United Airlines 2009 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2009 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

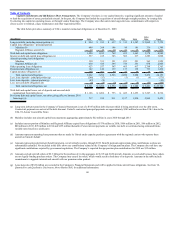

Table of Contents

other comprehensive income. The tax benefit recorded in 2008 is related to the impairment and sale of certain indefinite-lived intangible assets, partially offset by

the impact of an increase in state tax rates. UAL recorded income tax expense of $297 million for the year ended December 31, 2007 (an effective tax rate of

45.5%). See Note 7, “Income Taxes,” in the Footnotes for additional information.

Liquidity and Capital Resources

As of the date of this Form 10-K, the Company believes it has sufficient liquidity to fund its operations for the next twelve months, including liquidity for

scheduled repayments of debt and capital lease obligations, capital expenditures, cash deposits required under fuel hedge contracts and other contractual

obligations. We expect to meet our liquidity needs in 2010 primarily from cash flows from operations, cash and cash equivalents on hand and proceeds from the

2010 financing arrangements described below. In addition, the Company may be able to generate a limited amount of liquidity from other sources, including

proceeds from aircraft sales and sales of other assets, and potentially, new financing arrangements. While the Company expects to meet its future cash

requirements in 2010, our ability to do so could be impacted by many factors including, but not limited to, the following:

• The global recession has had, and may in the future continue to have, a significant adverse impact on travel demand which has resulted in decreased

revenues and may adversely affect revenues in future periods. In addition, the Company’s current operational plans to address the weak global

economy may not be successful in improving its results of operations and liquidity. Further, certain of the Company’s competitors may increase

capacity, thereby potentially negatively impacting the Company’s unit revenue. The Company may also not achieve expected revenue

improvements from merchandising and fee enhancement initiatives;

• Higher jet fuel prices, and the cost and effectiveness of hedging jet fuel prices, may require the use of significant liquidity in future periods. Crude

oil prices have been extremely volatile and unpredictable in recent years and likely will remain volatile in future periods. As of December 31, 2009,

the Company was hedged using purchased call options and swaps. The Company has been, and may in the future be, required to make significant

payments at the settlement dates of the hedge contracts if the settlement price is below the fixed swap price. Additionally, the Company has been,

and may in the future be, required to provide counterparties with additional cash collateral prior to derivative settlement dates. While the Company’s

results of operations benefit from lower fuel prices on its unhedged fuel consumption, the Company may not realize the full benefit of lower fuel

prices due to unfavorable fuel hedge cash settlements. In addition, the Company may not be able to increase its revenues in response to higher fuel

prices. See Item 7A, Quantitative and Qualitative Disclosures About Market Risk, and Note 12, “Fair Value Measurements and Derivative

Instruments” in the Footnotes for further information regarding the Company’s fuel derivative instruments;

• The Company has limited remaining assets available as collateral for loans and other indebtedness, which may make it difficult to raise capital to

meet its liquidity needs. Our level of indebtedness, non-investment grade credit rating, and credit market conditions may also make it difficult for us

to raise capital to meet liquidity needs and may increase our cost of borrowing. A higher cost of capital could negatively impact our results of

operations, financial position and liquidity;

• Due to the factors above, and other factors, the Company may be unable to comply with its Amended Credit Facility covenants that currently require

the Company to maintain an unrestricted cash balance of $1.0 billion and a minimum ratio of EBITDAR to fixed charges. If the Company does not

comply with these covenants, the lenders may accelerate repayment of these debt obligations, which would have a material adverse impact on the

Company’s financial position and liquidity; and

• If a default occurs under our Amended Credit Facility or other debt obligations, the cost to cure any such default may materially and adversely

impact our financial position and liquidity, and no assurance can be provided that such a default will be mitigated or cured.

52