United Airlines 2009 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2009 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Landing fees and other rent increased $43 million, or 5%, in 2009 as compared to 2008 primarily due to higher rates.

Distribution expenses decreased $176 million, or 25%, in 2009 primarily due to lower passenger revenues on lower traffic and yields driving reductions in

commissions, credit card fees and GDS fees as compared to 2008. The Company has also implemented several operating cost savings programs for both

commissions and GDS fees which produced realized savings in the current year.

Aircraft rent expense decreased by $63 million, or 15%, primarily as a result of the Company’s operational plans to retire its entire fleet of B737 aircraft,

some of which were financed through operating leases.

Cost of third party sales decreased by $42 million, or 15%, primarily due to reduced sales of engine maintenance services.

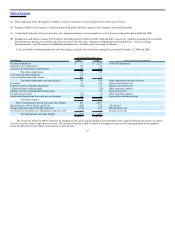

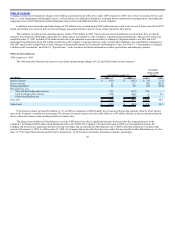

Asset Impairments and Special Items.

In 2009, the Company recorded special charges of $27 million related to the final settlement of the LAX municipal bond litigation, $104 million primarily

related to B737 aircraft lease terminations and $93 million related to the impairment of regional aircraft and nonoperating B737 and B747 aircraft. In addition,

the Company recorded a $150 million intangible asset impairment to decrease the value of United tradenames. A significant factor resulting in the lower fair

value of the tradenames was a decrease in estimated future revenues due to the weak economic environment and the Company’s capacity reductions, among

other factors. In 2008, the Company incurred asset impairment charges of $2.6 billion, as shown in the table below. All special charges and impairments relate to

the Mainline segment and the non-goodwill impairment charges are classified within “Other impairments and special items” in the Company’s Financial

Statements. See Note 3, “Asset Impairments and Intangible Assets” and Note 12, “Fair Value Measurements and Derivative Instruments,” and in the Footnotes

for additional information.

(In millions) 2009 2008

Goodwill impairment $ — $ 2,277

Indefinite-lived intangible assets:

Codeshare agreements — 44

Tradenames 150 20

Intangible asset impairments 150 64

Tangible assets:

Pre-delivery advance deposits including related capitalized interest — 105

Nonoperating aircraft, spare engines and parts and other 93 145

Tangible asset impairments 93 250

Total impairments 243 2,591

LAX municipal bond litigation 27 —

Lease termination and other charges 104 25

Total impairments and special items $ 374 $ 2,616

In 2009, other operating expenses decreased by $123 million, or 11%, as compared to 2008 due to the Company’s cost savings initiatives and lower

variable expenses due to reduced capacity in the 2009 period as compared to 2008. UAL recorded a gain of $29 million for a litigation settlement resulting in a

reduction of other operating expenses during 2008.

47