United Airlines 2009 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2009 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

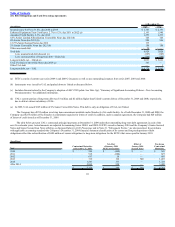

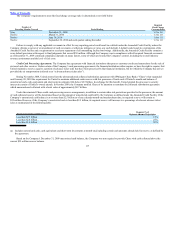

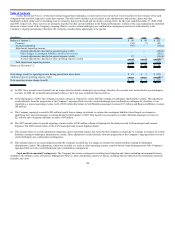

Description Fair Value Methodology

Foreign Currency Derivative Instruments

Fair value is determined with a formula utilizing observable inputs. Significant inputs to the valuation models

include contractual terms, risk-free interest rates and forward exchange rates.

Long-Term Debt

The fair value is based on the quoted market prices for the same or similar issues, discounted cash flow models

using appropriate market rates and a pricing model to value conversion rights in UAL’s convertible debt

instruments. The Company’s credit risk was considered in estimating fair value.

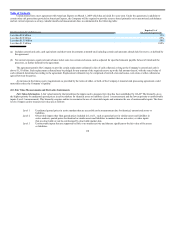

Derivative Credit Risk and Fair Value

The Company is exposed to credit losses in the event of nonperformance by counterparties to its derivative instruments. The Company enters into master

netting agreements with its derivative counterparties. While the Company records derivative instruments on a gross basis, the Company monitors its net

derivative position with each counterparty to monitor credit risk. As of December 31, 2009, the Company had a net derivative asset of $135 million with certain

of its fuel derivative counterparties; therefore, this amount represents the potential credit-risk loss if these counterparties fail to perform. The Company had a net

derivative payable of $2 million with its remaining fuel counterparties at December 31, 2009.

Based on the fair value of the Company’s fuel derivative instruments, our counterparties may require the Company to post collateral when the price of the

underlying commodity decreases and we may require our counterparties to provide us with collateral when the price of the underlying commodity increases. The

Company was required to post $10 million of cash collateral with certain of its fuel derivative counterparties at December 31, 2009. The Company routinely

reviews the credit risk associated with its counterparties and believes its collateral is fully recoverable from its counterparties as of December 31, 2009. The

collateral is classified as Fuel hedge collateral deposits in the accompanying Financial Statements.

The Company reviews the credit risk associated with its derivative counterparties and may require collateral from its counterparties in the event the

Company has a significant net derivative asset with the counterparties. As of December 31, 2009, the Company’s counterparties had posted cash collateral of $49

million into escrow accounts, which the Company has classified as restricted cash.

The Company considered counterparty credit risk in determining the fair value of its financial instruments. The Company considered credit risk to have a

minimal impact on fair value because varying amounts of collateral are either provided by or received from United’s hedging counterparties based on current

market exposure and the credit-worthiness of the counterparties.

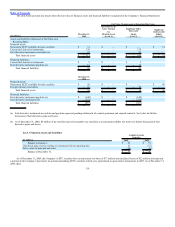

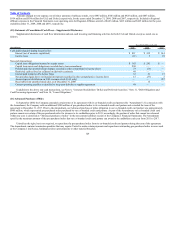

Derivative Instruments

Instruments classified as economic hedges were not designated as cash flow or fair value hedges under accounting principles related to hedge accounting.

All changes in the fair value of these economic hedges are recorded currently in income, with the offset to either current assets or liabilities each reporting period.

Economic fuel hedge gains and losses are classified as part of aircraft fuel expense and fuel hedge gains and losses from instruments that are not deemed

economic hedges are classified as part of nonoperating income. Foreign currency hedge gains and losses are classified as part of nonoperating income.

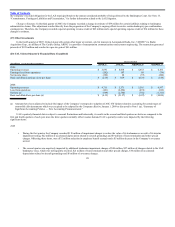

Aircraft Fuel Hedges

The Company has a risk management strategy to hedge a portion of its price risk related to projected jet fuel requirements. As of December 31, 2009, the

Company’s hedge portfolio consisted of swaps and purchased call options. The swaps utilized by the Company generally provide that the counterparty will pay

to (receive from)

121