United Airlines 2009 Annual Report Download

Download and view the complete annual report

Please find the complete 2009 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FORM 10-K

SEC Filing

UAL CORP /DE/ - UAUA

Filing Date: February 26, 2010

Filing Period: December 31, 2009

DESCRIPTION

Annual report which provides a comprehensive overview of the company for the past year

Table of contents

-

Page 1

FORM 10-K SEC Filing UAL CORP /DE/ - UAUA Filing Date: Filing Period: DESCRIPTION February 26, 2010 December 31, 2009 Annual report which provides a comprehensive overview of the company for the past year -

Page 2

... ON ACCOUNTING AND FINANCIAL DISCLOSURE. CONTROLS AND PROCEDURES. OTHER INFORMATION. PART III ITEM 10. ITEM 11. ITEM 12. ITEM 13. ITEM 14. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE. EXECUTIVE COMPENSATION. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED... -

Page 3

... OFFICER BENEFITS) EX-10.25 (FORM OF PERFORMANCE BASED RESTRICTED STOCK UNIT AWARD NOTICE) EX-10.26 (DESCRIPTION OF BENEFITS FOR UAL CORPORATION DIRECTORS) EX-12.1 (UAL CORPORATION COMPUTATION OF RATIO OF EARNINGS TO FIXED CHARGES) EX-12.2 (UNITED AIR LINES) EX-21 (LIST OF UAL CORPORATION AND UNITED... -

Page 4

... of securities under a plan confirmed by a court. UAL Corporation Yes ⌧ No � United Air Lines, Inc. Indicate the number of shares outstanding of each of the issuer's classes of common stock, as of February 15, 2010. UAL Corporation United Air Lines, Inc. 167,453,840 shares of common stock ($0.01... -

Page 5

Information required by Items 10, 11, 12, 13 and 14 of Part III of this Form 10-K are incorporated by reference for UAL Corporation from its definitive proxy statement for its 2010 Annual Meeting of Stockholders to be held on June 10, 2010. -

Page 6

... Statements Changes in and Disagreements with Accountants on Accounting and Financial Disclosure Controls and Procedures Other Information PART III Directors, Executive Officers and Corporate Governance Executive Compensation Security Ownership of Certain Beneficial Owners and Management and Related... -

Page 7

... its annual flight schedule as of January 1, 2010. With key global air rights in the Pacific region, Europe and Latin America, United is one of the largest international carriers based in the United States. United also is a founding member of Star Alliance, the world's largest airline network, which... -

Page 8

...Angeles and San Francisco; and SM United Express, with a total fleet of 292 aircraft operated by regional airline partners, including approximately 150 aircraft that offer explus service, United's premium regional service providing both United First and Economy Plus seating. ® SM The Company also... -

Page 9

...During 2009, United Cargo accounted for approximately 3% of the Company's operating revenues by generating $536 million in freight and mail revenue, a 37% decrease versus 2008. United Services. United Services is a global airline support business offering customers comprehensive aircraft maintenance... -

Page 10

... price per gallon (in cents) 2009 2008 2007 (In millions, except per gallon) Mainline fuel purchase cost Non-cash fuel hedge (gains) losses in Mainline fuel Cash fuel hedge (gains) losses in Mainline fuel Total Mainline fuel expense Regional Affiliates fuel expense (a) UAL system operating fuel... -

Page 11

...a coordinated process for reservations/ticketing, check-in, flight connections and baggage transfer. Frequent flyer reciprocity allows members of Continental's OnePass program and United's Mileage Plus program to earn miles in their accounts when flying on either partner airline and redeem awards on... -

Page 12

... earn mileage credit for flights on United, United Express, members of the Star Alliance and certain other airlines that participate in the program. Miles can also be earned by purchasing the goods and services of our non-airline partners, such as hotels, car rental companies and credit card issuers... -

Page 13

... arrangements that allow these carriers to exchange traffic between each other's flights and route networks. See Alliances, above, for further information. Insurance. United carries hull and liability insurance of a type customary in the air transportation industry, in amounts that the Company deems... -

Page 14

...including air traffic control operations, capacity control issues, airline competition issues, aircraft and airport technology requirements, safety issues, taxes, fees and other funding sources. Congress may also pass other legislation that could increase labor and operating costs. Climate change 10 -

Page 15

..., requiring changes to the Company's security processes and frequently increasing the cost of its security procedures. International Regulation. General. International air transportation is subject to extensive government regulation. In connection with United's international services, the Company is... -

Page 16

... carbon emissions trading scheme, effective in 2012. The legality of applying such a scheme to non-EU airlines has been widely questioned. In December 2009, the Air Transportation Association, joined by United, Continental and American Airlines, filed a lawsuit in the United Kingdom challenging... -

Page 17

... groups were as follows: Number of Employees Contract Open for Amendment Employee Group Public Contact/Ramp & Stores/Food Service Employees/Security Officers/Maintenance Instructors/Fleet Technical Instructors Flight Attendants Pilots Mechanics & Related Engineers Dispatchers Union (a) 14,811 12... -

Page 18

... business, operating results, financial condition and the actual outcome of matters as to which forward-looking statements are made in this report. Risks Related to the Company's Business The Amended Credit Facility and the indentures governing the Senior Notes impose certain operating and financial... -

Page 19

... that process customer credit card transactions for the sale of air travel and other services. Under certain of the Company's card processing agreements, the financial institutions either require, or have the right to require, that United maintain a reserve equal to a portion of advance ticket sales... -

Page 20

...1, 2009 with an initial five year term. Under the agreement, in addition to certain other risk protections provided to American Express, the Company will be required to provide reserves based primarily on its unrestricted cash balance and net current exposure as of any calendar month-end measurement... -

Page 21

... the Senior Notes and certain of its credit card processing agreements. The factors noted above, among other things, may impair the Company's ability to comply with these covenants or could allow certain of our credit card processors to increase the required reserves on our advance ticket sales... -

Page 22

.... In addition, fare increases may not totally offset the fuel price increase and may also reduce demand for air travel. From time to time, the Company enters into hedging arrangements to protect against rising fuel costs. The Company's hedging programs may use significant amounts of cash due to... -

Page 23

... or cargo security procedures and/or to recover associated costs in the future may result in similar adverse effects on United's results of operations. Extensive government regulation could increase the Company's operating costs and restrict its ability to conduct its business. Airlines are subject... -

Page 24

..., including the potential for increased fuel costs, carbon taxes or fees, or a requirement to purchase carbon credits. The ability of U.S. carriers to operate international routes is subject to change because the applicable arrangements between the United States and foreign governments may... -

Page 25

... of UAL common stock, rating agency changes in outlook for the Company's debt instruments from stable to negative, the announcement of the planned removal from UAL's fleet of 100 aircraft and a significant decrease in the fair value of the UAL's outstanding equity and debt securities, including... -

Page 26

... and ultimate success of the Company's programs and initiatives to improve the delivery of its products and services to its customers, reduce its costs and increase both its revenues and shareholder value cannot be assured. Union disputes, employee strikes and other labor-related disruptions may... -

Page 27

... its business, such as operation of United Express flights, operation of customer service call centers, provision of information technology infrastructure and services, provision of aircraft maintenance and repairs, provision of various utilities and performance of aircraft fueling operations, among... -

Page 28

...stock issued and outstanding plus the number of shares of common stock still held in reserve for payment to unsecured creditors under the Debtors' Second Amended Joint Plan of Reorganization pursuant to Chapter 11 of the U.S. Bankruptcy Code (the "Plan of Reorganization"). For additional information... -

Page 29

... Europe are a vital part of its worldwide airline network. Volatile economic, political and market conditions in these international regions may have a negative impact on the Company's operating results and its ability to achieve its business objectives. In addition, significant or volatile changes... -

Page 30

...'s Plan of Reorganization. Holders of these securities may convert them into shares of UAL's common stock according to their terms. See Note 11, "Debt Obligations and Card Processing Agreements," in the Footnotes for further information regarding these instruments. The UAL restated certificate of... -

Page 31

... planned early aircraft retirement of a B747 aircraft occurred in January 2010. See Note 2, "Company Operational Plans," in the Footnotes for additional information. Details of UAL and United's Mainline operating fleet as of December 31, 2009 are provided in the following table: Aircraft Type UAL... -

Page 32

... Operations Center"). During 2009, the Company conducted an extensive review of multiple sites in the Chicago area and selected the Willis Tower (formerly the Sears Tower) as the new location of the Current Operations Center, offering much improved workspaces, technology and other resources. United... -

Page 33

... December 15, 2008, the New Zealand Commerce Commission issued Notices of Proceeding and Statements of Claim to 13 airlines, including United. The Company is currently preparing its response to these proceedings. On October 28, 2009, the Korean Fair Trade Commission issued an examiner's report which... -

Page 34

...itself. EEOC Claim Under the Americans with Disabilities Act On June 5, 2009, the U.S. Equal Employment Opportunity Commission ("EEOC") filed a lawsuit on behalf of five named individuals and other similarly situated employees alleging that United's reasonable accommodation policy for employees with... -

Page 35

... of Mileage Plus since October 2008. From September 2006 to September 2008, Mr. Atkinson served as Executive Vice President-Chief Customer Officer of UAL and United. From January 2004 to September 2006, Mr. Atkinson served as Senior Vice President-Worldwide Sales and Alliances of United. Peter... -

Page 36

...provides that the Company can carry out further shareholder initiatives in an amount equal to future term loan prepayments, provided the covenants are met. See Note 11, "Debt Obligations and Card Processing Agreements," in the Footnotes for more information related to dividend restrictions under the... -

Page 37

... future stock price performance. The following table presents repurchases of UAL common stock made in the fourth quarter of fiscal year 2009: Total number of shares purchased as part of publicly Total number of shares purchased (a) Average price paid per share announced plans or programs Maximum... -

Page 38

... (loss) per share Diluted earnings (loss) per share Cash distribution declared per common share (b) Balance Sheet Data at period-end: Total assets Long-term debt and capital lease obligations, including current portion Liabilities subject to compromise 2009 2008 2007 Year Ended December 31, 2005... -

Page 39

... rates) Successor Year Ended December 31, Period from February 1 to December 31, 2006 Predecessor Period from January 1 to January 31, 2006 2009 2008 2007 Year Ended December 31, 2005 Mainline Operating Statistics (c): Revenue passengers Revenue passenger miles ("RPMs") (d) Available seat miles... -

Page 40

... its near-term scheduled debt payments. Recent Developments. The global recession created an extremely challenging environment for the Company. For most of 2008 and 2009, the airline industry experienced decreased demand for air travel which put pressure on the Company's operating cash reserves, as... -

Page 41

... Affiliates-operated flights through Premier Baggage; In October 2009, Continental joined United and its 24 partners in the Star Alliance linking the airlines' networks and services worldwide and creating new revenue opportunities, cost savings and other efficiencies; In December 2009, United filed... -

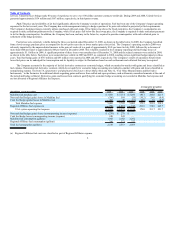

Page 42

..., the dramatic increase in fuel cost. SUMMARY RESULTS OF OPERATIONS (In millions) UAL information Revenues Special revenue items (a) Revenues due to Mileage Plus policy change (a) Total revenues Mainline fuel purchase cost Operating non-cash fuel hedge (gain)/loss Operating cash fuel hedge (gain... -

Page 43

... and special items Salaries and related costs Salaries and related costs Other operating expenses Purchased services Other operating expenses Depreciation and amortization Aircraft fuel Miscellaneous, net Income tax benefit The income tax benefit in 2009 is related to the impairment and sale of... -

Page 44

...payment over the lease term. Bankruptcy Matters. On December 9, 2002, UAL, United and 26 direct and indirect wholly-owned subsidiaries filed voluntary petitions to reorganize its business under Chapter 11 of the Bankruptcy Code. The Company emerged from bankruptcy on February 1, 2006, under the Plan... -

Page 45

... 26 companies on December 18, 2007. The Statement of Objections sets out evidence related to the utilization of fuel and security surcharges and exchange of pricing information that the Commission views as supporting the conclusion that an illegal price-fixing cartel had been in operation in the air... -

Page 46

... United passenger revenues and selected operating data from our Mainline segment, broken out by geographic region, and from our Regional Affiliates segment, expressed as year-over-year changes. Increase (decrease) from 2008: Passenger revenues (in millions) Passenger revenues Available seat miles... -

Page 47

... the size of our aircraft and capacity across United's total network to conform to market demand and fulfill prior contractual commitments. Although the impact of the global recession on the Company's international network, as well as business and premium travel, during late 2008 and 2009 was... -

Page 48

... allocation of the special revenue item, and from our Regional Affiliates segment, expressed as year-over-year changes. Regional Affiliates Increase (decrease) from 2007: Passenger revenues (in millions) Passenger revenues Available seat miles ("ASMs") Revenue passenger miles ("RPMs") Passenger... -

Page 49

... table below includes data related to UAL and United operating expenses. Year Ended December 31, 2009 2008 (In millions) Salaries and related costs Aircraft fuel Regional Affiliates Purchased services Aircraft maintenance materials and outside repairs Landing fees and other rent Depreciation and... -

Page 50

... on a year-over-year basis as the benefits of increased traffic and lower fuel cost offset the yield decrease. Purchased services decreased $208 million, or 15%, in 2009 as compared to 2008 primarily due to the Company's operating cost savings programs and lower variable costs associated with... -

Page 51

... on lower traffic and yields driving reductions in commissions, credit card fees and GDS fees as compared to 2008. The Company has also implemented several operating cost savings programs for both commissions and GDS fees which produced realized savings in the current year. Aircraft rent expense... -

Page 52

... table below includes data related to UAL and United operating expenses. Significant fluctuations are discussed below. Year Ended December 31, 2008 2007 (In millions) Aircraft fuel Salaries and related costs Regional Affiliates Purchased services Aircraft maintenance materials and outside repairs... -

Page 53

... discount rate changes. These negative impacts were partially offset by lower combined profit and success sharing expense in the 2008 period as compared to the year-ago period due to the unfavorable financial results in 2008 as compared to 2007. In addition, 2008 salaries and related costs benefited... -

Page 54

...to the resolution of bankruptcy administrative claims and are not indicative of the Company's ongoing financial performance. Special items in the year ended December 31, 2007 included a $30 million benefit due to the reduction in recorded accruals for bankruptcy litigation related to our SFO and LAX... -

Page 55

... yields. Interest expense for the years ended December 31, 2008 and 2007 includes $48 million and $43 million, respectively, of non-cash interest expense related to the Company's retrospective adoption of new accounting principles related to convertible debt instruments that may be settled in... -

Page 56

... adverse impact on travel demand which has resulted in decreased revenues and may adversely affect revenues in future periods. In addition, the Company's current operational plans to address the weak global economy may not be successful in improving its results of operations and liquidity. Further... -

Page 57

... invested. We believe credit risk is limited with respect to our money market fund investments. The following table provides a summary of UAL's net cash provided (used) by operating, investing and financing activities for the years ended December 31, 2009, 2008 and 2007 and total cash position as of... -

Page 58

...600 million from the Company's advanced sale of miles and license agreement with its co-branded credit card partner, as discussed below. In 2009, the Company contributed approximately $245 million and $18 million to its defined contribution plans and non-U.S. pension plans, respectively, as compared... -

Page 59

... cash held by the Company's largest credit card processor and was released as a part of an amendment to the Company's agreement with this processor. See Credit Card Processing Agreements, below, for further discussion of the amended agreement and future cash reserve requirements. In 2008, cash... -

Page 60

... net of fees, from the issuance of 19.0 million shares of UAL common stock in an underwritten, public offering for a price of $7.24 per share. The proceeds from these transactions were partially offset by $984 million used for scheduled long-term debt and capital lease payments during 2009, as well... -

Page 61

..., aircraft spare parts, route authorities and Mileage Plus intangible assets were pledged under various loan and other agreements. In January 2010, the Company completed a debt offering secured by United's route authorities to operate between the United States and Japan and beyond Japan to points in... -

Page 62

...Amended Credit Facility. A summary of financial covenants, after the May amendment, is included below. The Company must maintain a specified minimum ratio of EBITDAR to the sum of the following fixed charges for all applicable periods: (a) cash interest expense and (b) cash aircraft operating rental... -

Page 63

... that process customer credit card transactions for the sale of air travel and other services. Under certain of the Company's card processing agreements, the financial institutions either require, or have the right to require, that United maintain a reserve equal to a portion of advance ticket sales... -

Page 64

.... Future interest payments on variable rate debt are estimated using estimated future variable rates based on a yield curve. (d) Amounts represent operating lease payments that are made by United under capacity purchase agreements with the regional carriers who operate these aircraft on United... -

Page 65

...these debt payments are made directly to the creditor by a company that leases three aircraft from United. The creditor's only recourse to United is repossession of the aircraft. (i) The Company's current and long-term portions of debt presented in its December 31, 2009 Financial Statements reflects... -

Page 66

...actual historical results. Accounting for Frequent Flyer Program Miles Sold to Third Parties and the Advanced Purchase of Miles. The Company has an agreement with its co-branded credit card partner that requires its partner to purchase miles in advance of when miles will be awarded to the co-branded... -

Page 67

... based upon the equivalent ticket value of similar fares on United and amounts paid to other airlines for miles. The initial revenue deferral is presented as "Mileage Plus deferred revenue" in the Financial Statements. When recognized, the revenue related to the air transportation component is... -

Page 68

... U.S. economy, analyst downgrade of UAL common stock, rating agency changes in outlook for the Company's debt instruments from stable to negative, the planned removal from UAL's fleet of 100 aircraft and a significant decrease in the fair value of the Company's outstanding equity and debt securities... -

Page 69

.... For purposes of testing impairment of aircraft, the estimated undiscounted cash flows were dependent on a number of critical management assumptions including estimates of future capacity, passenger yield, traffic, operating costs (including fuel prices) and other relevant assumptions. If estimates... -

Page 70

..., international route authorities, London Heathrow slots and codesharing agreements. The Company utilized appropriate valuation techniques to separately estimate the fair values of all of its indefinite-lived intangible assets as of February 28, 2009, and compared those estimates to related carrying... -

Page 71

..., traffic, operating costs (including fuel prices), appropriate discount rates and other relevant assumptions. The Company estimated its future fuel-related cash flows for the income approach based on the five-year forward curve for crude oil as of May 31, 2008. The impacts of the Company's aircraft... -

Page 72

...and thus reflect the Company's current expectations and beliefs with respect to certain current and future events and financial performance. Such forward-looking statements are and will be subject to many risks and uncertainties relating to United's operations and business environment that may cause... -

Page 73

.... The Company does not use derivative financial instruments in its investment portfolio. United's policy is to manage interest rate risk through a combination of fixed and variable rate debt and by entering into swap agreements, depending upon market conditions. A portion of United's aircraft lease... -

Page 74

... to secure workers' compensation obligations, reserves for institutions that process credit card ticket sales and, in 2009, cash collateral received from fuel hedge counterparties. Due to the short term nature of these cash balances, their carrying values approximate their fair values. The Company... -

Page 75

.... Such expenses include fuel, aircraft leases, commissions, catering, personnel expense, advertising and distribution costs, customer service expenses and aircraft maintenance. Changes in foreign currency exchange rates impact the Company's results of operations through changes in the dollar value... -

Page 76

... PUBLIC ACCOUNTING FIRM To the Board of Directors and Stockholders of UAL Corporation Chicago, Illinois We have audited the accompanying statements of consolidated financial position of UAL Corporation and subsidiaries (the "Company") as of December 31, 2009 and 2008, and the related statements... -

Page 77

... PUBLIC ACCOUNTING FIRM To the Board of Directors and Stockholder of United Air Lines, Inc. Chicago, Illinois We have audited the accompanying statements of consolidated financial position of United Air Lines, Inc. and subsidiaries (the "Company") as of December 31, 2009 and 2008, and the related... -

Page 78

... share amounts) Year Ended December 31, 2008 2007 Operating revenues: Passenger-United Airlines Passenger-Regional Affiliates Cargo Special operating items (Note 18) Other operating revenues Operating expenses: Salaries and related costs Aircraft fuel Regional Affiliates Purchased services Aircraft... -

Page 79

Table of Contents UAL Corporation and Subsidiary Companies Statements of Consolidated Financial Position (In millions, except shares) At December 31, 2009 2008 Assets Current assets: Cash and cash equivalents Restricted cash Receivables, less allowance for doubtful accounts (2009-$14; 2008-$24) ... -

Page 80

...and Subsidiary Companies Statements of Consolidated Financial Position (In millions, except shares) At December 31, 2009 2008 Liabilities and Stockholders' Deficit Current liabilities: Mileage Plus deferred revenue Advance ticket sales Accounts payable Accrued salaries, wages and benefits Long-term... -

Page 81

... amendment Mileage Plus deferred revenue and advanced purchase of miles Debt and lease discount amortization Deferred income taxes Share-based compensation Gain on sale of investments Other operating activities Changes in assets and liabilities Net change in fuel derivative instruments and related... -

Page 82

...prior period gains Total pension and other postretirement plans Total comprehensive loss, net Sale of common stock Share-based compensation Other Treasury stock acquisitions Balance at December 31, 2009 $ 82 - $ $ $ $ $ See accompanying Combined Notes to Consolidated Financial Statements. 78 -

Page 83

... Companies Statements of Consolidated Operations (In millions) Year Ended December 31, 2008 2007 Operating revenues: Passenger-United Airlines Passenger-Regional Affiliates Cargo Special operating items (Note 18) Other operating revenues Operating expenses: Salaries and related costs Aircraft fuel... -

Page 84

... United Air Lines, Inc. and Subsidiary Companies Statements of Consolidated Financial Position (In millions, except shares) At December 31, 2009 2008 Assets Current assets: Cash and cash equivalents Restricted cash Receivables, less allowance for doubtful accounts (2009-$14; 2008-$24) Aircraft... -

Page 85

...and Subsidiary Companies Statements of Consolidated Financial Position (In millions, except shares) At December 31, 2009 2008 Liabilities and Stockholder's Deficit Current liabilities: Mileage Plus deferred revenue Advance ticket sales Accounts payable Accrued salaries, wages and benefits Long-term... -

Page 86

... amendment Mileage Plus deferred revenue and advanced purchase of miles Debt and lease discount amortization Deferred income taxes Share-based compensation Gain on sale of investment Other operating activities Changes in assets and liabilities Net change in fuel derivative instruments and related... -

Page 87

... other postretirement plans Total comprehensive income, net Preferred stock dividends (Note 4) Adoption of ASC 740 update Tax adjustment on ASC 715 update (Note 10) MPI Note forgiveness (Note 17) Share-based compensation Proceeds from exercise of stock options Balance at December 31, 2007 Net loss... -

Page 88

...the fee is incurred. Change fees related to non-refundable tickets are considered a separate transaction from the air transportation because they represent a charge for the Company's additional service to modify a previous sale. Therefore, the pricing of the change fee and the initial customer order... -

Page 89

...to secure workers' compensation obligations, reserves for institutions that process credit card ticket sales and, in 2009, cash collateral received from fuel hedge counterparties. The Company classifies changes in restricted cash balances as an investing activity in its Financial Statements, because... -

Page 90

...the Financial Statements as "Advanced purchase of miles." Subsequently, when the Company's credit card partner awards pre-purchased miles to its cardholders, the Company transfers the related air transportation element for the awarded miles from "Advanced purchase of miles" to "Mileage Plus deferred... -

Page 91

... of miles redemption. This change did not materially impact the Company's Mileage Plus revenue recognition in 2009 or 2008. See Note 16, "Advanced Purchase of Miles," for additional information related to the Mileage Plus program. (h) (i) Deferred Gains (Losses)-Gains and losses on aircraft sale and... -

Page 92

... difference between the asset's carrying value and fair market value. See Note 3, "Asset Impairments and Intangible Assets," for information related to asset impairments recognized in 2009 and 2008. Share-Based Compensation-The Company measures the cost of employee services received in exchange for... -

Page 93

... its financial statements. Retrospective Adoption of ASC 470 Update and ASC 260 Update The Company adopted new accounting guidance related to accounting for convertible debt instruments that may be settled in cash (or other assets) on conversion ("ASC 470 Update") and new accounting guidance related... -

Page 94

... by the ASC 470 Update. UAL (In millions, except per share) As Reported As Adjusted Effect of Change As Reported United As Adjusted Effect of Change Statement of Consolidated Operations Year Ended December 31, 2008 Interest expense Net loss Loss per share, basic and diluted Total comprehensive loss... -

Page 95

... programs, such as voluntary early-out options. Workforce reductions included salaried and management positions and certain of the Company's unionized workforce. The Company's standard severance policies provide the affected employees with salary continuation, as well as certain insurance benefits... -

Page 96

... and special items," respectively, in the Company's Financial Statements. The total expected future payments for leased aircraft that were removed from service at December 31, 2009 are $89 million, payable through 2013. Actual lease payments may be less if the Company is able to negotiate early... -

Page 97

... of UAL common stock, rating agency changes in outlook for the Company's debt instruments from stable to negative, the announcement of the planned removal from UAL's fleet of 100 aircraft and a significant decrease in the fair value of the Company's outstanding equity and debt securities, including... -

Page 98

... on existing contract terms. Indefinite-lived intangible assets 2009 Interim Impairment Test Indefinite-lived intangible assets tested for impairment included tradenames, international route authorities, London Heathrow slots and codesharing agreements. The Company utilized appropriate valuation... -

Page 99

...: Weighted Average Life of Assets (in years) 2009 2008 (Dollars in millions) Gross Carrying Amount Accumulated Amortization Gross Carrying Amount Accumulated Amortization Amortized intangible assets Airport slots and gates Hubs Patents Mileage Plus database Contracts Other Total Unamortized... -

Page 100

...2009, 2008 and 2007 were as follows: Year Ended December 31, 2008 UAL Shares outstanding at beginning of year Issuance of UAL stock under equity offering Issuance of UAL stock upon conversion of preferred stock Issuance of UAL stock to creditors Issuance of UAL stock to employees Forfeiture of non... -

Page 101

... by the weighted-average number of shares of UAL common stock outstanding. Approximately 0.4 million, 2.0 million and 2.8 million UAL shares remaining to be issued to unsecured creditors and employees under the bankruptcy plan of reorganization are included in outstanding basic shares for 2009, 2008... -

Page 102

... share-based compensation plans. 8,339,284 (6,017,100) 1,004,221 3,326,405 175,000 (131,327) - 43,673 8,514,284 (6,148,427) 1,004,221 3,370,078 (In millions) Compensation cost: Restricted stock units Restricted stock Stock options Total compensation cost Year Ended December 31, 2009 2008 2007... -

Page 103

... 422 of the Code, non-qualified stock options ("NSOs"), stock appreciation rights ("SARs"), restricted share awards, RSUs, performance compensation awards, performance units, cash incentive awards and other equity-based and equity-related awards. Any shares of our common stock issued under the ICP... -

Page 104

... Financial Statements. The table below summarizes UAL's RSU and restricted stock activity for the twelve months ended December 31, 2009: WeightedAverage Grant Price WeightedAverage Grant Price Non-vested at beginning of year Granted Vested Canceled Non-vested at end of year Restricted Stock Units... -

Page 105

... of federal income tax benefit Goodwill Nondeductible employee meals Nondeductible interest expense Medicare Part D Subsidy Valuation allowance Share-based compensation Rate change beginning deferreds Other, net $ (225) 6 - 6 12 (7) 182 7 - 3 $ (16) 101 2009 Year Ended December 31, 2008 $ (1,882... -

Page 106

... as follows: UAL December 31, 2009 2008 2009 United December 31, 2008 (In millions) Deferred income tax asset (liability): Employee benefits, including postretirement and medical Federal and state net operating loss carry forwards Mileage Plus deferred revenue AMT credit carry forwards Fuel hedge... -

Page 107

...well as certain life insurance benefits to certain retirees reflected as "Other Benefits" in the tables below. The Company has reserved the right, subject to collective bargaining agreements, to modify or terminate the health care and life insurance benefits for both current and future retirees. 103 -

Page 108

...in the Financial Statements for the defined benefit and other postretirement plans ("Other Benefits"): Pension Benefits Year Ended December 31, 2009 2008 Other Benefits Year Ended December 31, 2009 2008 (In millions) Change in Benefit Obligation Benefit obligation at beginning of year Service cost... -

Page 109

... benefit cost Other Changes in Plan Assets and Benefit Obligations Recognized in Other Comprehensive Income Current year actuarial (gain) loss and prior service (credit) Amortization of actuarial gain (loss) Total recognized in other comprehensive income Total recognized in net periodic benefit cost... -

Page 110

... effects: (In millions) 1% Increase 1% Decrease Effect on total service and interest cost for the year ended December 31, 2009 Effect on postretirement benefit obligation at December 31, 2009 $ $ 22 241 $ $ (16) (199) The Company believes that the long-term asset allocations on average will... -

Page 111

... insurance contract Other investments Total Other Benefit Plan Assets: Deposit administration fund $ $ $ 25 81 41 9 156 58 $ $ $ - - - - - - $ $ $ 25 81 - 9 115 - $ $ $ - - 41 - 41 58 Level 3 Financial Assets and Liabilities-All (In millions) Balance at January 1, 2009 Purchases Sales... -

Page 112

... the years ended December 31, 2009, 2008 and 2007, respectively, for all of the Company's defined contribution employee retirement plans, of which $34 million, $34 million and $28 million, respectively, related to the IAM multi-employer plan. (9) Segment Information Segments. The Company manages its... -

Page 113

... Company's Financial Statements. (b) Equity earnings are part of the Mainline segment. The following table presents United segment information for the years ended December 31, 2009, 2008 and 2007: (In millions) United Year Ended December 31, 2008 2007 Revenue: Mainline Regional Affiliates Special... -

Page 114

... of Transportation) for the years ended December 31, 2009, 2008 and 2007 is presented in the table below. (In millions) UAL Year Ended December 31, 2009 2008 2007 Domestic (U.S. and Canada) Pacific Atlantic Latin America Total UAL Add (Less): UAL other domestic Total United $ 10,775 2,628 2,538... -

Page 115

... Lien Notes offering, as discussed below in 2010 Financings and in Note 21, "Subsequent Events," are also presented. In accordance with applicable accounting standards the Company's December 31, 2009 financial statement classification of its current and long-term portions of debt obligations reflect... -

Page 116

... its Amended Credit Facility. The Senior Secured Notes and Senior Second Lien Notes are secured by United's route authority to operate between the United States and Japan and beyond Japan to points in other countries, certain airport takeoff and landing slots and airport gate leaseholds utilized in... -

Page 117

... with the regional flying partner that allows a $49 million deferral of future obligations under that agreement. Interest obligations due under the secured note are at a fixed interest rate; principal and interest payments are due monthly over the ten-year secured note term but may be repaid... -

Page 118

... ratios for more senior debt classes. These credit enhancements lower United's total borrowing cost. The other purpose of the trust is to receive principal and interest payments on the equipment notes purchased by the trusts from United and remit these proceeds to the trusts' certificate holders... -

Page 119

... may elect to pay the repurchase price in cash, shares of UAL common stock or a combination thereof. The 5% Notes are guaranteed by United. 6% Senior Notes due 2031 (the "6% Senior Notes"). The 6% Senior Notes are unsecured and do not require any payment of principal prior to maturity. Interest is... -

Page 120

..., international slots, related gate interests and associated rights. The international routes include the Pacific (Narita, China and Hong Kong) and Atlantic (London Heathrow) routes (the "Primary Routes") that United had as of February 2, 2007. In connection with the issuance of the Senior Secured... -

Page 121

... beyond the Company's control, including the overall industry revenue environment and the level of fuel costs. Credit Card Processing Agreements. The Company has agreements with financial institutions that process customer credit card transactions for the sale of air travel and other services. Under... -

Page 122

... March 1, 2009 which has an initial five year term. Under the agreement, in addition to certain other risk protections provided to American Express, the Company will be required to provide reserves based primarily on its unrestricted cash balance and net current exposure as of any calendar month-end... -

Page 123

... (Level 3) (In millions) Assets and Liabilities Measured at Fair Value on a Recurring Basis: Financial assets: Noncurrent EETC available-for-sale securities Current fuel derivative instruments Fuel derivative instrument receivables (a) Total financial assets Financial liabilities: Current fuel... -

Page 124

... inputs to the valuation models include contractual terms, risk-free interest rates and credit spreads. Derivative contracts are privately negotiated contracts and are not exchange traded. Fair value measurements are estimated with option pricing models that employ observable and unobservable inputs... -

Page 125

... income. Aircraft Fuel Hedges The Company has a risk management strategy to hedge a portion of its price risk related to projected jet fuel requirements. As of December 31, 2009, the Company's hedge portfolio consisted of swaps and purchased call options. The swaps utilized by the Company generally... -

Page 126

... expenses include fuel, aircraft leases, commissions, catering, personnel expense, advertising and distribution costs, customer service expense and aircraft maintenance. Changes in foreign currency exchange rates impact the Company's results of operations and cash flows through changes in the dollar... -

Page 127

...the use, occupancy, operation or maintenance of the leased premises or financed aircraft. Currently, the Company believes that any future payments required under these guarantees or indemnities would be immaterial, as most tort liabilities and related indemnities are covered by insurance (subject to... -

Page 128

... claims and other bankruptcy-related claim reserves including reserves related to legal, professional and tax matters, among others, for the years ended December 31, 2009, 2008 and 2007, respectively. These reserves are primarily classified in other current liabilities in the Financial Statements... -

Page 129

... 26 companies on December 18, 2007. The Statement of Objections sets out evidence related to the utilization of fuel and security surcharges and exchange of pricing information that the Commission views as supporting the conclusion that an illegal price-fixing cartel had been in operation in the air... -

Page 130

...Company's Financial Statements at December 31, 2009 or 2008. The related lease agreement is recorded on a straight-line basis resulting in ratable accrual of the final $270 million lease obligation over the expected lease term through 2032. Labor Negotiations. Approximately 82% of United's employees... -

Page 131

...Company's leased aircraft, scheduled future minimum lease payments under capital leases (substantially all of which are for aircraft) and operating leases having initial or remaining noncancelable lease terms of more than one year were as follows: Number of Leased Aircraft in Operating Fleet United... -

Page 132

... deferred loss on sale will be recognized in future periods. In January 2009, the Company completed a $94 million sale-leaseback agreement for nine aircraft. The leaseback agreement, which has a one-year term, a single one-year renewal option, and a bargain purchase option, was accounted for as... -

Page 133

... of miles that cannot be redeemed within one year is classified as "Advanced purchase of miles" in the non-current liabilities section of the Company's Financial Statements. The Amendment specifies the maximum amount of the pre-purchased miles that our co-branded credit card partner can award to... -

Page 134

... other contractual payments. Between 2008 and 2012, our co-branded credit card partner is allowed to carry forward those miles purchased subject to the annual guarantee that have not been awarded to its cardholders. Any miles carried forward subject to this provision will result in a net increase to... -

Page 135

... ASC 470 Update related to accounting for certain types of convertible debt instruments which were required to be adopted by the Company effective January 1, 2009 as discussed in Note 1 (p), "Summary of Significant Accounting Policies - New Accounting Pronouncements." UAL's quarterly financial data... -

Page 136

...release of the collateral from the Amended Credit Facility. The EETC repayments, discussed above, significantly reduced the future near term debt requirements. See Note 11, "Debt Obligations and Card Processing Agreements," for additional information related to these financings including the Company... -

Page 137

... they file with the SEC on a timely basis. Based on that evaluation, the Chief Executive Officer and the Chief Financial Officer of UAL and United have concluded that as of December 31, 2009, disclosure controls and procedures were effective. Changes in Internal Control over Financial Reporting... -

Page 138

... Chicago, Illinois The management of UAL Corporation and subsidiaries ("UAL") is responsible for establishing and maintaining adequate internal control over financial reporting, as such term is defined in Exchange Act Rules 13a-15(f). Our internal control over financial reporting is designed... -

Page 139

...with the policies or procedures may deteriorate. Under the supervision and with the participation of management, including our Chief Executive Officer and Chief Financial Officer, we conducted an evaluation of the design and operating effectiveness of our internal control over financial reporting as... -

Page 140

... PUBLIC ACCOUNTING FIRM To the Board of Directors and Stockholders of UAL Corporation Chicago, Illinois We have audited the internal control over financial reporting of UAL Corporation and subsidiaries (the "Company") as of December 31, 2009, based on criteria established in Internal Control... -

Page 141

... statement for its 2010 Annual Meeting of Stockholders. Information required by this item with respect to United is omitted pursuant to General Instruction I(2)(c) of Form 10-K. ITEM 14. PRINCIPAL ACCOUNTANT FEES AND SERVICES. The Audit Committee of the UAL Board of Directors adopted a policy... -

Page 142

.... Fees for audit-related services billed in 2008 consisted of audits for employee benefit plans, United Airlines Foundation and carve-out audits. TAX FEES Fees for tax services in 2009 and 2008 consisted of assistance with tax issues in certain foreign jurisdictions, tax consultation and bankruptcy... -

Page 143

... the signature page hereto. Schedule II-Valuation and Qualifying Accounts for the years ended December 31, 2009, 2008 and 2007. All other schedules are omitted because they are not applicable, not required or the required information is shown in the consolidated financial statements or notes thereto... -

Page 144

... Glenn F. Tilton Date: February 25, 2010 Glenn F. Tilton Chairman of the Board, President and Chief Executive Officer of UAL Corporation and Chief Executive Officer of United Air Lines, Inc. Pursuant to the requirements of the Securities Exchange Act of 1934, this Form 10-K has been signed below... -

Page 145

... Officer and Director of United Air Lines, Inc. (principal executive officer) /s/ Kathryn A. Mikells Kathryn A. Mikells Executive Vice President and Chief Financial Officer (principal financial officer) /s/ David M. Wing David M. Wing Vice President and Controller (principal accounting officer... -

Page 146

... Years Ended December 31, 2009, 2008 and 2007 Additions Charged to Costs and Expenses (In millions) Description Balance at Beginning of Period Deductions (a) Balance at End of Period Reserves deducted from assets to which they apply: Allowance for doubtful accounts (UAL and United): 2009 2008... -

Page 147

..., Commission file number 1-11355, and incorporated herein by reference) Amended and Restated Revolving Credit, Term Loan and Guaranty Agreement, dated as of February 2, 2007 by and among United Air Lines, Inc., UAL Corporation, certain subsidiaries of United Air Lines, Inc. and UAL Corporation, as... -

Page 148

... all 12.75% Senior Secured Notes due 2012 (filed as Exhibit 4.19 to UAL's Form 8-K dated July 2, 2009, Commission file number 1-6033, and incorporated herein by reference) Guarantee dated as of July 2, 2009 from UAL Corporation of 12.75% Senior Secured Notes due 2012 (filed as Exhibit 4.8 to... -

Page 149

...) UAL Corporation Executive Severance Plan Amendment No.1 dated January 1, 2008 (filed as Exhibit 10.5 to UAL's Form 10-K for the year ended December 31, 2007, Commission file number 1-6033, and incorporated herein by reference) Employment Agreement dated September 5, 2002 by and among United Air... -

Page 150

... quarter ended March 31, 2009, Commission file number 1-6033, and incorporated herein by reference) Form of Performance-Based Restricted Stock Unit Award Notice pursuant to the UAL Corporation 2008 Incentive Compensation Plan Description of Benefits for UAL Corporation Directors UAL Corporation 2006... -

Page 151

..., 2009, regarding the change in certifying accountant (filed as Exhibit 16.1 to UAL's Form 8-K dated July 28, 2009, Commission file number 1-6033, and incorporated herein by reference) List of UAL Corporation and United Air Lines, Inc. Subsidiaries Consent of Independent Registered Public Accounting... -

Page 152

..., known or unknown, which you ever had, or now have, against the Released Parties to the date of this Agreement. The claims you release include, but are not limited to, any (a) claims for benefits under the UAL Corporation and United Air Lines, Inc. Executive Severance Plan and (b) claims that... -

Page 153

... are entering into this Agreement knowingly, voluntarily, and in full settlement of all claims which existed in the past or which currently exist, that arise out of your employment with the Company or your separation from employment. You acknowledge that you have been specifically advised to consult... -

Page 154

... taken while employed by the Company to the same extent as other former employees of the Company at your job level under the Company's Corporate Charter as in effect on the date hereof, and you shall continue to be covered by the Company's directors and officers liability insurance policy as in... -

Page 155

... include information not generally available to the public, including but not limited to financial affairs, business plans or strategies, marketing, product pricing information, operating policies and procedures, vendor information, expenses, performance statistics, and information designated in... -

Page 156

... 409A Compliance. The payments and benefits under this Agreement are intended to comply with or be exempt from Section 409A of the Internal Revenue Code of 1986, as amended, and the interpretative guidance thereunder ("Section 409A"), including the exceptions for short-term deferrals, separation pay... -

Page 157

... with an attorney prior to signing this Agreement. EMPLOYEE By: /s/ Paul R. Lovejoy Paul R. Lovejoy UAL CORPORATION By: Title: /s/ Peter D. McDonald Executive Vice President & Chief Administrative Officer UNITED AIR LINES, INC. By: Title: 6 /s/ Marc L. Ugol Senior Vice President - Human Resources -

Page 158

... at target) Medical/Dental Insurance Life Insurance-Company Paid Variable Universal Life Disability Insurance Executive Outplacement Accrued Rights/Non-Severance: Vacation Pay Unused Personal Holidays Long Term Incentive Compensation Lump sum payment for the balance of 2009 unused vacation and 2010... -

Page 159

... to all Officers of UAL Corporation and United Air Lines, Inc. This Program is designed to pay matching contributions to all officers in cash where, as a result of IRS limits, such matching contributions can not be made to the United Airlines Management and Administrative 401(k) Plan. In order to be... -

Page 160

... Incentive Compensation Plan (the "Plan"). This award constitutes an unfunded and unsecured promise of the Company to deliver (or cause to be delivered to you), subject to the terms of this Agreement, either a share of the Company's Common Stock, $0.01 par value (a "Share"), or a cash payment, for... -

Page 161

... a lump sum cash payment on such Vesting Date, in accordance with the terms of this Award Notice, equal to the closing price of the Company's Common Stock on the Nasdaq Global Select Market on the trading date immediately preceding the applicable Vesting Date, multiplied by the number of RSUs that... -

Page 162

... to which you may be subject under any applicable securities laws). The Company may advise the transfer agent to place a stop order against any legended Shares. SECTION 8. Successors and Assigns of the Company. The terms and conditions of this Award Notice shall be binding upon and shall inure to... -

Page 163

... Committee may waive any conditions or rights under, amend any terms of, or alter, suspend, discontinue, cancel or terminate this Award Notice prospectively or retroactively; provided, however, that, except as set forth in Section 10(e) of the Plan, any such waiver, amendment, alteration, suspension... -

Page 164

IN WITNESS WHEREOF, the Company has duly executed this Award Notice as of the date first written above. UAL CORPORATION by Name: Glenn F. Tilton Title: Chairman, President & CEO -

Page 165

...for personal goods on United Airlines, for up to 2,500 pounds per year, and are reimbursed for the related income tax liability. Stock Based Compensation of Non-employee Directors. Under the UAL Corporation 2006 Director Equity Incentive Plan, non-employee directors may receive awards in the form of... -

Page 166

Exhibit 12.1 UAL Corporation and Subsidiary Companies Computation of Ratio of Earnings to Fixed Charges and Ratio of Earnings to Fixed Charges and Preferred Stock Dividend Requirements Successor Predecessor Period from January 1 to January 31, 2006 2005 (In millions, except ratios) Earnings (... -

Page 167

Exhibit 12.2 United Air Lines, Inc. and Subsidiary Companies Computation of Ratio of Earnings to Fixed Charges and Ratio of Earnings to Fixed Charges and Preferred Stock Dividend Requirements Successor Period from February 1 to December 31, 2006 Predecessor Period from January 1 to January 31, ... -

Page 168

... Services, Inc. Four Star Insurance Company, Ltd. UAL Benefits Management, Inc. United Air Lines, Inc. United Air Lines, Inc. (Wholly-owned subsidiaries): Covia LLC Kion de Mexico, S.A. de C.V. Mileage Plus, Inc. Mileage Plus Holdings, LLC United Aviation Fuels Corporation United Cogen, Inc. United... -

Page 169

... and financial statement schedule of UAL Corporation (which report expresses an unqualified opinion and includes an explanatory paragraph relating to changes in accounting for convertible debt and participating securities), and the effectiveness of UAL Corporation's internal control over financial... -

Page 170

... to the consolidated financial statements and financial statement schedule of United Air Lines, Inc. (which report expresses an unqualified opinion and includes an explanatory paragraph relating to a change in accounting for convertible debt) for the year ended December 31, 2009, appearing in this... -

Page 171

... in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the Company's ability to record, process, summarize and report financial information; and Any fraud, whether or not material, that involves management or other employees who have... -

Page 172

... in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the Company's ability to record, process, summarize and report financial information; and Any fraud, whether or not material, that involves management or other employees who have... -

Page 173

... in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the Company's ability to record, process, summarize and report financial information; and Any fraud, whether or not material, that involves management or other employees who have... -

Page 174

... in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the Company's ability to record, process, summarize and report financial information; and Any fraud, whether or not material, that involves management or other employees who have... -

Page 175

... requirements of Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended; and The information contained in the Report fairly presents, in all material respects, the financial condition and results of operations of UAL Corporation. Date: February 25, 2010 /s/ Glenn F. Tilton Glenn... -

Page 176

... requirements of Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended; and The information contained in the Report fairly presents, in all material respects, the financial condition and results of operations of United Air Lines, Inc. Date: February 25, 2010 /s/ Glenn F. Tilton...