Rogers 2015 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2015 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

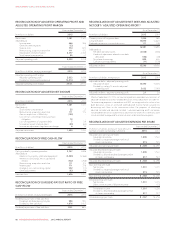

CONSOLIDATED FINANCIAL STATEMENTS

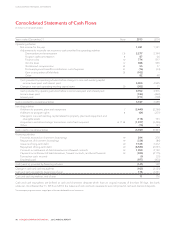

Consolidated Statements of Cash Flows

(In millions of Canadian dollars)

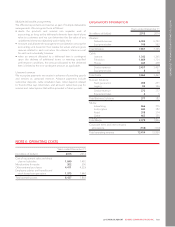

Years ended December 31 Note 2015 2014

Operating activities:

Net income for the year 1,381 1,341

Adjustments to reconcile net income to cash provided by operating activities:

Depreciation and amortization 7, 8 2,277 2,144

Program rights amortization 887 66

Finance costs 10 774 817

Income taxes 12 466 506

Stock-based compensation 25 55 37

Post-employment benefits contributions, net of expense 23 (16) (34)

Gain on acquisition of Mobilicity 26 (102) –

Other 82 48

Cash provided by operating activities before changes in non-cash working capital,

income taxes paid, and interest paid 5,004 4,925

Change in non-cash operating working capital items 30 (302) 11

Cash provided by operating activities before income taxes paid and interest paid 4,702 4,936

Income taxes paid (184) (460)

Interest paid (771) (778)

Cash provided by operating activities 3,747 3,698

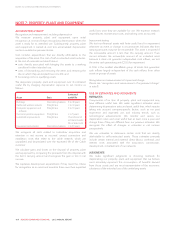

Investing activities:

Additions to property, plant and equipment 7(2,440) (2,366)

Additions to program rights 8(64) (231)

Changes in non-cash working capital related to property, plant and equipment and

intangible assets (116) 153

Acquisitions and other strategic transactions, net of cash acquired 8, 17, 26 (1,077) (3,456)

Other (70) (51)

Cash used in investing activities (3,767) (5,951)

Financing activities:

Proceeds received on short-term borrowings 19 294 276

Repayment of short-term borrowings 19 (336) (84)

Issuance of long-term debt 30 7,338 3,412

Repayment of long-term debt 30 (6,584) (2,551)

Proceeds on settlement of debt derivatives and forward contracts 30 1,059 2,150

Payments on settlement of debt derivatives, forward contracts, and bond forwards 30 (930) (2,115)

Transaction costs incurred (9) (30)

Dividends paid (977) (930)

Cash (used in) provided by financing activities (145) 128

Change in cash and cash equivalents (165) (2,125)

Cash and cash equivalents, beginning of year 176 2,301

Cash and cash equivalents, end of year 11 176

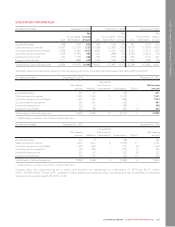

Cash and cash equivalents are defined as cash and short-term deposits which have an original maturity of less than 90 days, less bank

advances. As at December 31, 2015 and 2014, the balance of cash and cash equivalents was comprised of cash and demand deposits.

The accompanying notes are an integral part of the consolidated financial statements.

96 ROGERS COMMUNICATIONS INC. 2015 ANNUAL REPORT