United Airlines 2009 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2009 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

(d) Cash and Cash Equivalents and Restricted Cash—Cash in excess of operating requirements is invested in short-term, highly liquid investments.

Investments with a maturity of three months or less on their acquisition date are classified as cash and cash equivalents. Investments in debt securities

classified as available-for-sale are stated at fair value. The gains or losses from changes in the fair value of available-for-sale securities are included in

other comprehensive income.

As of December 31, 2009, approximately 25% of the Company’s cash and cash equivalents consisted of money market funds that primarily invest in U.S.

treasury securities and 75% consisted of AAA-rated money market funds. There are no withdrawal restrictions at the present time on any of the money

market funds in which the Company has invested.

Restricted cash primarily includes cash collateral to secure workers’ compensation obligations, reserves for institutions that process credit card ticket sales

and, in 2009, cash collateral received from fuel hedge counterparties. The Company classifies changes in restricted cash balances as an investing activity in

its Financial Statements, because it considers restricted cash similar to an investment. Certain other companies within our industry also classify certain of

their restricted cash transactions as investing activities in their statement of cash flows, while others classify certain of their restricted cash transactions as

operating activities. The pro-forma impact of UAL classifying all changes in its restricted cash balances as operating activities in the years ended

December 31, 2009, 2008 and 2007 is shown in the table below:

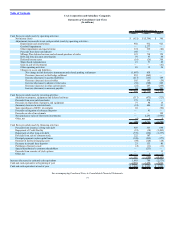

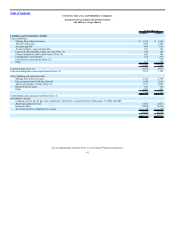

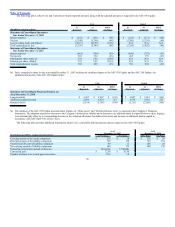

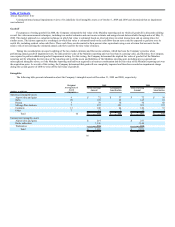

Year Ended December 31,

(In millions) 2009 2008 2007

Cash flows provided (used) from operating activities $ 966 $ (1,239) $ 2,134

Adjustment for (increase) decrease in restricted cash (19) 484 91

Pro-forma cash flows provided (used) from operating activities $ 947 $ (755) $ 2,225

Cash flows provided (used) from investing activities $ (80) $ 2,721 $ (2,560)

Adjustment for increase (decrease) in restricted cash 19 (484) (91)

Pro-forma cash flows provided (used) from investing activities $ (61) $ 2,237 $ (2,651)

(e) Aircraft Fuel, Spare Parts and Supplies—The Company records fuel, maintenance, operating supplies and aircraft spare parts at cost when acquired and

provides an obsolescence allowance for aircraft spare parts.

(f) Property and Equipment—The Company records additions to owned operating property and equipment at cost when acquired. Property under capital

leases and the related obligation for future lease payments are recorded at an amount equal to the initial present value of those lease payments.

Depreciation and amortization of owned depreciable assets is based on the straight-line method over the assets’ estimated service lives. Leasehold

improvements are amortized over the remaining term of the lease, including estimated facility renewal options when renewal is reasonably assured at key

airports, or the estimated service life of the related asset, whichever is less. Properties under capital leases are amortized on the straight-line method over

the life of the lease or, in the case of certain aircraft, over their estimated service lives. Amortization of capital lease assets is included in depreciation and

amortization expense. The estimated useful lives of our property and equipment are as follows:

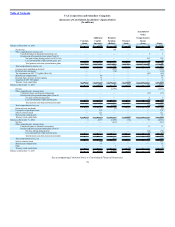

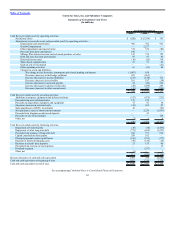

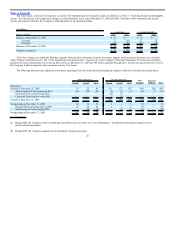

Estimated Useful Life (in years)

Aircraft 27 to 30

Buildings 25 to 45

Other property and equipment 4 to 15

Software 5

Building improvements 1 to 40

85