United Airlines 2009 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2009 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

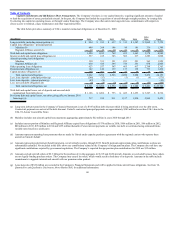

Capital Commitments and Off-Balance Sheet Arrangements. The Company’s business is very capital intensive, requiring significant amounts of capital

to fund the acquisition of assets, particularly aircraft. In the past, the Company has funded the acquisition of aircraft through outright purchase, by issuing debt,

by entering into capital or operating leases, or through vendor financings. The Company also often enters into long-term lease commitments with airports to

ensure access to terminal, cargo, maintenance and other required facilities.

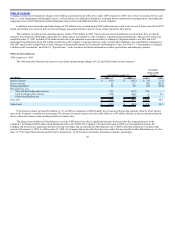

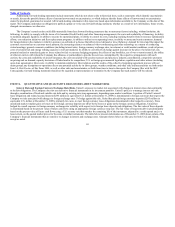

The table below provides a summary of UAL’s material contractual obligations as of December 31, 2009.

(In millions) 2010 2011 2012 2013 2014

After

2014 Total

Long-term debt, including current portion (a) $ 994 $ 915 $ 637 $ 315 $ 1,547 $ 2,862 $ 7,270

Capital lease obligations—principal portion

Mainline (b) 409 298 106 99 101 336 1,349

Regional Affiliates aircraft (b) 17 19 19 21 15 180 271

Total debt and capital lease obligations 1,420 1,232 762 435 1,663 3,378 8,890

Interest on debt and capital lease obligations (c) 537 415 343 303 217 1,283 3,098

Aircraft operating lease obligations

Mainline 330 331 321 293 291 363 1,929

Regional Affiliates (d) 410 416 396 374 331 878 2,805

Other operating lease obligations 623 557 503 465 417 2,798 5,363

Postretirement obligations (e) 142 142 139 137 139 733 1,432

Capital purchase obligations (f) 200 201 99 43 40 39 622

Total contractual obligations 3,662 3,294 2,563 2,050 3,098 9,472 24,139

Less: lease deposits—principal portion (g) (246) (17) — (1) (1) (6) (271)

Less: lease deposits—interest portion (g) (47) (8) — — — — (55)

Less: non-cash debt obligations (h) (8) (9) (9) (9) (9) (65) (109)

Total contractual obligations, net $ 3,361 $ 3,260 $ 2,554 $ 2,040 $ 3,088 $ 9,401 $ 23,704

Total debt and capital leases, net of deposits and non-cash debt

(summarized from table above) $ 1,166 $ 1,206 $ 753 $ 425 $ 1,653 $ 3,307 $ 8,510

Pro-forma debt and capital leases, net (after giving effect to January 2010

financings) (i) 717 918 811 1,317 1,830 3,865 9,458

(a) Long-term debt presented in the Company’s Financial Statements is net of a $347 million debt discount which is being amortized over the debt terms.

Contractual payments are not net of the debt discount. United’s contractual principal payments are approximately $345 million lower than UAL’s due to the

UAL 6% Senior Convertible Notes.

(b) Mainline includes non-aircraft capital lease payments aggregating approximately $22 million in years 2010 through 2013.

(c) Includes interest portion of Mainline and Regional Affiliates capital lease obligations of $178 million in 2010, $106 million in 2011, $86 million in 2012,

$80 million in 2013, $70 million in 2014 and $155 million thereafter. Future interest payments on variable rate debt are estimated using estimated future

variable rates based on a yield curve.

(d) Amounts represent operating lease payments that are made by United under capacity purchase agreements with the regional carriers who operate these

aircraft on United’s behalf.

(e) Amounts represent postretirement benefit payments, net of subsidy receipts, through 2019. Benefit payments approximate plan contributions as plans are

substantially unfunded. Not included in the table above are contributions related to the Company’s foreign pension plans. The Company does not have any

significant contributions required by government regulations. The Company’s expected foreign pension plan contributions for 2010 are $12 million.

(f) Amounts exclude aircraft orders of $2.3 billion for the purchase of, in the aggregate, 42 A319 and A320 aircraft. Amounts are excluded because these orders

are not legally binding purchase orders. The Company may cancel its orders, which would result in forfeiture of its deposits. Amounts in the table include

commitments to upgrade international aircraft with our premium cabin product.

(g) Lease deposits of $326 million are recorded in the Company’s Financial Statements and will be applied to future aircraft lease obligations. See Item 7A,

Quantitative and Qualitative Disclosures About Market Risk, for additional information.

60