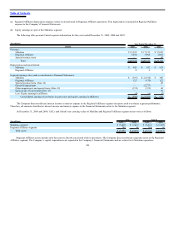

(8) Retirement and Postretirement Plans

The Company maintains various retirement plans, both defined benefit, which primarily cover certain international employees, and defined contribution,

which cover substantially all U.S. employees. The Company also provides certain health care benefits, primarily in the U.S., to retirees and eligible dependents,

as well as certain life insurance benefits to certain retirees reflected as “Other Benefits” in the tables below. The Company has reserved the right, subject to

collective bargaining agreements, to modify or terminate the health care and life insurance benefits for both current and future retirees.

103